all 3 parts please and thank you !

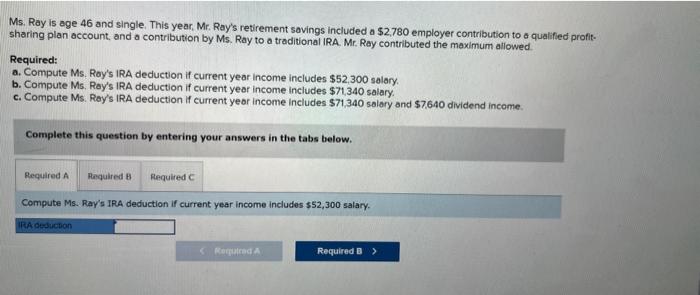

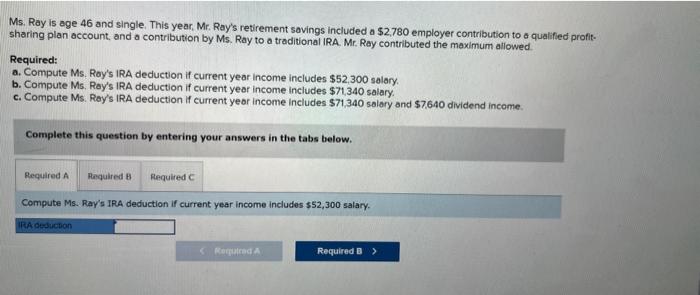

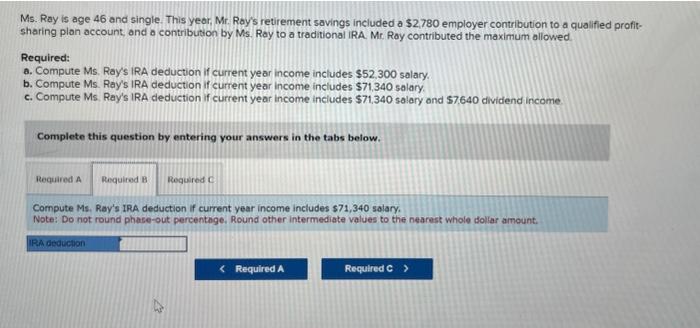

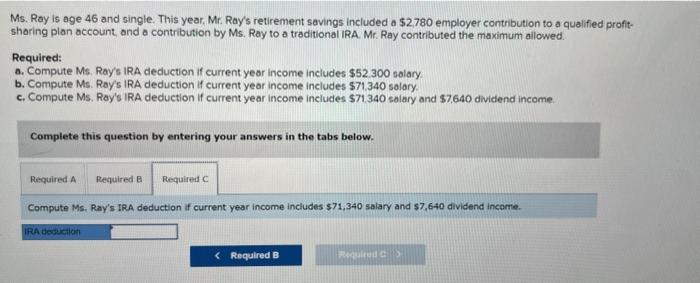

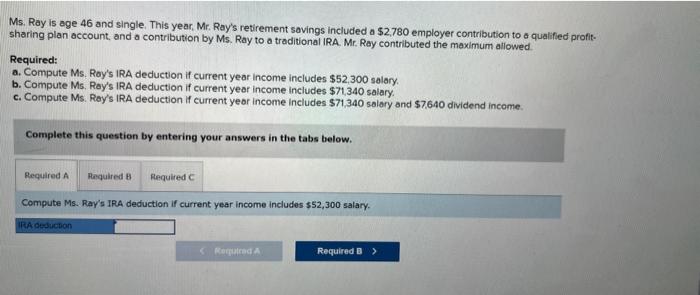

Ms. Ray is age 46 and single. This year, Mr. Ray's retirement savings included a $2,780 employer contribution to a qualified profit. sharing plan account, and a contribution by Ms. Ray to a traditional IRA. Mr. Ray contributed the moximum allowed. Required: a. Compute Ms. Ray's IRA deduction if current year income includes $52,300 salary. b. Compute Ms. Roy's IRA deduction if current year income includes $71,340 salary. c. Compute Ms. Ray's IRA deduction if current year income includes $71,340 salary and $7,640 dividend income. Complete this question by entering your answers in the tabs below. Compute Ms. Ray's IRA deduction if current year income includes $52,300 salary. Ms. Ray is age 46 and single. This yeor, Mr. Ray's retirement savings included a $2,780 employer contribution to a qualified profitsharing plon account, and a contribution by Mis. Ray to a traditional IRA. Mr. Ray contributed the maximum allowed. Required: a. Compute Ms. Ray's IRA deduction if current year income includes $52,300 salary. b. Compute Ms. Ray's IRA deduction if current year income includes $71,340 salary. c. Compute Ms. Ray's IRA deduction if current year income includes $71,340 salary and $7,640 dividend income Complete this question by entering your answers in the tabs below. Compute Ms. Ray's IRA deduction if current year income includes $71,340 salary. Note: Do not round phase-out percentage. Round other intermediate values to the nearest whole dollar amount. Ms. Ray is age 46 and single. This year, Mr. Ray's retirement savings included a $2,780 employer contribution to a qualified profitsharing plan account, and a contribution by Ms. Ray to a traditional IRA. Mr. Ray contributed the maximum allowed. Required: a. Compute Ms. Ray's IRA deduction if current year income includes $52.300 salary b. Compute Ms. Ray's IRA deduction if current yeor income includes $71.340 salary. c. Compute Ms. Ray's IRA deduction if current year income includes $71,340 salary and $7,640 dividend income. Complete this question by entering your answers in the tabs below. Compute Ms, Ray's IRA deduction if current year income includes $71,340 salary and $7,640 dividend income