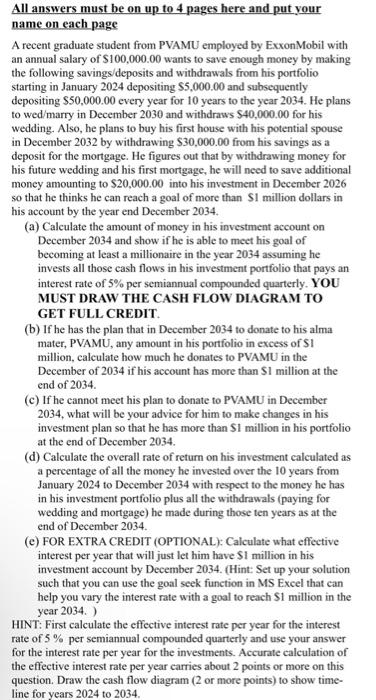

All answers must be on up to 4 pages here and put your name on each page A recent graduate student from PVAMU employed by ExxonMobil with an annual salary of $100,000.00 wants to save enough money by making the following savings/deposits and withdrawals from his portfolio starting in January 2024 depositing $5,000.00 and subsequently depositing $50,000.00 every year for 10 years to the year 2034 . He plans to wed/marry in December 2030 and withdraws $40,000.00 for his wedding. Also, he plans to buy his first house with his potential spouse in December 2032 by withdrawing $30,000.00 from his savings as a deposit for the mortgage. He figures out that by withdrawing money for his future wedding and his first mortgage, he will need to save additional money amounting to $20,000.00 into his investment in December 2026 so that he thinks he can reach a goal of more than $1 million dollars in his account by the year end December 2034. (a) Calculate the amount of money in his investment account on December 2034 and show if he is able to meet his goal of becoming at least a millionaire in the year 2034 assuming he invests all those cash flows in his investment portfolio that pays an interest rate of 5% per semiannual compounded quarterly. YOU MUST DRAW THE CASH FLOW DIAGRAM TO GET FULL CREDIT. (b) If he has the plan that in December 2034 to donate to his alma mater, PVAMU, any amount in his portfolio in excess of $1 million, calculate how much he donates to PVAMU in the December of 2034 if his account has more than $1 million at the end of 2034. (c) If he cannot meet his plan to donate to PVAMU in December 2034, what will be your advice for him to make changes in his investment plan so that he has more than $1 million in his portfolio at the end of December 2034. (d) Calculate the overall rate of return on his investment calculated as a percentage of all the money he invested over the 10 years from January 2024 to December 2034 with respect to the money he has in his investment portfolio plus all the withdrawals (paying for wedding and mortgage) he made during those ten years as at the end of December 2034. (e) FOR EXTRA CREDIT (OPTIONAL); Calculate what effective interest per year that will just let him have $1 million in his investment account by December 2034. (Hint: Set up your solution such that you can use the goal seek function in MS Excel that can help you vary the interest rate with a goal to reach $1 million in the year 2034.) HINT: First calculate the effective interest rate per year for the interest rate of 5% per semiannual compounded quarterly and use your answer for the interest rate per year for the investments. Accurate calculation of the effective interest rate per year carries about 2 points or more on this question. Draw the cash flow diagram ( 2 or more points) to show timeline for years 2024 to 2034