Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all 3 parts . please solve please solve 3 4 5 will highly appreciate Project number: 1 2 3 4 5 6 7 8 Initial

all 3 parts . please solve

please solve 3 4 5 will highly appreciate

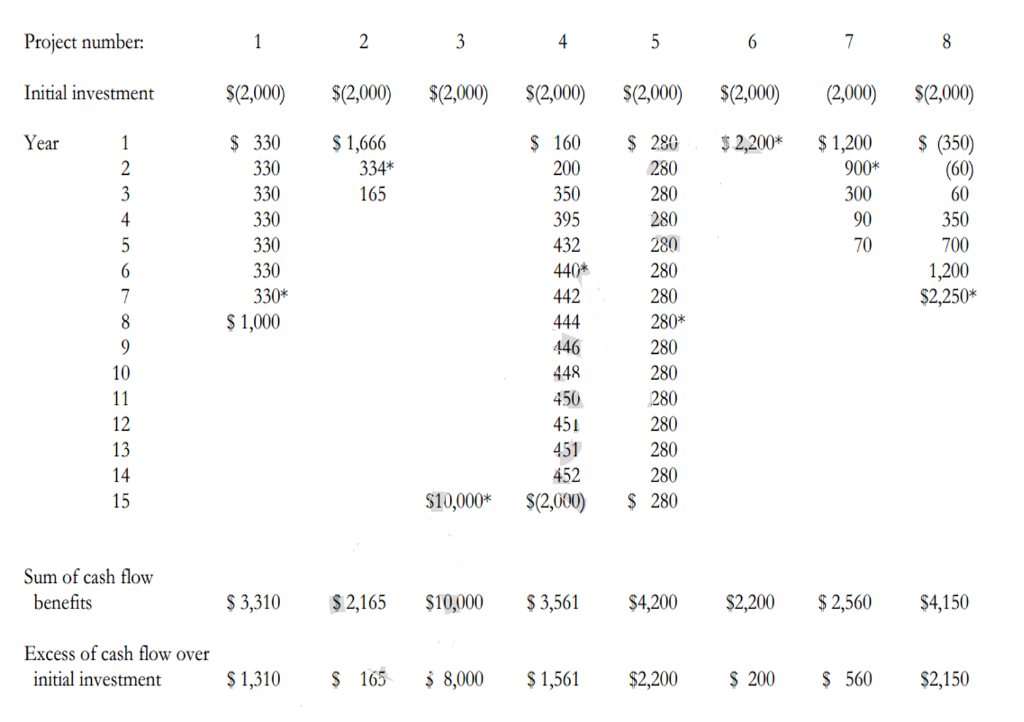

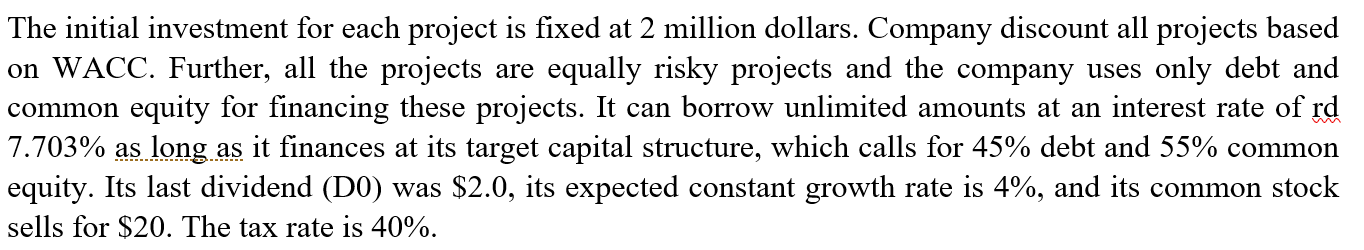

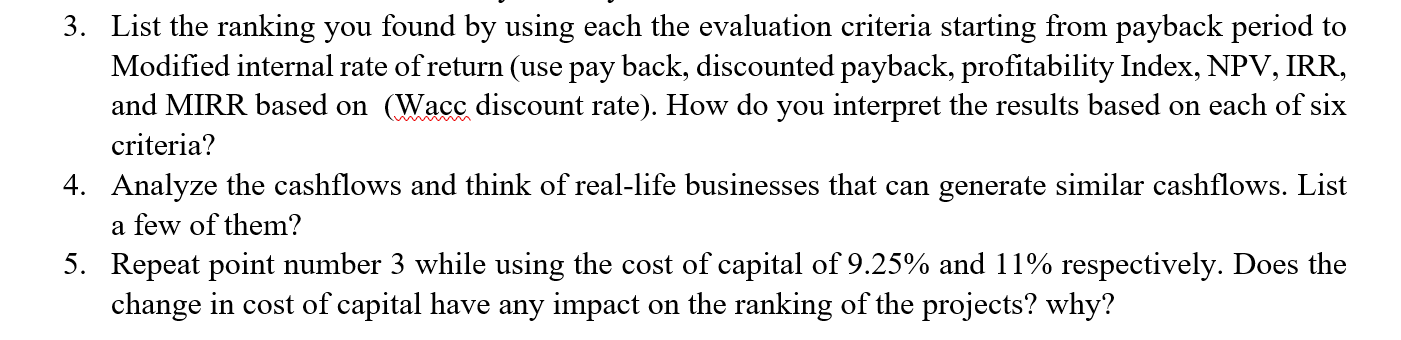

Project number: 1 2 3 4 5 6 7 8 Initial investment $(2,000) $(2,000) $(2,000) $(2,000) $(2,000) $(2,000) (2,000) $(2,000) Year $2,200* $ 1,666 334* 165 $ 160 200 $ (350) 350 $ 330 330 330 330 330 330 330* $1,000 $ 280 280 280 280 280 280 $ 1,200 900* 300 90 70 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 (60) 60 350 700 1,200 $2,250* 280 395 432 440* 442 444 446 448 450 280* 280 280 280 451 280 451 452 $(2,000) 280 280 $ 280 $10,000* Sum of cash flow benefits $ 3,310 $ 2,165 $10,000 $ 3,561 $4,200 $2,200 $ 2,560 $4,150 Excess of cash flow over initial investment $ 1,310 $ 165 $ 8,000 $ 1,561 $2,200 $ 200 $ 560 $2,150 The initial investment for each project is fixed at 2 million dollars. Company discount all projects based on WACC. Further, all the projects are equally risky projects and the company uses only debt and common equity for financing these projects. It can borrow unlimited amounts at an interest rate of rd 7.703% as long as it finances at its target capital structure, which calls for 45% debt and 55% common equity. Its last dividend (DO) was $2.0, its expected constant growth rate is 4%, and its common stock sells for $20. The tax rate is 40%. 3. List the ranking you found by using each the evaluation criteria starting from payback period to Modified internal rate of return (use pay back, discounted payback, profitability Index, NPV, IRR, and MIRR based on (Wacc discount rate). How do you interpret the results based on each of six criteria? 4. Analyze the cashflows and think of real-life businesses that can generate similar cashflows. List a few of them? 5. Repeat point number 3 while using the cost of capital of 9.25% and 11% respectively. Does the change in cost of capital have any impact on the ranking of the projects? whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started