Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All answers are to be completed using the financial functions in Excel, with each input of the calculation having its own unique cell. Highlight final

All answers are to be completed using the financial functions in Excel, with each input of the calculation having its own unique cell. Highlight final answer in yellow.

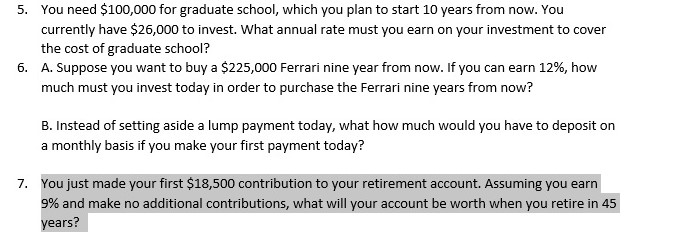

5. You need $100,000 for graduate school, which you plan to start 10 years from now. You currently have $26,000 to invest. What annual rate must you earn on your investment to cover the cost of graduate school? 6. A. Suppose you want to buy a $225,000 Ferrari nine year from now. If you can earn 12%, how much must you invest today in order to purchase the Ferrari nine years from now? B. Instead of setting aside a lump payment today, what how much would you have to deposit on a monthly basis if you make your first payment today? 7. You just made your first $18,500 contribution to your retirement account. Assuming you earn 9% and make no additional contributions, what will your account be worth when you retire in 45 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started