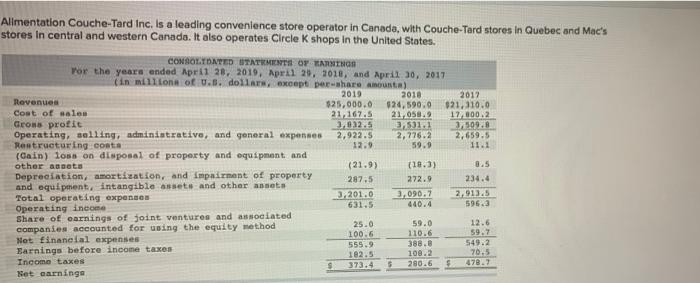

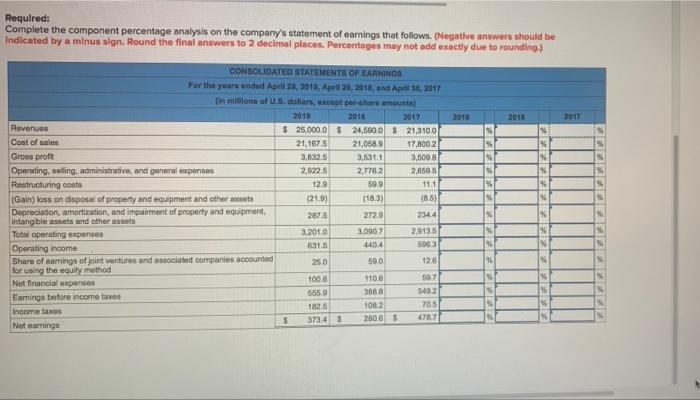

Alimentation Couche-Tard Inc. is a leading convenience store operator in Canada, with Couche-Tard stores in Quebec and Mac's stores in central and western Canada. It also operates Circle K shops in the United States. CONSOLIDATED STATEMENTS OY TANTRA For the years ended April 28, 2019, April 25, 2018, and April 30, 2017 in millions of u.s. dollars, except pershare amount) 2019 2010 2012 Revenues $25,000.0 $24.590.0 921.110.0 Coat of sales 21,167.5 21.058.9 17,000.2 Grons profit 2.032.5 3,531.1 3509.8 Operating, solling, administrative, and general expenses 2,922.5 2,276.2 2,659.5 Restructuring conta 12.9 59.9 11.1 (Cain) loss on disposal of property and equipment and other assets (21.93 (18.3) Depreciation, amortization, and impairment of property 287.5 272.9 234.4 and equipment, intangible assets and other anseta Total operating expenses 3. 201.0 3,090.2 2,913.5 631.5 Operating income 596.3 Share of earnings of joint ventures and associated 25.0 59.0 companies accounted for using the equity method 12.6 100.6 110.6 59.7 Net financial expenses 555.9 388. 549.2 Earnings before income taxes 182.5 100.2 70.5 Income taxes 373.4 280.6 478.7 Net carning 5 Required: Complete the component percentage analysis on the company's statement of earnings that follows. (Negative answers should be Indicated by a minus sign. Round the final answers to 2 decimal places. Percentages may not add exactly due to rounding) 2010 2018 2017 * 129 CONSOLIDATED STATEMENTS OF EARNINOS For the years ended April 20, 2018 April 29, 2018, and April 10, 2017 in milions of U.S. dollars, except pershare amounts) 2010 2010 2017 Revenues $ 25,000,0 $ 24,560.0 21,3100 Cost of sales 21.167,5 21,068.9 17.8002 Gross pront 3,632.5 3,531.1 3,5098 Operating, seling, administrative, and general expenses 2,922.5 2,7782 2.6595 Restructuring costs 59.0 11.1 (Gain) loss on disposal of property and equipment and other assets (219) (18.3) (85) Depreciation, amortization, and impairment of property and equipment 287s 272.0 2344 Intangible assets and other assets Total operating expenses 3,2010 3.0907 2.9135 Operating income 631.5 4404 5903 Share of earnings of joint ventures and associated companies accounted 250 50.0 124 for using the equity method 1000 Net financial expenses 1100 59.7 6559 3 5492 Earnings before income taxes 182.5 1082 705 Income taxes $ 373.4 5 2006 5 Net earnings 4787 X