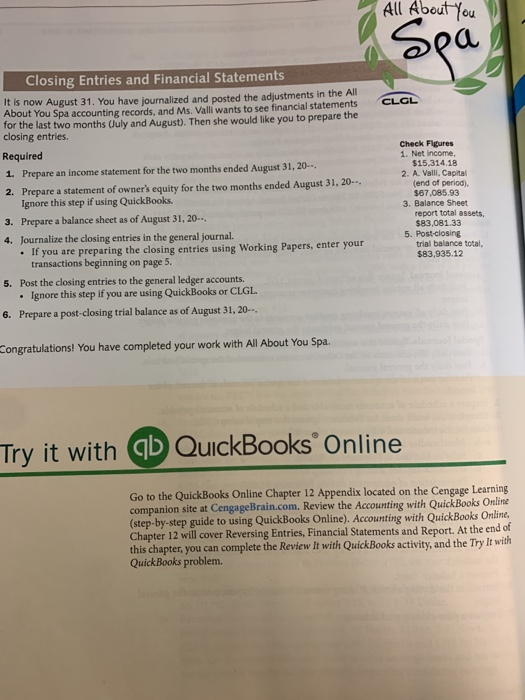

All About You Sea CLGL Closing Entries and Financial Statements It is now August 31. You have journalized and posted the adjustments in the All About You Spa accounting records, and Ms. Valli wants to see financial statements for the last two months (July and August). Then she would like you to prepare the closing entries. Required 1. Prepare an income statement for the two months ended August 31, 20-.. 2. Prepare a statement of owner's equity for the two months ended August 31, 20 Ignore this step if using QuickBooks. 3. Prepare a balance sheet as of August 31, 20.. 4. Journalize the closing entries in the general journal. If you are preparing the closing entries using Working Papers, enter your transactions beginning on page 5. 5. Post the closing entries to the general ledger accounts. Ignore this step if you are using QuickBooks or CLGL 6. Prepare a post-closing trial balance as of August 31, 20... Check Figures 1. Net income, $15,314.18 2. A Val Capital (end of period $67.085.93 3. Balance Sheet report total assets $83,081.33 5. Post-closing trial balance total, $83.935.12 Congratulations! You have completed your work with All About You Spa. Try it with ab QuickBooks Online Go to the QuickBooks Online Chapter 12 Appendix located on the Cengage Learning companion site at CengageBrain.com. Review the Accounting with QuickBooks Online (step-by-step guide to using QuickBooks Online). Accounting with QuickBooks Online, Chapter 12 will cover Reversing Entries, Financial Statements and Report. At the end of this chapter, you can complete the Review It with QuickBooks activity, and the Try it with QuickBooks problem. All About You Sea CLGL Closing Entries and Financial Statements It is now August 31. You have journalized and posted the adjustments in the All About You Spa accounting records, and Ms. Valli wants to see financial statements for the last two months (July and August). Then she would like you to prepare the closing entries. Required 1. Prepare an income statement for the two months ended August 31, 20-.. 2. Prepare a statement of owner's equity for the two months ended August 31, 20 Ignore this step if using QuickBooks. 3. Prepare a balance sheet as of August 31, 20.. 4. Journalize the closing entries in the general journal. If you are preparing the closing entries using Working Papers, enter your transactions beginning on page 5. 5. Post the closing entries to the general ledger accounts. Ignore this step if you are using QuickBooks or CLGL 6. Prepare a post-closing trial balance as of August 31, 20... Check Figures 1. Net income, $15,314.18 2. A Val Capital (end of period $67.085.93 3. Balance Sheet report total assets $83,081.33 5. Post-closing trial balance total, $83.935.12 Congratulations! You have completed your work with All About You Spa. Try it with ab QuickBooks Online Go to the QuickBooks Online Chapter 12 Appendix located on the Cengage Learning companion site at CengageBrain.com. Review the Accounting with QuickBooks Online (step-by-step guide to using QuickBooks Online). Accounting with QuickBooks Online, Chapter 12 will cover Reversing Entries, Financial Statements and Report. At the end of this chapter, you can complete the Review It with QuickBooks activity, and the Try it with QuickBooks