Answered step by step

Verified Expert Solution

Question

1 Approved Answer

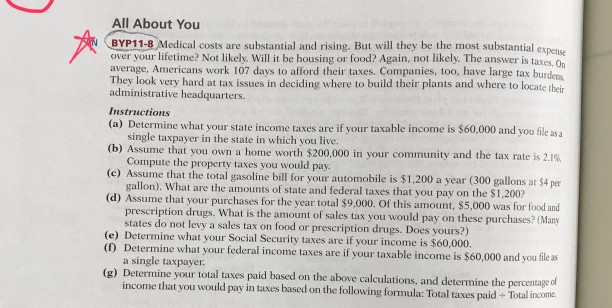

All About You BYP11-8 Medical costs are substantial and rising. But will they be the most substantial expens over your lifetime? Not likely. Will it

All About You BYP11-8 Medical costs are substantial and rising. But will they be the most substantial expens over your lifetime? Not likely. Will it be housing or food? Again, not likely. The answer is taxes average, Americans work 107 days to afford their taxes. Companies, too, have large tax burders They look very hard at tax issues in deciding where to build their plants and where to locate administrative headquarters Instructions (a) Determine what your state income taxes are if your taxable income is $60,000 and you file as a their single taxpayer in the state in which you live, Compute the property taxes you would pay gallon). What are the amounts of state and federal taxes that you pay on the $1,200? prescription drugs. What is the amount of sales tax you would pay on these purchases? Many (b) Assume that you own a home worth $200,000 in your community and the tax rate is 2.1%. (c) Assume that the total gasoline bil for your automobile is $1.200 a year (300 gallons at $4 pe ) Assume that your purchases for the year total $9,000. Of this amount, $5,000 was for food and states do not levy a sales tax on food or prescription dru gs. Does yours?) (e) Determine what your Social Security taxes are if your income is $60,000. (f) Determine what your federal income taxes are if your taxable income is $60,000 and you file s (g) Determine your total taxes paid based on the above calculations, and determine the percentage of a single taxpayer. income that you would pay in taxes based on the following formula: Total taxes paid +Total inome All About You BYP11-8 Medical costs are substantial and rising. But will they be the most substantial expens over your lifetime? Not likely. Will it be housing or food? Again, not likely. The answer is taxes average, Americans work 107 days to afford their taxes. Companies, too, have large tax burders They look very hard at tax issues in deciding where to build their plants and where to locate administrative headquarters Instructions (a) Determine what your state income taxes are if your taxable income is $60,000 and you file as a their single taxpayer in the state in which you live, Compute the property taxes you would pay gallon). What are the amounts of state and federal taxes that you pay on the $1,200? prescription drugs. What is the amount of sales tax you would pay on these purchases? Many (b) Assume that you own a home worth $200,000 in your community and the tax rate is 2.1%. (c) Assume that the total gasoline bil for your automobile is $1.200 a year (300 gallons at $4 pe ) Assume that your purchases for the year total $9,000. Of this amount, $5,000 was for food and states do not levy a sales tax on food or prescription dru gs. Does yours?) (e) Determine what your Social Security taxes are if your income is $60,000. (f) Determine what your federal income taxes are if your taxable income is $60,000 and you file s (g) Determine your total taxes paid based on the above calculations, and determine the percentage of a single taxpayer. income that you would pay in taxes based on the following formula: Total taxes paid +Total inome

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started