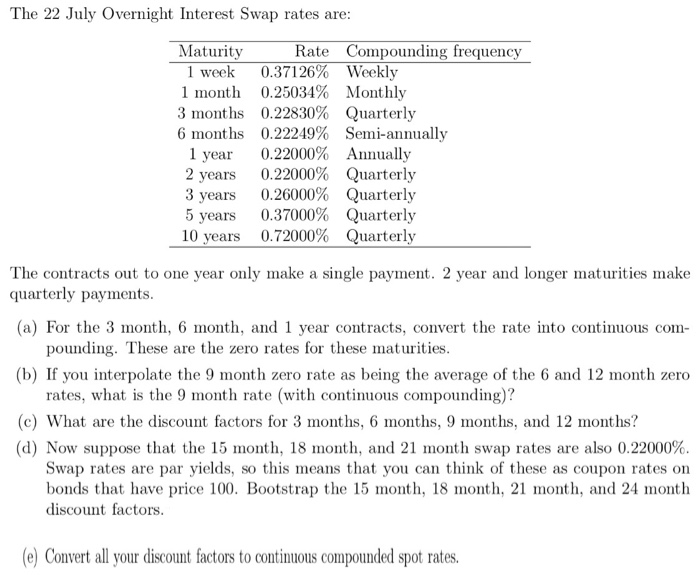

The 22 July Overnight Interest Swap rates are: Maturity Rate Compounding frequency 1 week 0.37126% Weekly 1 month 0.25034% Monthly 3 months 0.22830% Quarterly 6 months 0.22249% Semi-annually 1 year 0.22000% Annually 2 years 0.22000% Quarterly 3 years 0.26000% Quarterly 5 years 0.37000% Quarterly 10 years 0.72000% Quarterly The contracts out to one year only make a single payment. 2 year and longer maturities make quarterly payments. (a) For the 3 month, 6 month, and 1 year contracts, convert the rate into continuous com- pounding. These are the zero rates for these maturities. (b) If you interpolate the 9 month zero rate as being the average of the 6 and 12 month zero rates, what is the 9 month rate (with continuous compounding)? (c) What are the discount factors for 3 months, 6 months, 9 months, and 12 months? (d) Now suppose that the 15 month, 18 month, and 21 month swap rates are also 0.22000%. Swap rates are par yields, so this means that you can think of these as coupon rates on bonds that have price 100. Bootstrap the 15 month, 18 month, 21 month, and 24 month discount factors. (e) Convert all your discount factors to continuous compounded spot rates. The 22 July Overnight Interest Swap rates are: Maturity Rate Compounding frequency 1 week 0.37126% Weekly 1 month 0.25034% Monthly 3 months 0.22830% Quarterly 6 months 0.22249% Semi-annually 1 year 0.22000% Annually 2 years 0.22000% Quarterly 3 years 0.26000% Quarterly 5 years 0.37000% Quarterly 10 years 0.72000% Quarterly The contracts out to one year only make a single payment. 2 year and longer maturities make quarterly payments. (a) For the 3 month, 6 month, and 1 year contracts, convert the rate into continuous com- pounding. These are the zero rates for these maturities. (b) If you interpolate the 9 month zero rate as being the average of the 6 and 12 month zero rates, what is the 9 month rate (with continuous compounding)? (c) What are the discount factors for 3 months, 6 months, 9 months, and 12 months? (d) Now suppose that the 15 month, 18 month, and 21 month swap rates are also 0.22000%. Swap rates are par yields, so this means that you can think of these as coupon rates on bonds that have price 100. Bootstrap the 15 month, 18 month, 21 month, and 24 month discount factors. (e) Convert all your discount factors to continuous compounded spot rates