all answered EXCEPT E and F

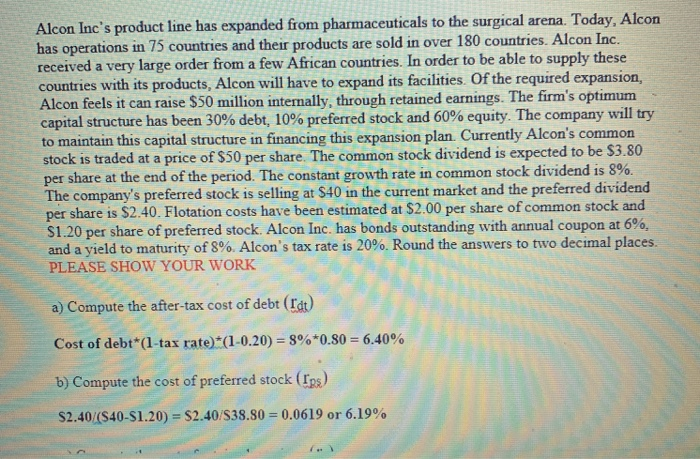

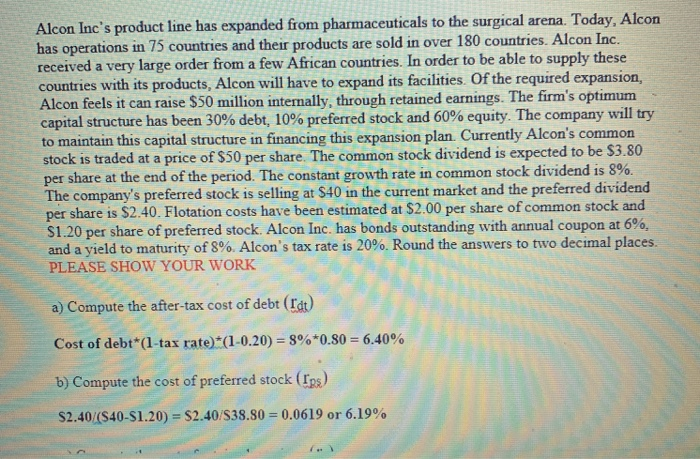

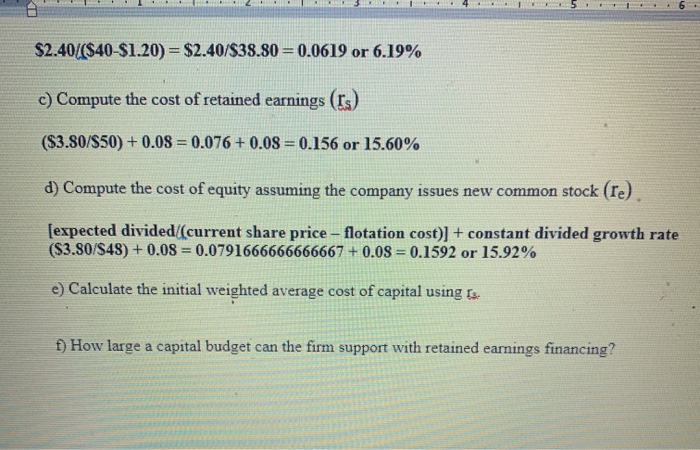

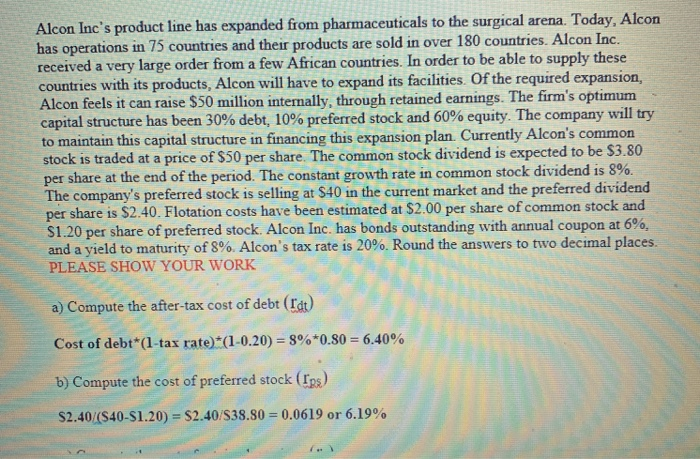

Alcon Inc's product line has expanded from pharmaceuticals to the surgical arena. Today, Alcon has operations in 75 countries and their products are sold in over 180 countries. Alcon Inc. received a very large order from a few African countries. In order to be able to supply these countries with its products, Alcon will have to expand its facilities. Of the required expansion, Alcon feels it can raise $50 million internally, through retained earnings. The firm's optimum capital structure has been 30% debt, 10% preferred stock and 60% equity. The company will try to maintain this capital structure in financing this expansion plan. Currently Alcon's common stock is traded at a price of $50 per share. The common stock dividend is expected to be $3.80 per share at the end of the period. The constant growth rate in common stock dividend is 8%. The company's preferred stock is selling at $40 in the current market and the preferred dividend per share is $2.40. Flotation costs have been estimated at $2.00 per share of common stock and $1.20 per share of preferred stock. Alcon Inc. has bonds outstanding with annual coupon at 6%, and a yield to maturity of 8%. Alcon's tax rate is 20%. Round the answers to two decimal places. PLEASE SHOW YOUR WORK a) Compute the after-tax cost of debt (rdt) Cost of debt*(1-tax rate)*(1-0.20) = 8%*0.30 = 6.40% b) Compute the cost of preferred stock (Ins) S2.40/(S40-$1.20) = $2.40/S38.80 = 0.0619 or 6.19% 3 . 4 6 . $2.40/($40-$1.20) = $2.40/$38.80 = 0.0619 or 6.19% c) Compute the cost of retained earnings (Is) ($3.80/850) + 0.08 = 0.076 + 0.08 = 0.156 or 15.60% d) Compute the cost of equity assuming the company issues new common stock (re). [expected divided (current share price - flotation cost)] + constant divided growth rate (S3.80/S48) + 0.08 = 0.0791666666666667 + 0.08 = 0.1592 or 15.92% e) Calculate the initial weighted average cost of