Answered step by step

Verified Expert Solution

Question

1 Approved Answer

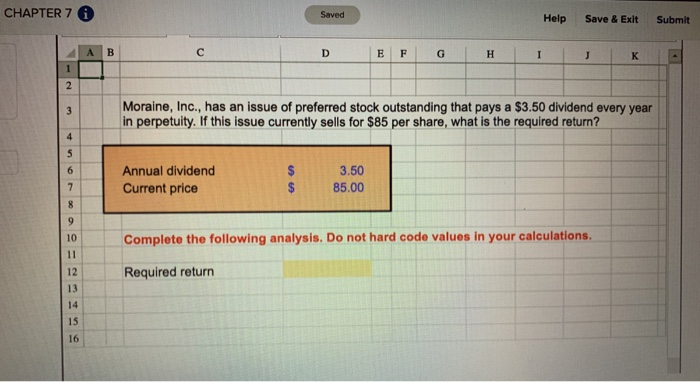

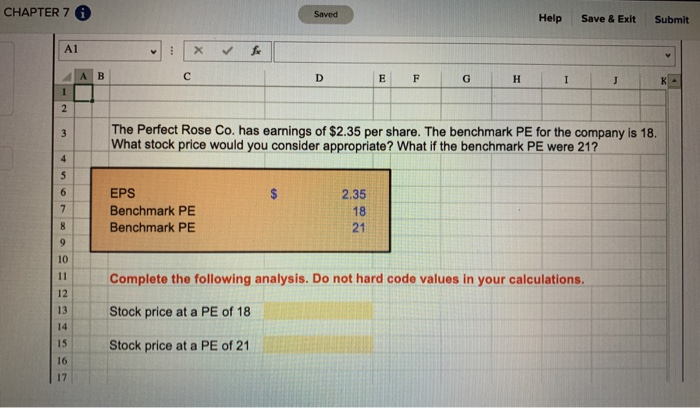

All answers must be entererd as formulas two different questions CHAPTER 7 6 Saved Help Save & Exit Submit E F G H Moraine, Inc.,

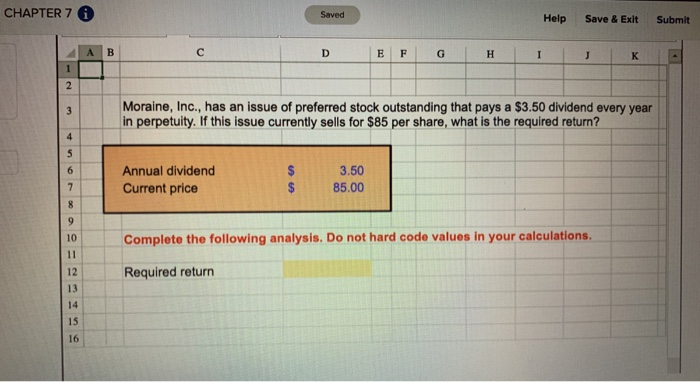

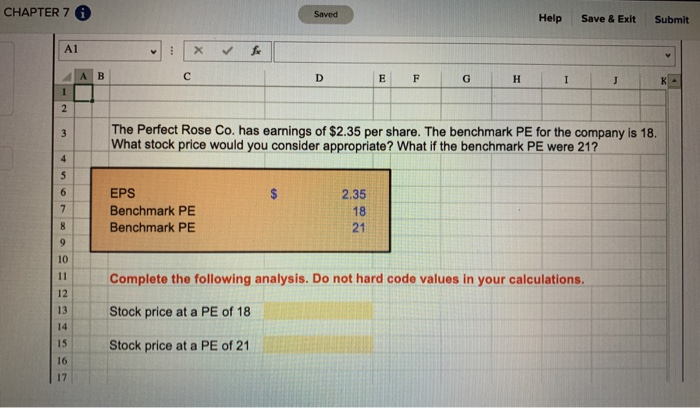

All answers must be entererd as formulas

CHAPTER 7 6 Saved Help Save & Exit Submit E F G H Moraine, Inc., has an issue of preferred stock outstanding that pays a $3.50 dividend every year in perpetuity. If this issue currently sells for $85 per share, what is the required return? Annual dividend Current price 3.50 85.00 Complete the following analysis. Do not hard code values in your calculations. Required return CHAPTER 7 0 Saved Help Save & Exit Submit The Perfect Rose Co. has earnings of $2.35 per share. The benchmark PE for the company is 18. What stock price would you consider appropriate? What if the benchmark PE were 21? 2.35 EPS Benchmark PE Benchmark PE Complete the following analysis. Do not hard code values in your calculations. Stock price at a PE of 18 Stock price at a PE of 21

two different questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started