Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alice plc has a WACC of 16%. It is financed partly by equity (cost 18% per annum) and partly by debt capital (cost 10% per

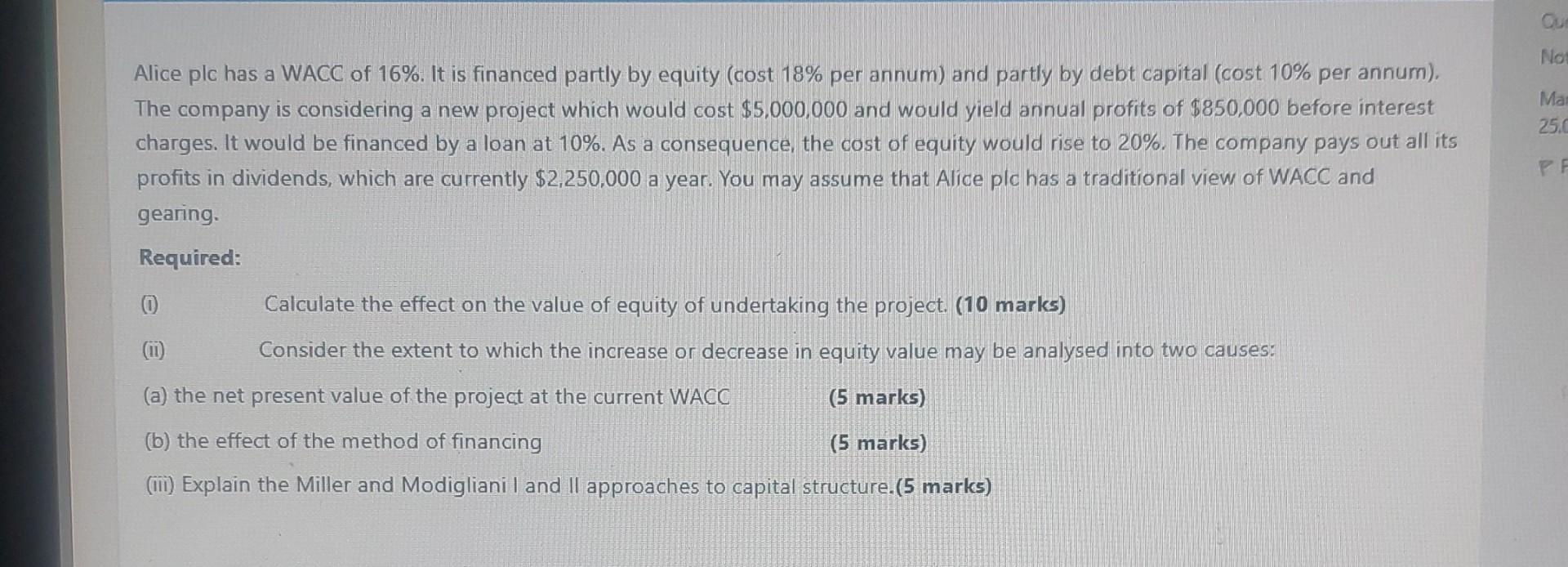

Alice plc has a WACC of 16%. It is financed partly by equity (cost 18% per annum) and partly by debt capital (cost 10% per annum). The company is considering a new project which would cost $5,000,000 and would yield annual profits of $850,000 before interest charges. It would be financed by a loan at 10%. As a consequence, the cost of equity would rise to 20%. The company pays out all its profits in dividends, which are currently $2,250,000 a year. You may assume that Alice plc has a traditional view of WACC and gearing. Required: (i) Calculate the effect on the value of equity of undertaking the project. (10 marks) (ii) Consider the extent to which the increase or decrease in equity value may be analysed into two causes: (a) the net present value of the project at the current WACC (5 marks) (b) the effect of the method of financing (5 marks) (iii) Explain the Miller and Modigliani I and II approaches to capital structure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started