capital using is f) How large a capital budget can the firm support with retained earnings financing? Alcon Inc's product line has expanded from pharmaceuticals to the surgical arena. Today, Alcon has operations in 75 countries and their products are sold in over 180 countries. Alcon Inc. received a very large order from a few African countries. In order to be able to supply these countries with its products, Alcon will have to expand its facilities. Of the required expansion, Alcon feels it can raise $50 million internally, through retained earnings. The firm's optimum capital structure has been 30% debt, 10% preferred stock and 60% equity. The company will try to maintain this capital structure in financing this expansion plan. Currently Alcon's common stock is traded at a price of $50 per share. The common stock dividend is expected to be $3.80 per share at the end of the period. The constant growth rate in common stock dividend is 8%. The company's preferred stock is selling at $40 in the current market and the preferred dividend per share is $2.40. Flotation costs have been estimated at $2.00 per share of common stock and $1.20 per share of preferred stock. Alcon Inc. has bonds outstanding with annual coupon at 6%, and a yield to maturity of 8%. Alcon's tax rate is 20%. Round the answers to two decimal places. PLEASE SHOW YOUR WORK a) Compute the after-tax cost of debt (rdt) Cost of debt*(1-tax rate)*(1-0.20) = 8%*0.30 = 6.40% b) Compute the cost of preferred stock (Ins) S2.40/(S40-$1.20) = $2.40/S38.80 = 0.0619 or 6.19% 3 . 4 6 . $2.40/($40-$1.20) = $2.40/$38.80 = 0.0619 or 6.19% c) Compute the cost of retained earnings (Is) ($3.80/850) + 0.08 = 0.076 + 0.08 = 0.156 or 15.60% d) Compute the cost of equity assuming the company issues new common stock (re). [expected divided (current share price - flotation cost)] + constant divided growth rate (S3.80/S48) + 0.08 = 0.0791666666666667 + 0.08 = 0.1592 or 15.92% e) Calculate the initial weighted average cost of capital using is f) How large a capital budget can the firm support with retained earnings financing