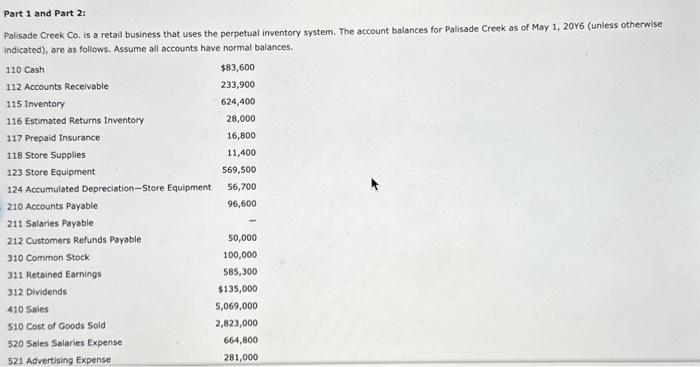

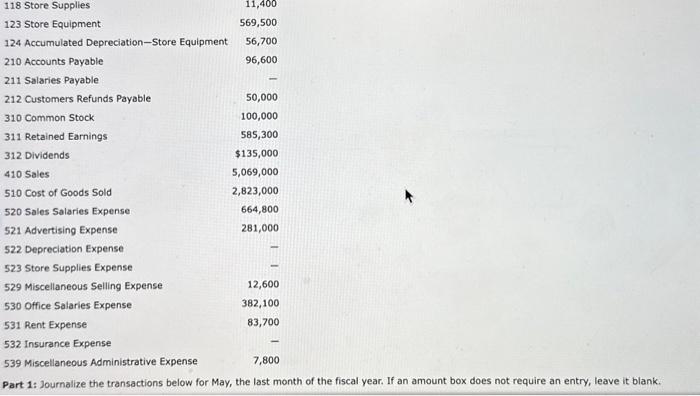

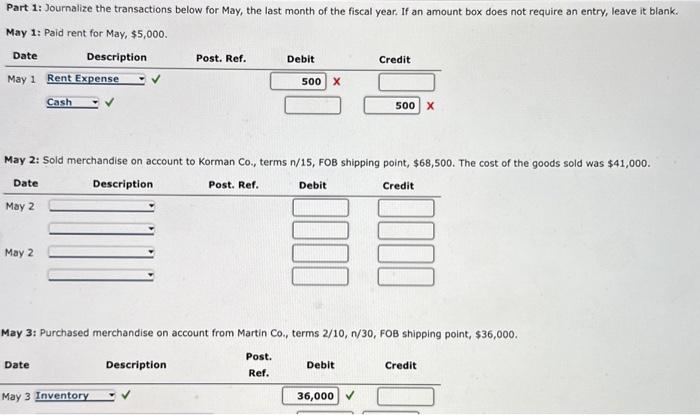

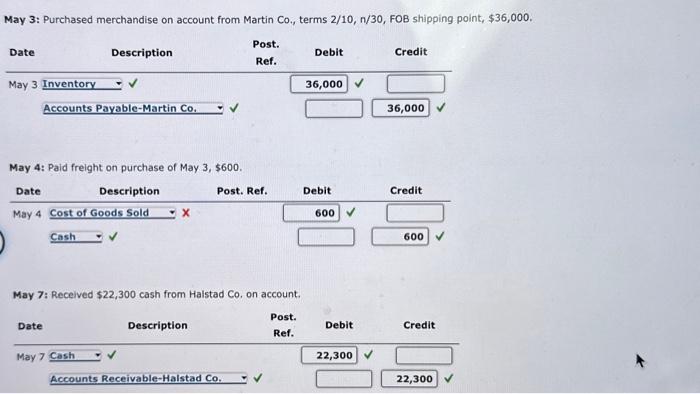

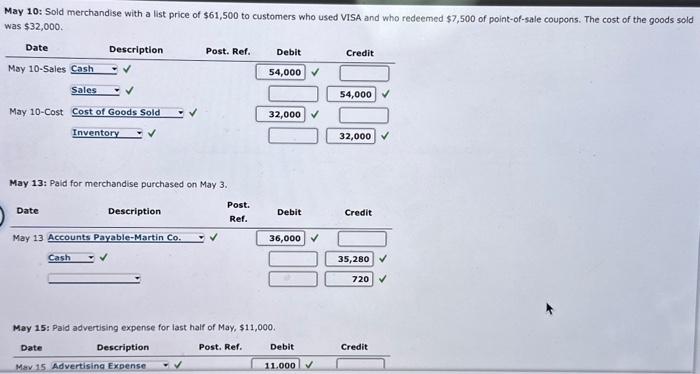

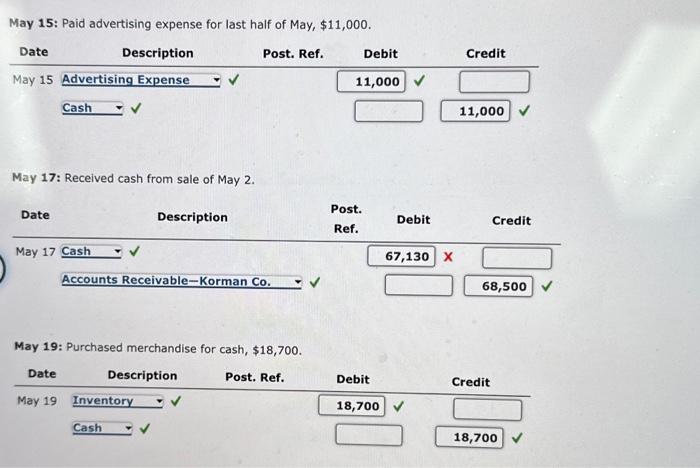

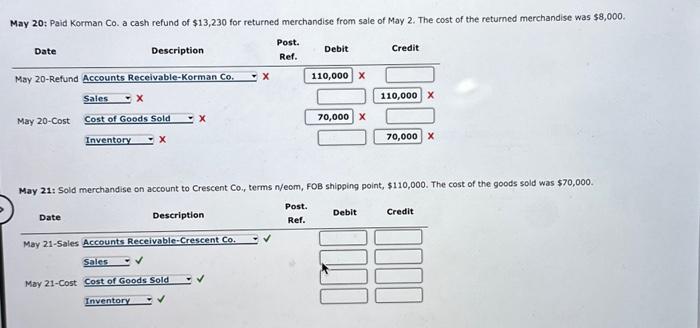

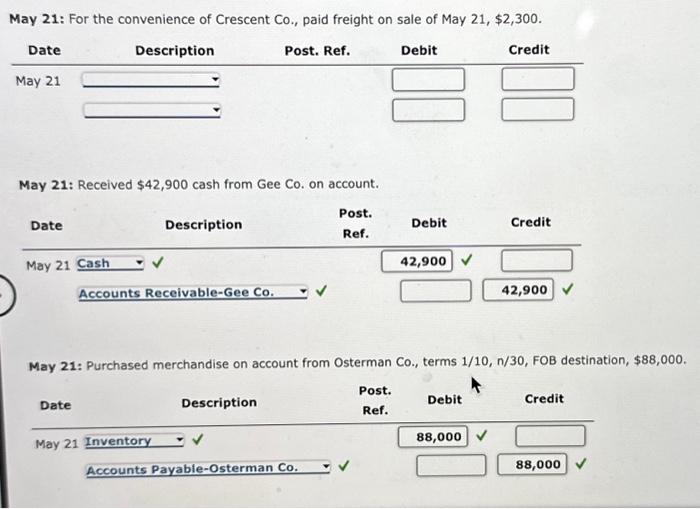

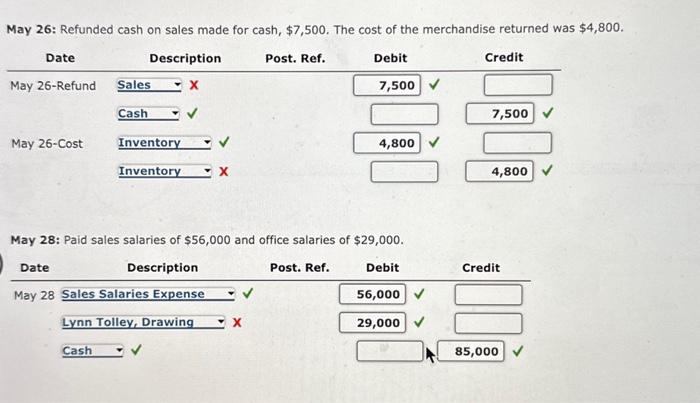

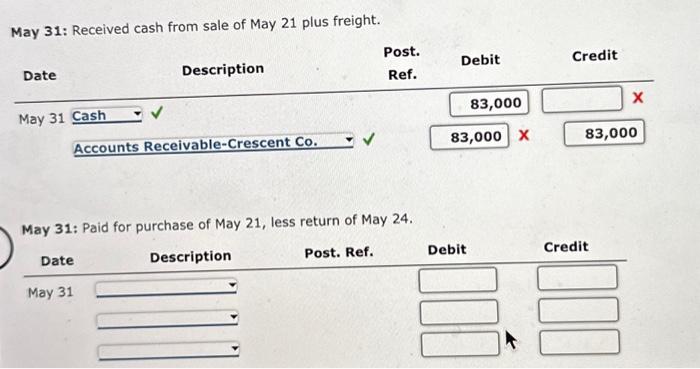

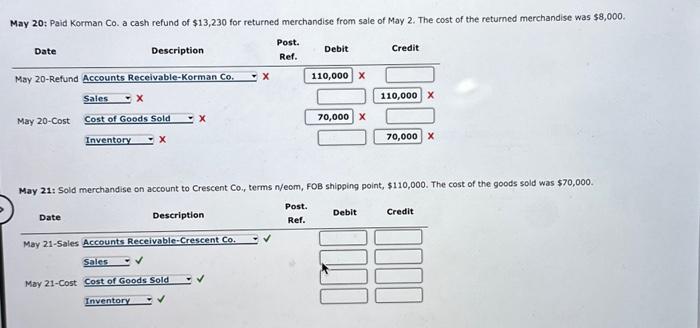

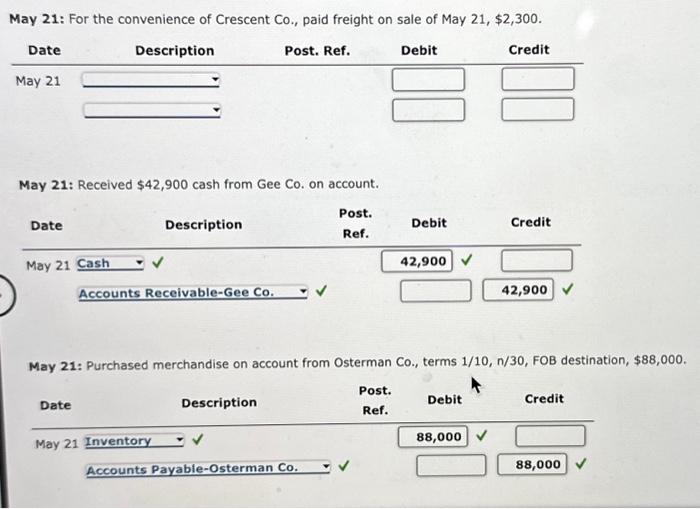

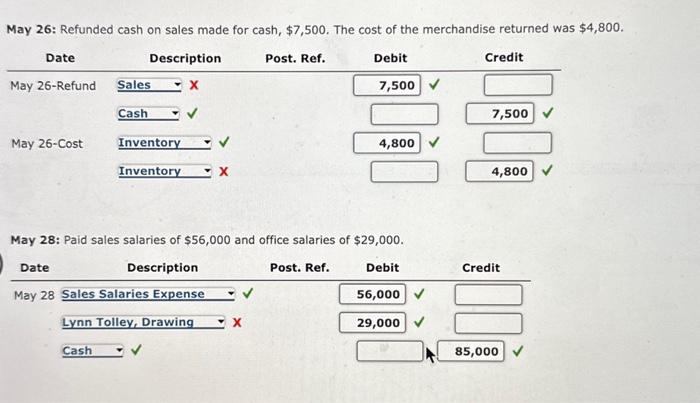

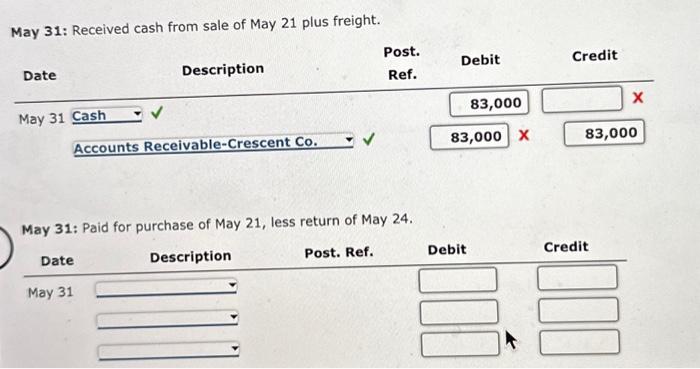

alisode Creek Co, is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1 , 20 Y 6 (unless otherwise Adicated), are as follows. Assume all accounts have normal balances. 