Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All amounts are stated in HK$, unless otherwise specified Question 2 Powerful Ltd (the Company) is incorporated and carrying on its business in Hong Kong.

All amounts are stated in HK$, unless otherwise specified

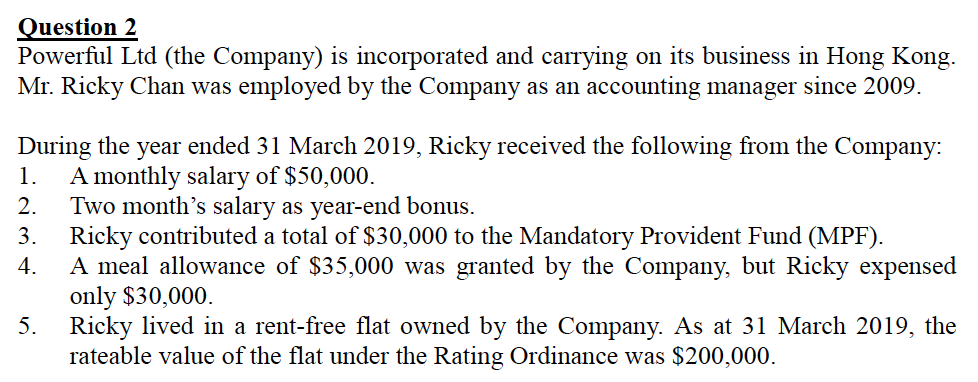

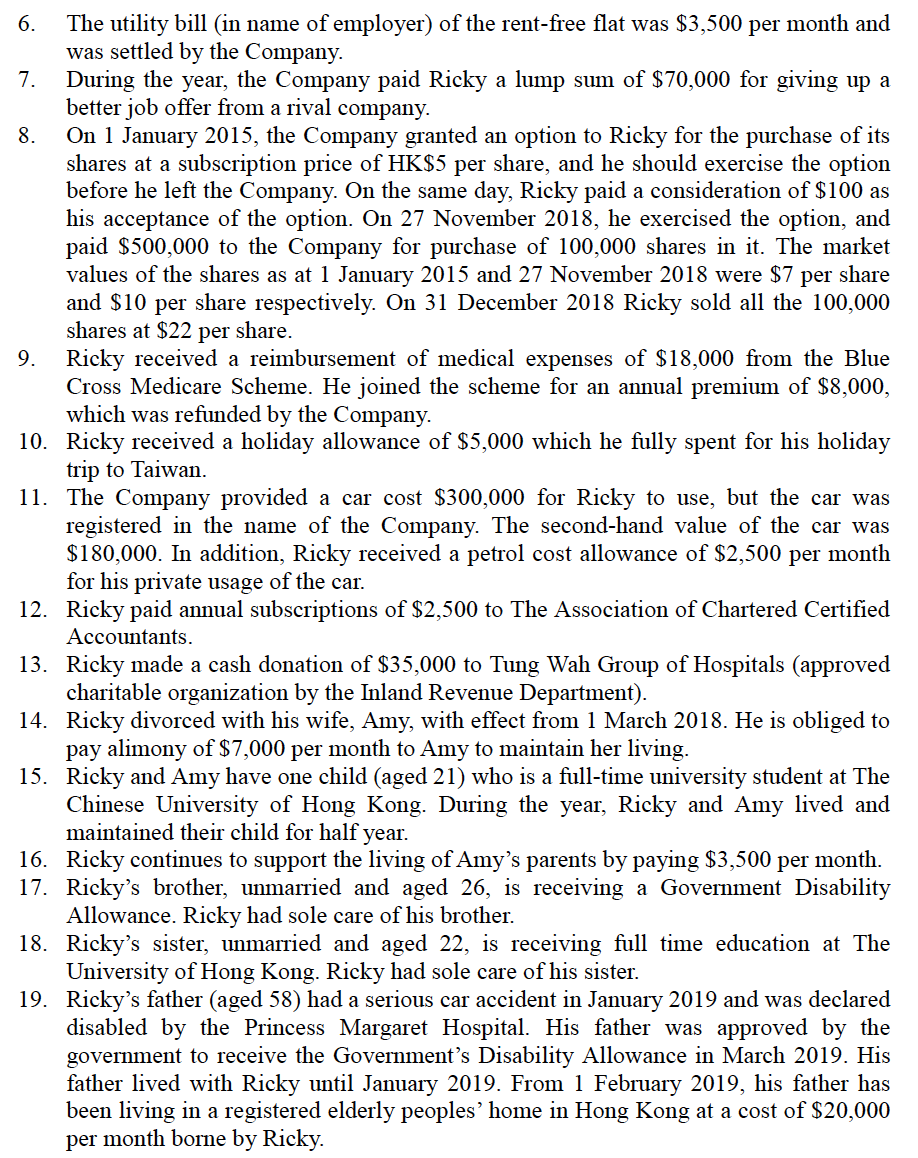

Question 2 Powerful Ltd (the Company) is incorporated and carrying on its business in Hong Kong. Mr. Ricky Chan was employed by the Company as an accounting manager since 2009. During the year ended 31 March 2019, Ricky received the following from the Company: 1. A monthly salary of $50,000. 2. Two month's salary as year-end bonus. 3. Ricky contributed a total of $30,000 to the Mandatory Provident Fund (MPF). 4. A meal allowance of $35,000 was granted by the Company, but Ricky expensed only $30,000. 5. Ricky lived in a rent-free flat owned by the Company. As at 31 March 2019, the rateable value of the flat under the Rating Ordinance was $200,000. 6. The utility bill (in name of employer) of the rent-free flat was $3,500 per month and was settled by the Company. 7. During the year, the Company paid Ricky a lump sum of $70,000 for giving up a better job offer from a rival company. 8. On 1 January 2015, the Company granted an option to Ricky for the purchase of its shares at a subscription price of HK$5 per share, and he should exercise the option before he left the Company. On the same day, Ricky paid a consideration of $100 as his acceptance of the option. On 27 November 2018, he exercised the option, and paid $500,000 to the Company for purchase of 100,000 shares in it. The market values of the shares as at 1 January 2015 and 27 November 2018 were $7 per share and $10 per share respectively. On 31 December 2018 Ricky sold all the 100,000 shares at $22 per share. 9. Ricky received a reimbursement of medical expenses of $18,000 from the Blue Cross Medicare Scheme. He joined the scheme for an annual premium of $8,000, which was refunded by the Company. 