Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All Agency A employees are paid biweekly on the 5th (for wages earned during the payperiod of the previous month's 16 through month end)

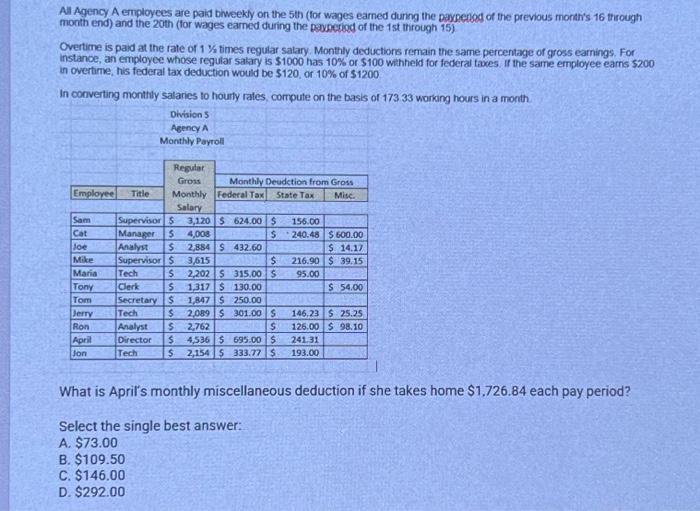

All Agency A employees are paid biweekly on the 5th (for wages earned during the payperiod of the previous month's 16 through month end) and the 20th (for wages earned during the payperiod of the 1st through 15) Overtime is paid at the rate of 1 % times regular salary. Monthly deductions remain the same percentage of gross earnings. For instance, an employee whose regular salary is $1000 has 10% or $100 withheld for federal taxes. If the same employee earns $200 in overtime, his federal tax deduction would be $120, or 10% of $1200 In converting monthly salaries to hourly rates, compute on the basis of 173 33 working hours in a month. Division 5 Agency A Monthly Payroll Employee Sam Cat Joe Mike Maria Tony Tom Jerry Ron April Jon Title Regular Gross Monthly Deudction from Gross Monthly Federal Tax State Tax Misc. Salary Supervisor $3,120 5 624.00 $ 156.00 Manager S 4,008 $240.48 Analyst $ Supervisor $ 2,884 S 432.60 3,615 US $ 2,202 $315.00 $ $ S 1,317 $ 130.00 Secretary S 1,847 $ 250.00 Tech $ 2,089 $ 301.00 $ Analyst $ 2,762 $ Director $ 4,536 $ 695.00 $ Tech $ 2,154 $ 333.77 $ Tech Clerk 216.90 95.00 $ 600.00 $ 14.17 $39.15 $ 54.00 146.23 $ 25.25 126.00 $98.10 241.31 193.00 What is April's monthly miscellaneous deduction if she takes home $1,726.84 each pay period? Select the single best answer: A. $73.00 B. $109.50 C. $146.00 D. $292.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is B 10950 To calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started