ALL 1 Question

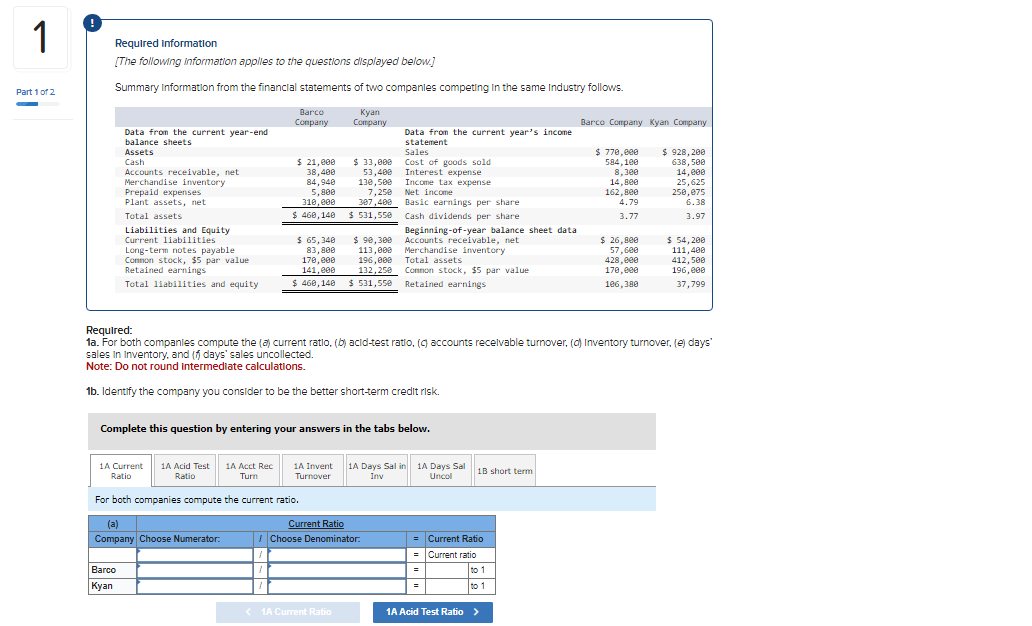

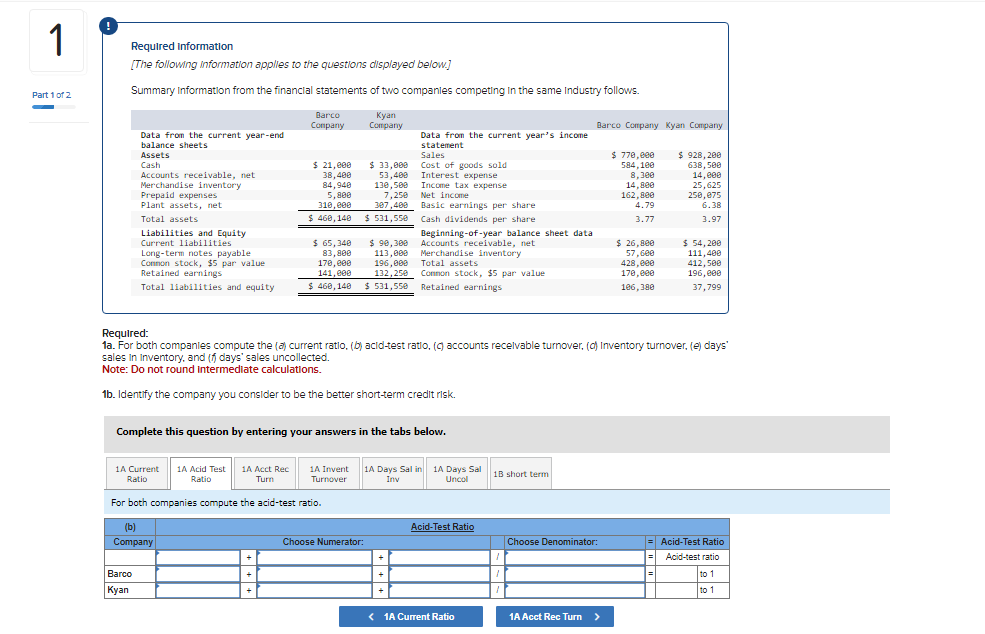

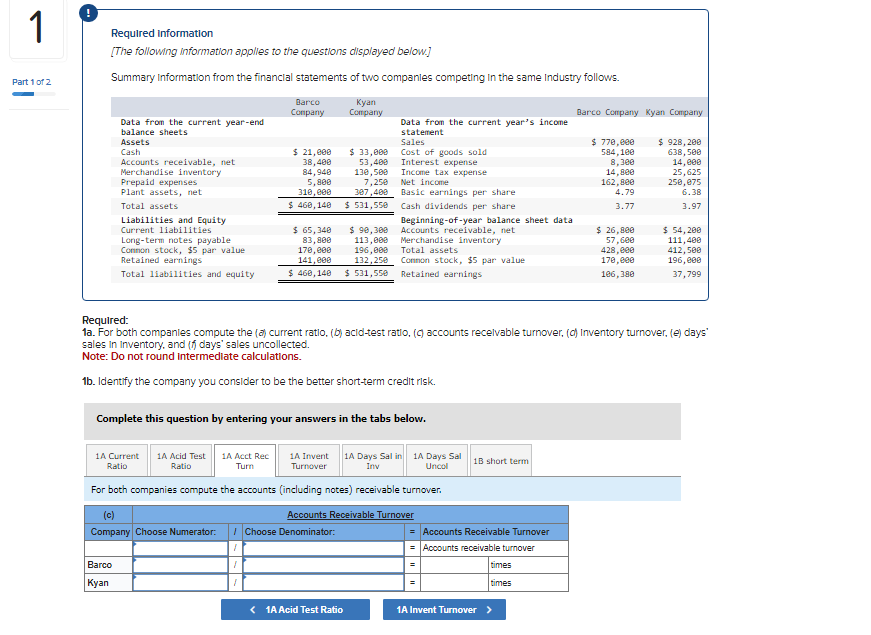

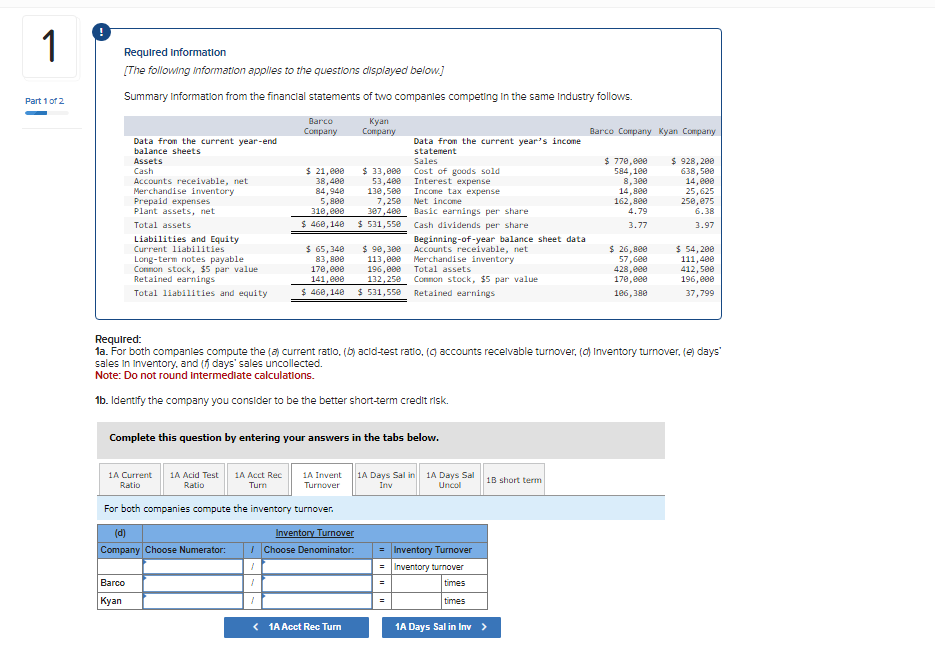

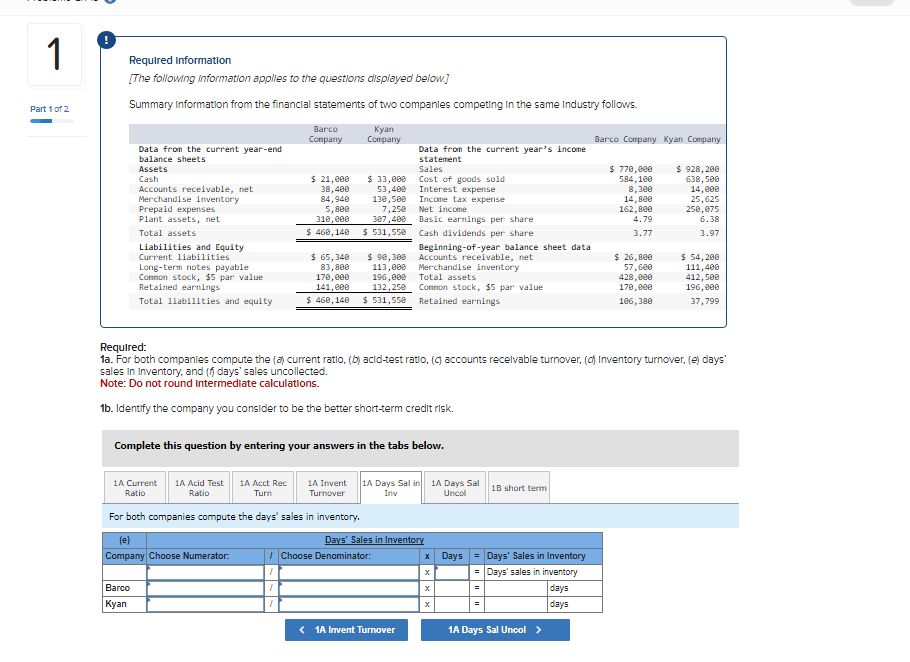

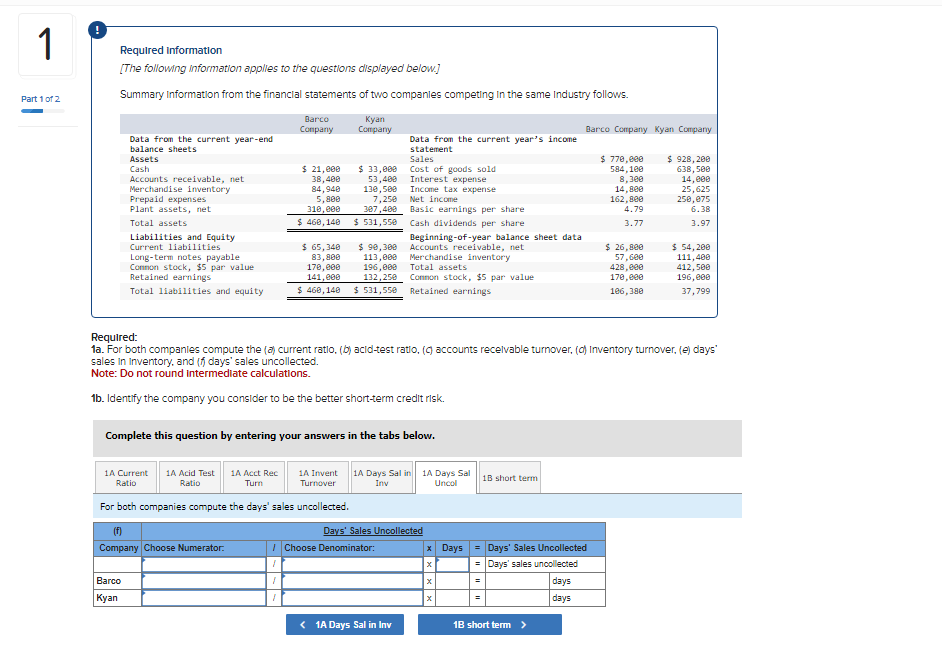

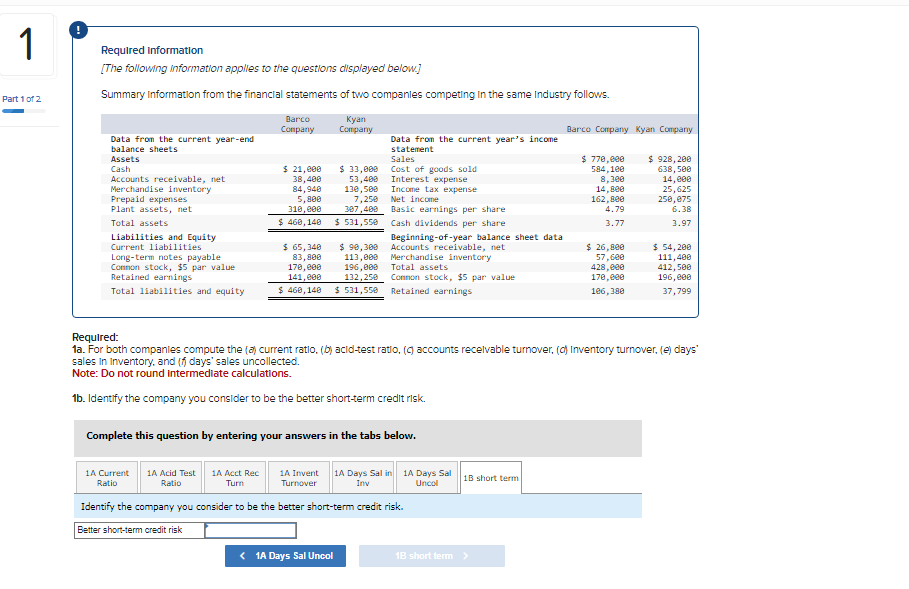

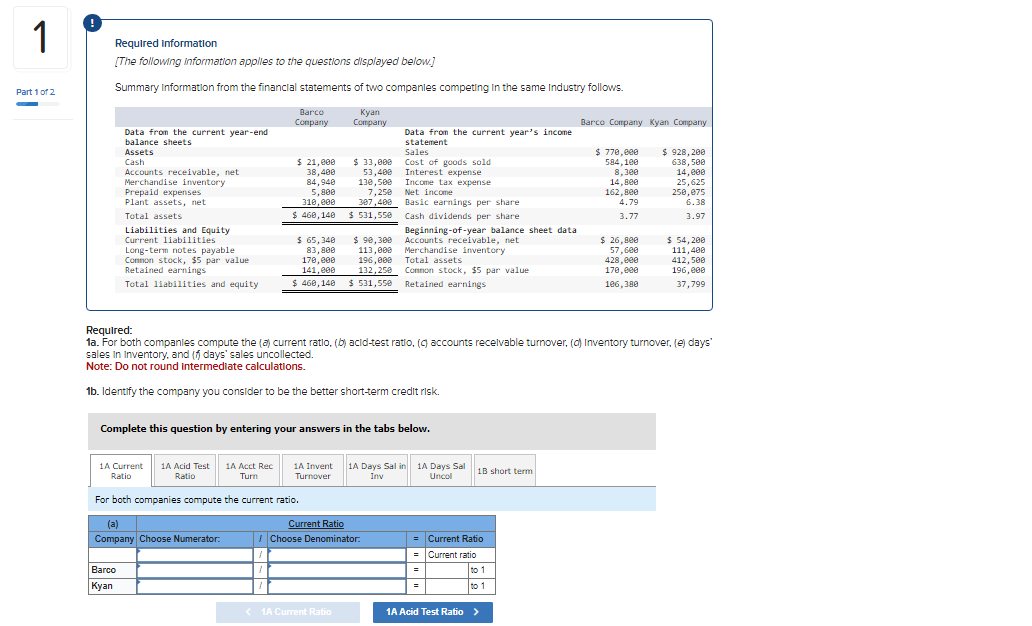

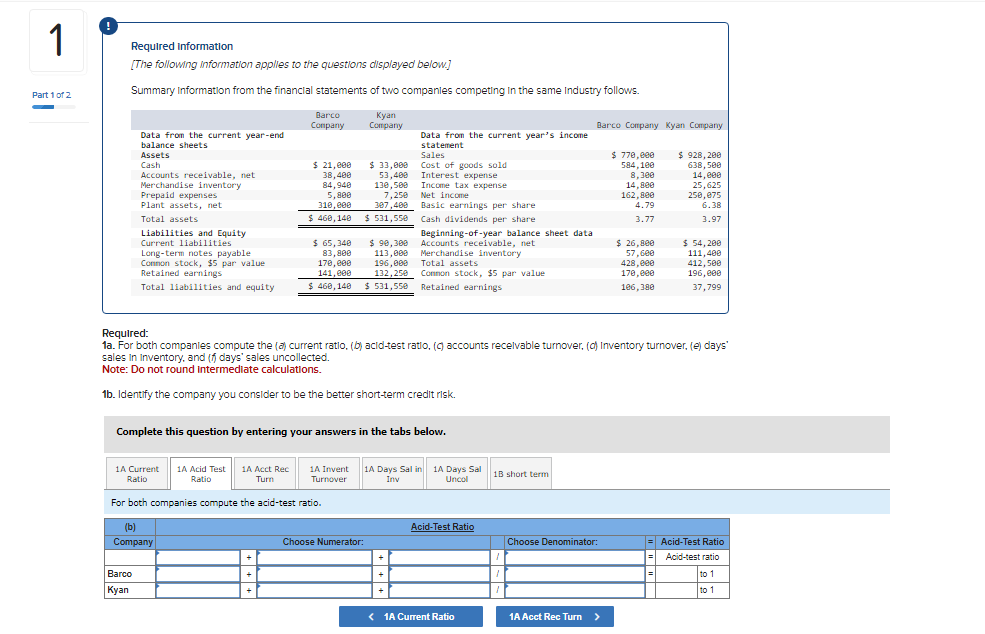

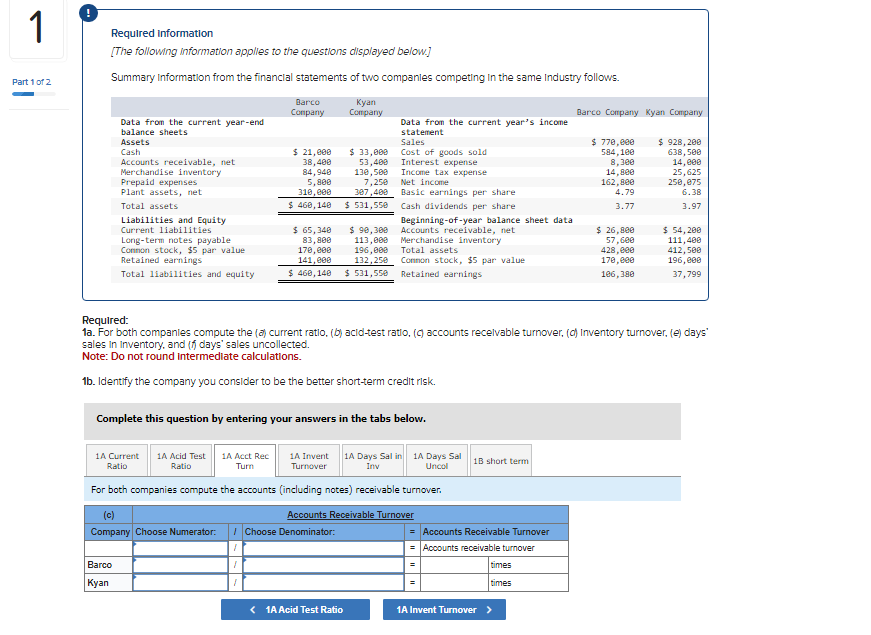

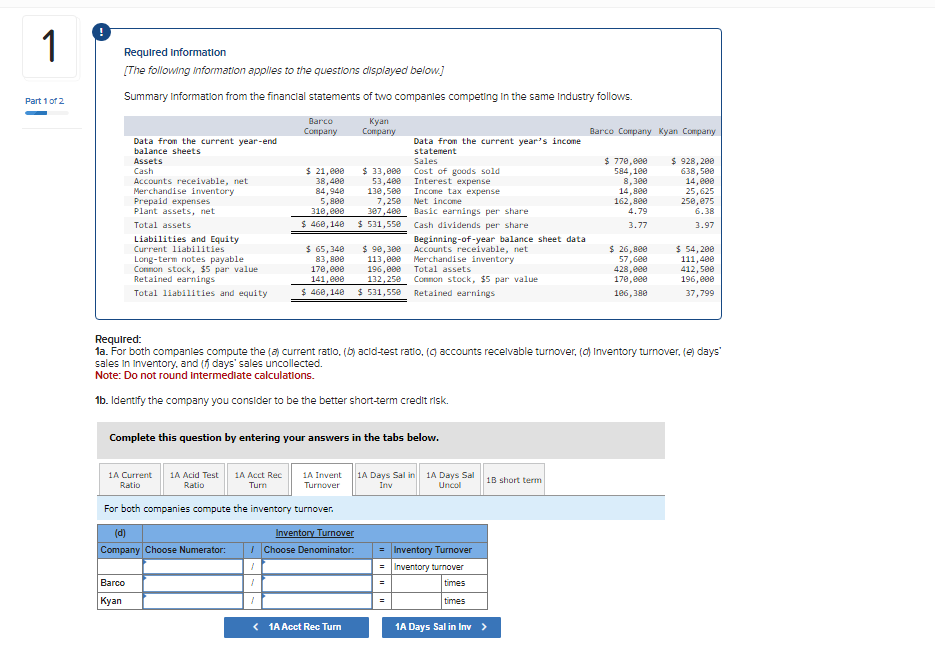

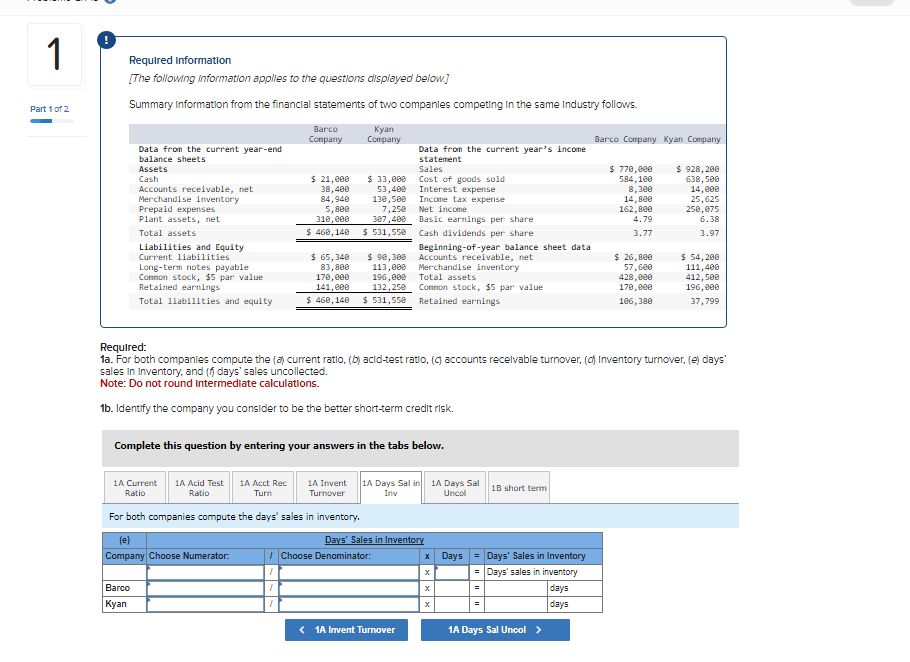

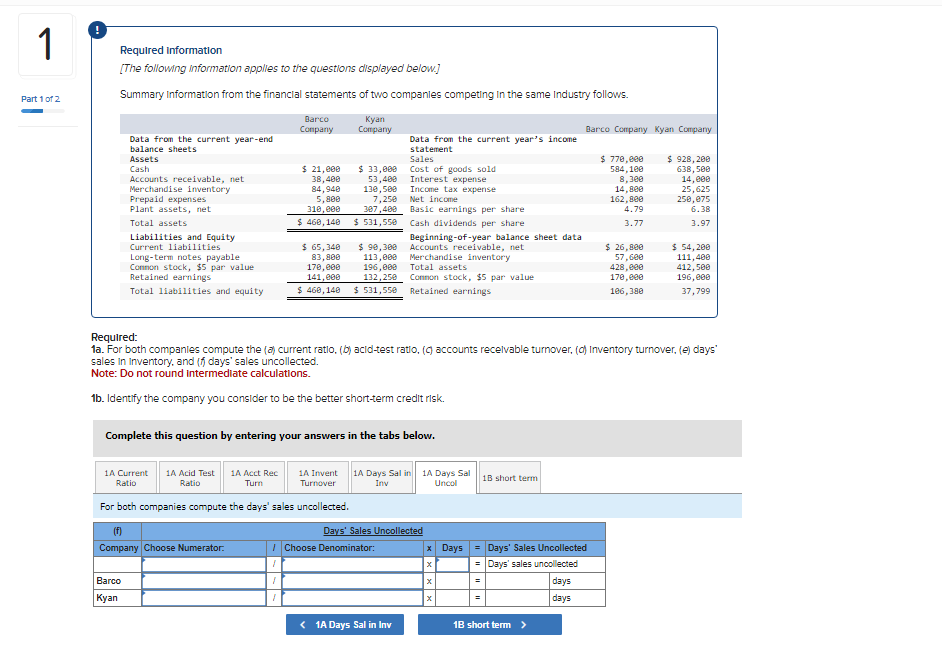

