Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All boxes need to be filled. Can anybody help? Flounder Company has determined, based on several years' of collections history, that 3% of its accounts

All boxes need to be filled. Can anybody help?

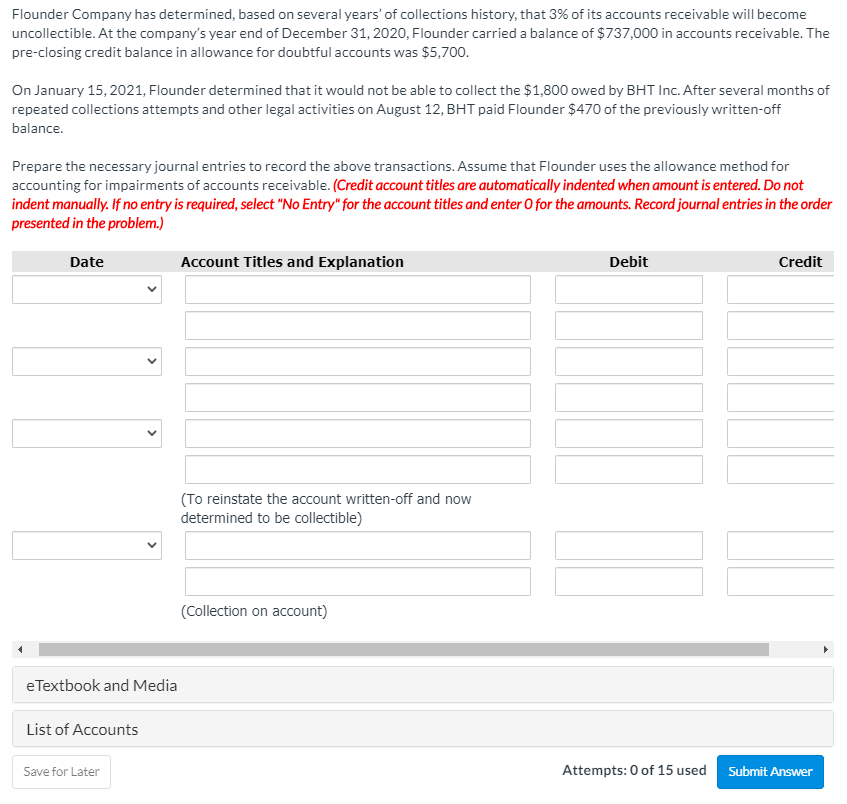

Flounder Company has determined, based on several years' of collections history, that 3% of its accounts receivable will become uncollectible. At the company's year end of December 31, 2020, Flounder carried a balance of $737,000 in accounts receivable. The pre-closing credit balance in allowance for doubtful accounts was $5,700. On January 15, 2021, Flounder determined that it would not be able to collect the $1,800 owed by BHT Inc. After several months of repeated collections attempts and other legal activities on August 12, BHT paid Flounder $470 of the previously written-off balance. Prepare the necessary journal entries to record the above transactions. Assume that Flounder uses the allowance method for accounting for impairments of accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To reinstate the account written-off and now determined to be collectible) (Collection on account) e Textbook and Media List of Accounts Save for Later Attempts: 0 of 15 used SubmitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started