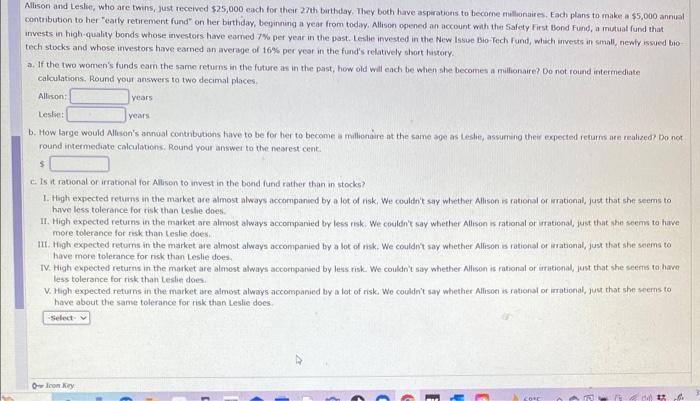

Alison and Leske, who are twins, just teceived $25,000 each for their 27 th birthday. They both have asperations to become mullionaires, Each plans to make a $5,000 annual contribution to her "early retrement fund" on her birthiday, beginning a year from today. Allison ogened an account wath thet Safety first Bond Fund, a mutual fund that invests in high-quality bonds whose investors have eamed 7% per year in the past. Leslie invested in the New Issige Bio-lech fund, which inverts in small, newly issued bio tech stocks and whose investors have earned an average of 16% per year in the fund's relatively ohort history. a. If the two women's funds cam the same returns in the future as in the past, how old will ench be when she becomes a millionaire? Do not round intermediate calculations. Round your answers to two decimal places. Allinon:Lestee:yearsyears b. How large would Allison's annual contnbutions twave to be for her to become a millionaire at the same age as teshie, assuming their expected returns are realized? Do not round intermediate calculations. Round your answer to the nearest cent. 5 c. Is it rathonal or irrational for. Alisen to invest in the bond fund rather than in stocks? 1. High expected returns in the market are almost always acrompanoed by a lot of risk, We couldn't say whether Allison ws rational or irrational, just that she seems to have less tolerance for tisk than Leslie does: II. High expected returns in the market are alenost always accompanied by less risk. We couldn't say whether Allison is rational or irrational, just that ahn seems to have more tolerance for risk than testic does. 111. High expected returns in the market are almost always accompanied by a lot of msk. We couldn't say whether Allison as rational of arational, just that she seems to have more tolerance for rick than Leslie does. IV. High expected returns in the market are almost always accompaniod by less risk. We couldn't say whether Allison is rational or irational, just that she seerrs to havo less tolerance for risk than Leslie does. V. High expected returns in the market are almost always accompanied by a lot of riski We couldn't say whether Allisoei is rational ar irrabional, jug that she seerns to have about the same tolerance for risk than Leslie does