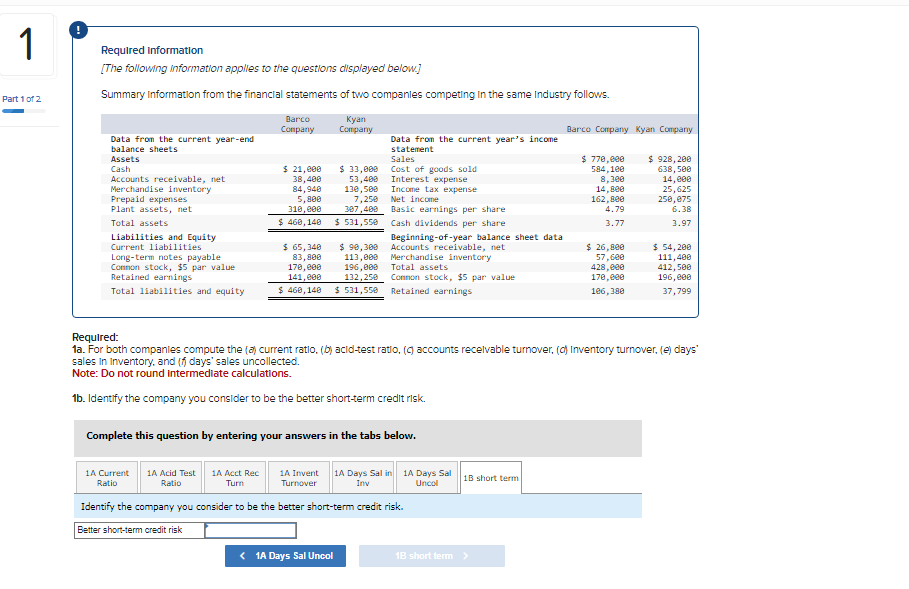

Required Information [The following information applles to the questions displayed below.] Summary Information from the financial statements of two companles competing in the same Industry follows. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts recelvable turnover, (d) Inventory turnover, (e) days' sales in Inventory, and (f) days' sales uncollected. Note: Do not round intermedlate calculations. 1b. Identify the company you consider to be the better short-term credlt rlsk. Complete this question by entering your answers in the tabs below. For