Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All answers must be entererd as formulas two different questions CHAPTER 3 Saved Help Save & Exit Submit E F G If Roten Rooters, Inc.,

All answers must be entererd as formulas

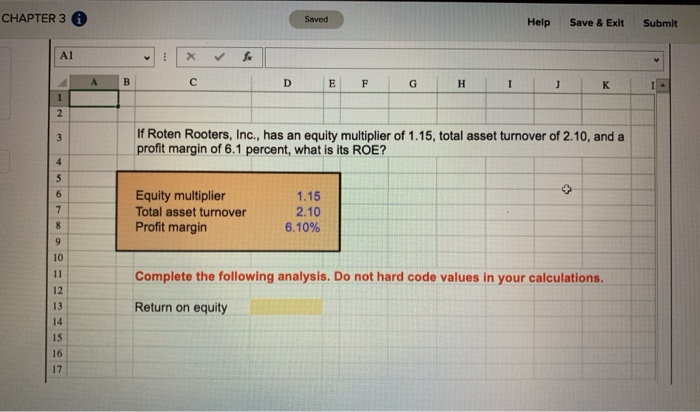

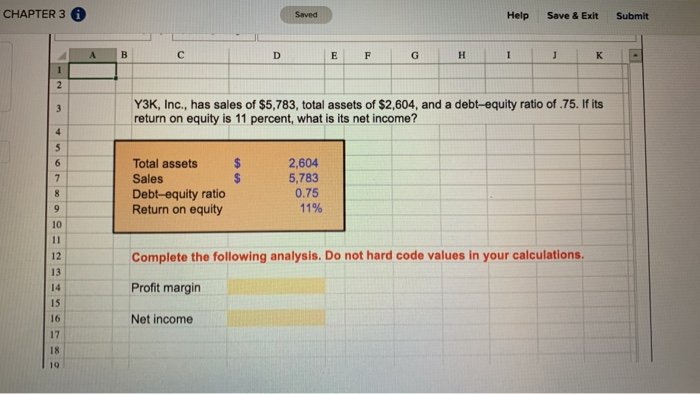

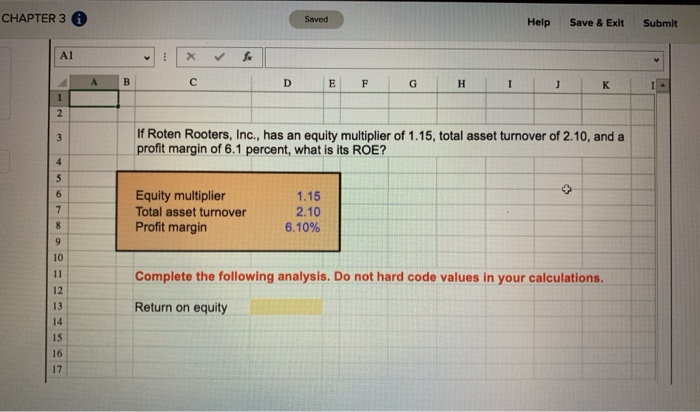

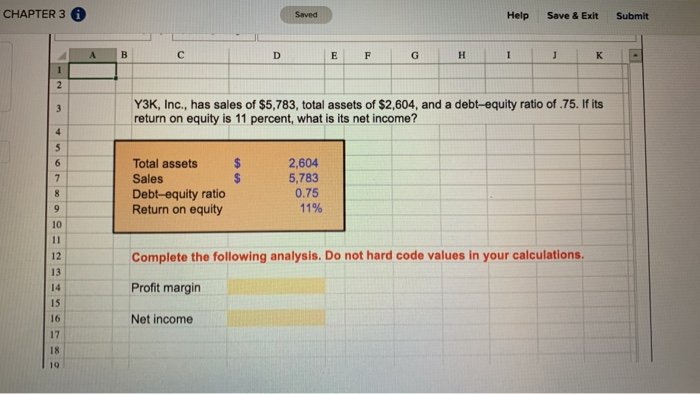

CHAPTER 3 Saved Help Save & Exit Submit E F G If Roten Rooters, Inc., has an equity multiplier of 1.15, total asset turnover of 2.10, and a profit margin of 6.1 percent, what is its ROE? 1.15 Equity multiplier Total asset turnover Profit margin 2.10 6.10% Complete the following analysis. Do not hard code values in your calculations. Return on equity CHAPTER 3 Saved Help Save & Exit Submit Y3K, Inc., has sales of $5,783, total assets of $2,604, and a debt-equity ratio of .75. If its return on equity is 11 percent, what is its net income? Total assets Sales Debt-equity ratio Return on equity 2,604 5,783 0.75 11% Complete the following analysis. Do not hard code values in your calculations. Profit margin Net income

two different questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started