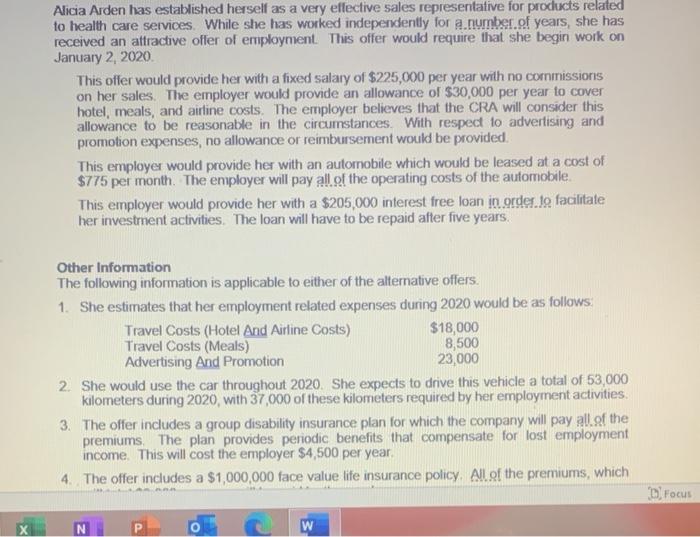

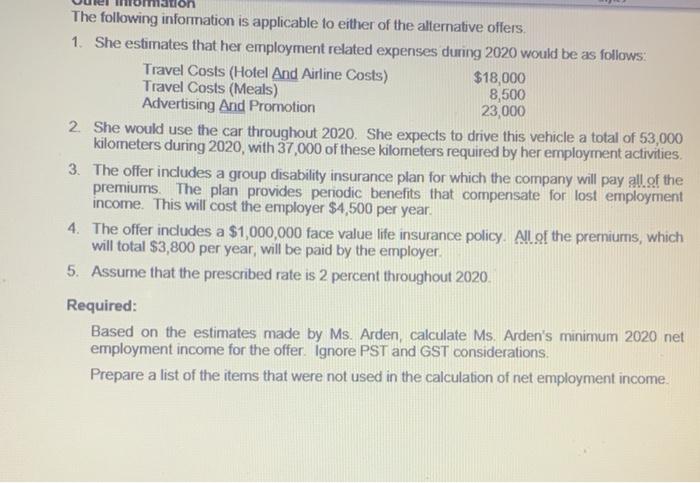

Alicia Arden has established herself as a very effective sales representative for products related to health care services. While she has worked independently for a number of years, she has received an attractive offer of employment. This offer would require that she begin work on January 2, 2020 This offer would provide her with a fixed salary of $225,000 per year with no commissions on her sales. The employer would provide an allowance of $30,000 per year to cover hotel, meals, and airline costs. The employer believes that the CRA will consider this allowance to be reasonable in the circumstances. With respect to advertising and promotion expenses, no allowance or reimbursement would be provided This employer would provide her with an automobile which would be leased at a cost of $775 per month. The employer will pay all of the operating costs of the automobile. This employer would provide her with a $205,000 interest free loan in order to facilitate her investment activities. The loan will have to be repaid after five years. Other Information The following information is applicable to either of the alternative offers. 1. She estimates that her employment related expenses during 2020 would be as follows Travel Costs (Hotel And Airline Costs) $18,000 Travel Costs (Meals) 8,500 Advertising And Promotion 23,000 2. She would use the car throughout 2020. She expects to drive this vehicle a total of 53,000 kilometers during 2020, with 37,000 of these kilometers required by her employment activities 3. The offer includes a group disability insurance plan for which the company will pay all of the premiums. The plan provides periodic benefits that compensate for lost employment income. This will cost the employer $4,500 per year. 4. The offer includes a $1,000,000 face value life insurance policy. All of the premiums, which D Focus P W lon The following information is applicable to either of the alternative offers. 1. She estimates that her employment related expenses during 2020 would be as follows: Travel Costs (Hotel And Airline Costs) $18,000 Travel Costs (Meals) 8,500 Advertising And Promotion 23,000 2. She would use the car throughout 2020. She expects to drive this vehicle a total of 53,000 kilometers during 2020, with 37,000 of these kilometers required by her employment activities. 3. The offer includes a group disability insurance plan for which the company will pay all of the premiums. The plan provides periodic benefits that compensate for lost employment income. This will cost the employer $4,500 per year. 4. The offer includes a $1,000,000 face value life insurance policy. All of the premiurns, which will total $3,800 per year, will be paid by the employer. 5. Assume that the prescribed rate is 2 percent throughout 2020 Required: Based on the estimates made by Ms. Arden, calculate Ms. Arden's minimum 2020 net employment income for the offer. Ignore PST and GST considerations. Prepare a list of the items that were not used in the calculation of net employment income. Alicia Arden has established herself as a very effective sales representative for products related to health care services. While she has worked independently for a number of years, she has received an attractive offer of employment. This offer would require that she begin work on January 2, 2020 This offer would provide her with a fixed salary of $225,000 per year with no commissions on her sales. The employer would provide an allowance of $30,000 per year to cover hotel, meals, and airline costs. The employer believes that the CRA will consider this allowance to be reasonable in the circumstances. With respect to advertising and promotion expenses, no allowance or reimbursement would be provided This employer would provide her with an automobile which would be leased at a cost of $775 per month. The employer will pay all of the operating costs of the automobile. This employer would provide her with a $205,000 interest free loan in order to facilitate her investment activities. The loan will have to be repaid after five years. Other Information The following information is applicable to either of the alternative offers. 1. She estimates that her employment related expenses during 2020 would be as follows Travel Costs (Hotel And Airline Costs) $18,000 Travel Costs (Meals) 8,500 Advertising And Promotion 23,000 2. She would use the car throughout 2020. She expects to drive this vehicle a total of 53,000 kilometers during 2020, with 37,000 of these kilometers required by her employment activities 3. The offer includes a group disability insurance plan for which the company will pay all of the premiums. The plan provides periodic benefits that compensate for lost employment income. This will cost the employer $4,500 per year. 4. The offer includes a $1,000,000 face value life insurance policy. All of the premiums, which D Focus P W lon The following information is applicable to either of the alternative offers. 1. She estimates that her employment related expenses during 2020 would be as follows: Travel Costs (Hotel And Airline Costs) $18,000 Travel Costs (Meals) 8,500 Advertising And Promotion 23,000 2. She would use the car throughout 2020. She expects to drive this vehicle a total of 53,000 kilometers during 2020, with 37,000 of these kilometers required by her employment activities. 3. The offer includes a group disability insurance plan for which the company will pay all of the premiums. The plan provides periodic benefits that compensate for lost employment income. This will cost the employer $4,500 per year. 4. The offer includes a $1,000,000 face value life insurance policy. All of the premiurns, which will total $3,800 per year, will be paid by the employer. 5. Assume that the prescribed rate is 2 percent throughout 2020 Required: Based on the estimates made by Ms. Arden, calculate Ms. Arden's minimum 2020 net employment income for the offer. Ignore PST and GST considerations. Prepare a list of the items that were not used in the calculation of net employment income