Answered step by step

Verified Expert Solution

Question

1 Approved Answer

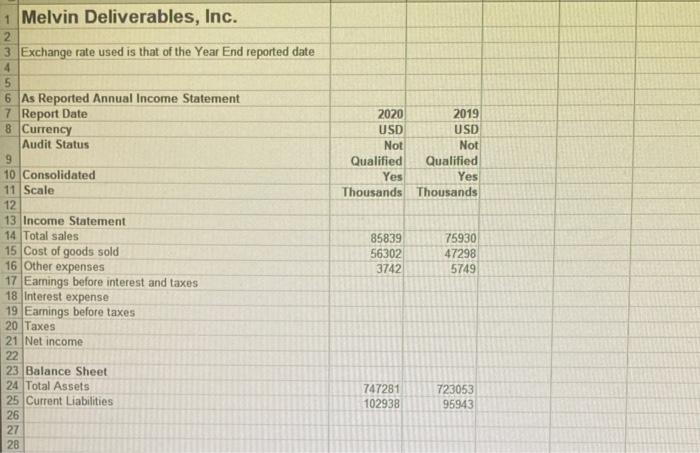

All 3 questions reside in the excel sheet provided, thank you. You are given this financial data for Melvin Deliverables, Inc. Given inventory of $26061822,

All 3 questions reside in the excel sheet provided, thank you.

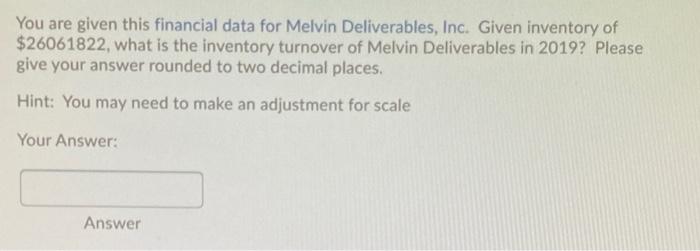

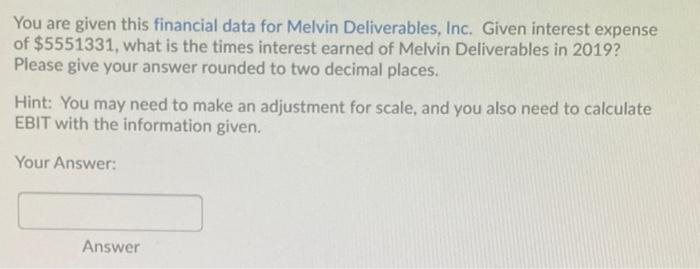

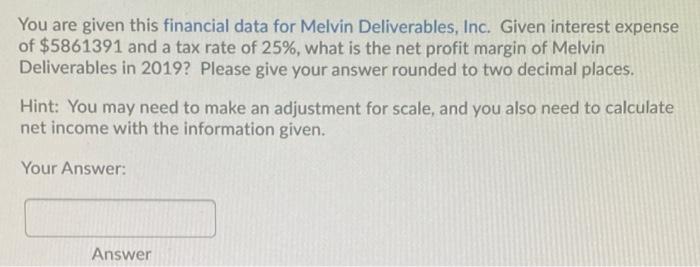

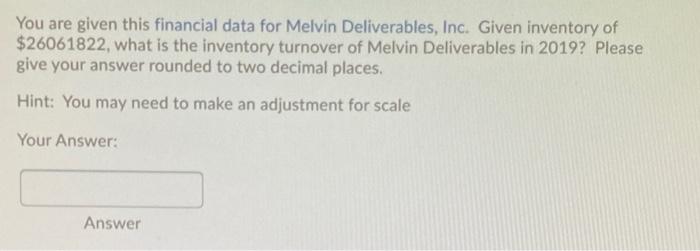

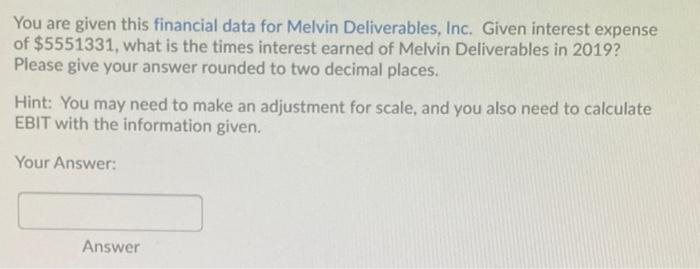

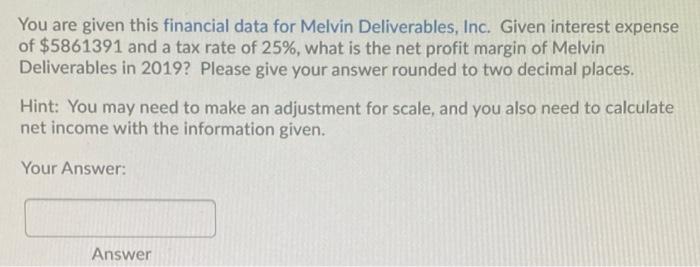

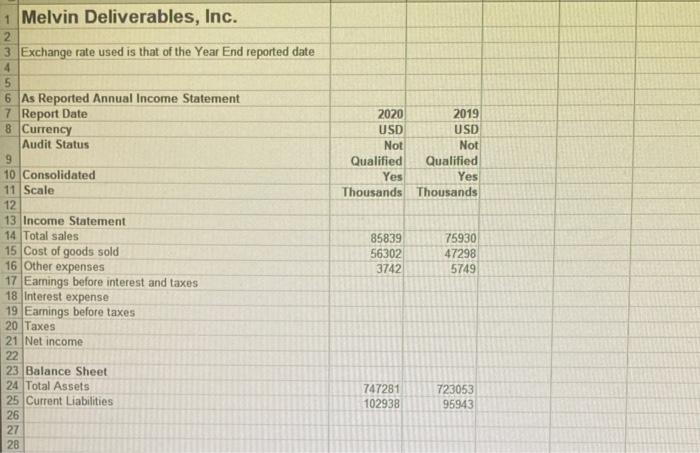

You are given this financial data for Melvin Deliverables, Inc. Given inventory of $26061822, what is the inventory turnover of Melvin Deliverables in 2019? Please give your answer rounded to two decimal places. Hint: You may need to make an adjustment for scale Your Answer: Answer You are given this financial data for Melvin Deliverables, Inc. Given interest expense of $5551331, what is the times interest earned of Melvin Deliverables in 2019? Please give your answer rounded to two decimal places. Hint: You may need to make an adjustment for scale, and you also need to calculate EBIT with the information given. Your Answer: Answer You are given this financial data for Melvin Deliverables, Inc. Given interest expense of $5861391 and a tax rate of 25%, what is the net profit margin of Melvin Deliverables in 2019? Please give your answer rounded to two decimal places. Hint: You may need to make an adjustment for scale, and you also need to calculate net income with the information given. Your Answer: Answer 2020 USD Not Qualified Yes Thousands 2019 USD Not Qualified Yes Thousands 1 Melvin Deliverables, Inc. 2 3 Exchange rate used is that of the Year End reported date 4 5 6 As Reported Annual Income Statement 7 Report Date 8 Currency Audit Status 9 10 Consolidated 11 Scale 12 13 Income Statement 14 Total sales 15 Cost of goods sold 16 Other expenses 17 Earnings before interest and taxes 18 Interest expense 19 Earnings before taxes 20 Taxes 21 Net income 22 23 Balance Sheet 24 Total Assets 25 Current Liabilities 26 27 28 85839 56302 3742 75930 47298 5749 747281 102938 723053 95943

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started