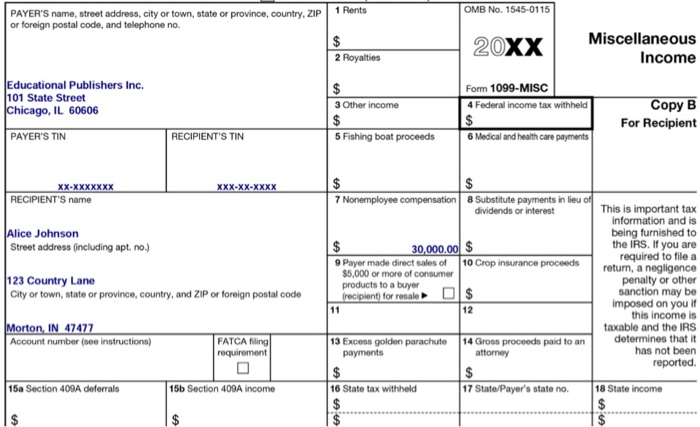

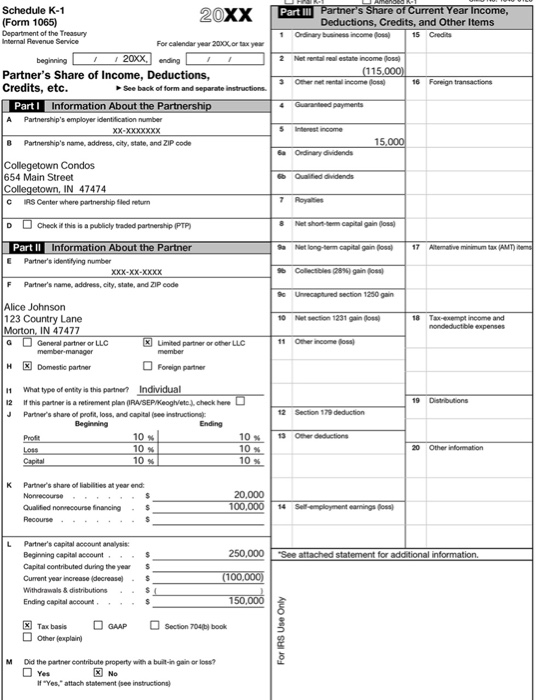

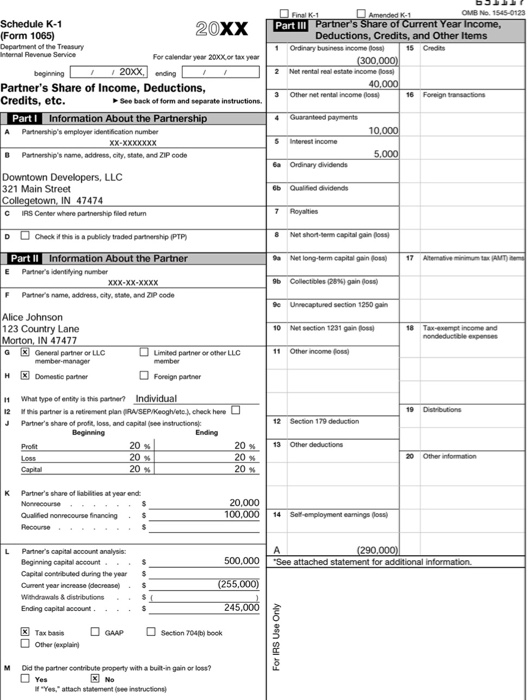

Alice Johnson, a single taxpayer, is a full-time employee at Midwest University. Alice also does editorial work for a publisher as an independent contractor. She does not deduct any expenses related to her editorial work. Alice is also a 20 percent owner in Downtown Developers LLC, in which she materially participates and receives a guaranteed payment each year. Alice is also a 10 percent limited partner in Collegetown Condos LP. Alice does not participate in Collegetown Condos' business activities. Alice has sufficient tax basis and at-risk basis to flow through any losses from her LLC and partnership interests, and does not take any distributions.

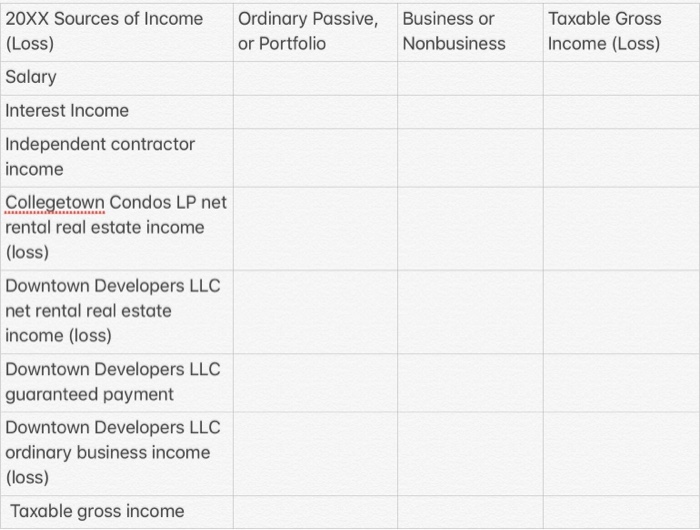

Alice has provided documentation for her 20XX gross income in the exhibits above. In the table below, calculate the amount of Alice's 20XX taxable gross income. In column B, select from the option list provided whether the income (loss) item is ordinary, passive, or portfolio for purposes of calculating any passive activity loss (PAL) limitation. In column C, select from the option list provided whether the income (loss) item is business or nonbusiness for purposes of calculating any excess business loss deduction limitation. In column D, enter the appropriate amount for each income (loss) item for calculating Alice's 20XX taxable gross income, taking into account the effect, if any, of other items of income and expense included in this problem. Enter income.