both companies compute the current ratio. Required information [The following information applies to the questions displayed below.] Summary Information from the financlal statements of two companles competing in the same Industry follows. Required: 1a. For both companles compute the (a) current ratio, (b) acid-test ratio, (c) accounts recelvable turnover, (d) Inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credlt rlsk. Complete this question by entering your answers in the tabs below. For both companies compute the acid-test ratio. Required information [The following information applies to the questions displayed below.] Summary Information from the financial statements of two companles competing in the same Industry follows. Required: 1a. For both companles compute the (d) current ratio, (b) acid-test ratio, (c) accounts recelvable turnover, (d) Inventory turnover, (e) days sales in Inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identlfy the company you consider to be the better short-term credit rlsk. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) receivable turnover. Required information [The following information applles to the questions displayed below.] Summary Information from the financlal statements of two companles competing in the same Industry follows. Required: 1a. For both companies compute the (d) current ratlo, (b) acid-test ratio, (c) accounts recelvable turnover, (d) Inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit rlsk. Complete this question by entering your answers in the tabs below. For both companies compute the inventory turnover. Required information [The following information applies to the questions displayed below.] Summary Information from the financial statements of two companles competing in the same Industry follows. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts recelvable turnover, (d) Inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales in inventory. Requlred information [The following information applies to the questions displayed below.] Summary Information from the financial statements of two companles competing in the same Industry follows. Required: 1a. For both companles compute the (a) current ratlo, (b) acid-test ratio, (c) accounts recelvable turnover, (d) Inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales uncollected. Required Information [The following information applies to the questions displayed below.] Summary Information from the financial statements of two companles competing in the same Industry follows. Required: 1a. For both companles compute the (a) current ratio, (b) acid-test ratio, ( (c) accounts recelvable turnover, ( (d) Inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit rlsk. Complete this question by entering your answers in the tabs below. Identify the company you consider to be the better short-term credit risk