118 Store Supplies 123 Store Equipment 569,500 124 Accumulated Depreciation-Store Equipment 56,700 210 Accounts Payable 96,600 211 Salaries Payable 212 Customers Refunds Payable 50,000 310 Common Stock 100,000 311 Retained Earnings 585,300 312. Dividends $135,000 410 Sales 5,069,000 510 Cost of Goods Sold 2,823,000 520 Sales Salaries Expense 664,800 521 Advertising Expense 522 Depreciation Expense 523 Store Supplies Expense 529 Miscellaneous Selling Expense 530 Office Salaries Expense 382,100 531 Rent Expense 532 Insurance Expense 539 Miscellaneous Administrative Expense 7,800 Part 1: Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require an entry, leave it blank. Part 1: Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require an entry, leave it blank. May 1: Paid rent for May, $5,000. May 2: Sold merchandise on account to Korman Co., terms n/15,FOB shipping point, $68,500. The cost of the goods sold was $41,000. May 3: Purchased merchandise on account from Martin Co., terms 2/10,n/30, FOB shipping point, $36,000. May 3: Purchased merchandise on account from Martin Co., terms 2/10,n/30,FOB shipping point, $36,000. May 4: Paid freight on purchase of May 3, $600. May 7: Recelved $22,300 cash from Halstad Co, on account. May 10: Sold merchandise with a list price of $61,500 to customers who used VISA and who redeemed $7,500 of point-of-sale coupons. The cost of the goods sold was $32,000. May 13: Paid for merchandise purchased on May 3. May 15: Paid advertising expense for last half of May, $11,000. May 15: Paid advertising expense for last half of May, $11,000. May 17: Received cash from sale of May 2. May 19: Purchased merchandise for cash, $18,700. May 20: Paid Korman Co. a cash refund of $13,230 for returned merchandise from sale of May 2. The cost of the returned merchandise was $8,000. May 21: Sold merchandise on account to Crescent Co, terms n/eom, FOB shipping point, $110,000. The cost of the goods sold was $70,000. May 21: For the convenience of Crescent Co., paid freight on sale of May 21,$2,300. May 21: Received $42,900 cash from Gee Co. on account. May 21: Purchased merchandise on account from Osterman Co., terms 1/10,n/30, FOB destination, $88,000. May 26: Refunded cash on sales made for cash, $7,500. The cost of the merchandise returned was $4,800. May 28: Paid sales salaries of $56,000 and office salaries of $29,000. May 31: Received cash from sale of May 21 plus freight. May 31: Paid for purchase of May 21, less return of May 24