20XX Sources of Income (Loss) Salary Interest Income Ordinary Passive, or Portfolio Business or Nonbusiness Taxable Gross Income (Loss) Independent contractor income Collegetown Condos LP net rental real estate income (loss) Downtown Developers LLC net rental real estate income (loss) Downtown Developers LLC guaranteed payment Downtown Developers LLC ordinary business income (loss) Taxable gross income 1 Rents OMB No. 1545-0115 PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. 20XX Miscellaneous Income 2 Royalties Educational Publishers Inc. 101 State Street Form 1099-MISC For Recipient 3 Other income 4 Federal income tax withheld IL 60606 PAYER'S TIN RECIPIENT'S TIN 5 Fishing boat proceeds Medical and health care payments RECIPIENT'S name This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS dividends or interest Street address (including apt. no. 0,000,0 $ 9 Payer made direct sales of10 Crop insurance proceeds 123 Country Lane City or town, state or province, country, and ZIP or foreign postal code $5,000 or more of consumer products to a buyer for resale IN 47477 FATCA filing deermines that it Account number (see instructions) 3 Excess golden parachute 14 Gross proceeds paid to an has not been reported. 15a Section 400A deferrals 15b Section 409A income 16 State tax withheld 17 State/Payer's state no.18 State income OMB No. 1545-0123 Schedule K-1 (Form 1065) Department of the Treasury 20XX Part III ear Deductions, Credits, and Other Items Ordinary business income fss15 Credits For calendar year 20X or tax year 2 Net rental real estate inoome ploss Partner's Share of Income, Deductions, Credits, etc. 40 3Other net rental income (oss See back of form and separate instructions. the 10 5 Interest income Partnership's name, address, city, state, and 21P code Downtown Developers, LLC 321 Main Street IN 47474 IRS Center where partnership filed return C Check i this is a publicly traded partnership (PTP Net shot-se capital gain os Net long-term capital gains17 Atemative minimum tax AMT E Partner's identying number 9b Collectibles(29%) gan 0osso Partner's name, address, city, state, and code Alice Johnson 123 Country Lane 0 Net section 1231 gain poss 18 Tax-exempt income and IN 47477 General partner or LLC Limted partner or other LLC Other inoome (oss) Domestic partner Foreign partner 11 What type of entity is this partne? Individual 12 this partner is a retirement plan (RA/SEP/Keogh/eto.check here JPartner's share of profit, loss, and captal(see instructionsk 12 Section 179 deduction Ending 20 20 K Partner's share of iabilities at year end 20,000 Qualified nonrecourse financing $ L Partners capital account analysis: 500,000 See attached statement for additional Beginning capital account Capital conbributed during the year $ Cument year increase (decrease) Ending capital account Tax basis GAAP Section 704R. book Other (explain) M Did the partner contribute property with a built-in gain or loss? "Yes, attach statement (ee instructions 20XX Sources of Income (Loss) Salary Interest Income Ordinary Passive, or Portfolio Business or Nonbusiness Taxable Gross Income (Loss) Independent contractor income Collegetown Condos LP net rental real estate income (loss) Downtown Developers LLC net rental real estate income (loss) Downtown Developers LLC guaranteed payment Downtown Developers LLC ordinary business income (loss) Taxable gross income 1 Rents OMB No. 1545-0115 PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. 20XX Miscellaneous Income 2 Royalties Educational Publishers Inc. 101 State Street Form 1099-MISC For Recipient 3 Other income 4 Federal income tax withheld IL 60606 PAYER'S TIN RECIPIENT'S TIN 5 Fishing boat proceeds Medical and health care payments RECIPIENT'S name This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS dividends or interest Street address (including apt. no. 0,000,0 $ 9 Payer made direct sales of10 Crop insurance proceeds 123 Country Lane City or town, state or province, country, and ZIP or foreign postal code $5,000 or more of consumer products to a buyer for resale IN 47477 FATCA filing deermines that it Account number (see instructions) 3 Excess golden parachute 14 Gross proceeds paid to an has not been reported. 15a Section 400A deferrals 15b Section 409A income 16 State tax withheld 17 State/Payer's state no.18 State income OMB No. 1545-0123 Schedule K-1 (Form 1065) Department of the Treasury 20XX Part III ear Deductions, Credits, and Other Items Ordinary business income fss15 Credits For calendar year 20X or tax year 2 Net rental real estate inoome ploss Partner's Share of Income, Deductions, Credits, etc. 40 3Other net rental income (oss See back of form and separate instructions. the 10 5 Interest income Partnership's name, address, city, state, and 21P code Downtown Developers, LLC 321 Main Street IN 47474 IRS Center where partnership filed return C Check i this is a publicly traded partnership (PTP Net shot-se capital gain os Net long-term capital gains17 Atemative minimum tax AMT E Partner's identying number 9b Collectibles(29%) gan 0osso Partner's name, address, city, state, and code Alice Johnson 123 Country Lane 0 Net section 1231 gain poss 18 Tax-exempt income and IN 47477 General partner or LLC Limted partner or other LLC Other inoome (oss) Domestic partner Foreign partner 11 What type of entity is this partne? Individual 12 this partner is a retirement plan (RA/SEP/Keogh/eto.check here JPartner's share of profit, loss, and captal(see instructionsk 12 Section 179 deduction Ending 20 20 K Partner's share of iabilities at year end 20,000 Qualified nonrecourse financing $ L Partners capital account analysis: 500,000 See attached statement for additional Beginning capital account Capital conbributed during the year $ Cument year increase (decrease) Ending capital account Tax basis GAAP Section 704R. book Other (explain) M Did the partner contribute property with a built-in gain or loss? "Yes, attach statement (ee instructions