10. Ricky received a holiday allowance of $5,000 which he fully spent for his holiday trip to Taiwan. 11. The Company provided a car cost $300,000 for Ricky to use, but the car was registered in the name of the Company. The second-hand value of the car was $180,000. In addition, Ricky received a petrol cost allowance of $2,500 per month for his private usage of the car. 12. Ricky paid annual subscriptions of $2,500 to The Association of Chartered Certified Accountants. 13. Ricky made a cash donation of $35,000 to Tung Wah Group of Hospitals (approved charitable organization by the Inland Revenue Department). 14. Ricky divorced with his wife, Amy, with effect from 1 March 2018. He is obliged to pay alimony of $7,000 per month to Amy to maintain her living. 15. Ricky and Amy have one child (aged 21) who is a full-time university student at The Chinese University of Hong Kong. During the year, Ricky and Amy lived and maintained their child for half year. 16. Ricky continues to support the living of Amy's parents by paying $3,500 per month. 17. Ricky's brother, unmarried and aged 26, is receiving a Government Disability Allowance. Ricky had sole care of his brother. 18. Ricky's sister, unmarried and aged 22, is receiving full time education at The University of Hong Kong. Ricky had sole care of his sister. 19. Ricky's father (aged 58) had a serious car accident in January 2019 and was declared disabled by the Princess Margaret Hospital. His father was approved by the government to receive the Government's Disability Allowance in March 2019. His father lived with Ricky until January 2019. From 1 February 2019, his father has been living in a registered elderly peoples' home in Hong Kong at a cost of $20,000 per month borne by Ricky. c) With reference to Inland Revenue Ordinance, case laws and DIPNs, discuss the tax treatments for items (7), (10) and (13). [Word limit is 150 words] (9 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started