Answered step by step

Verified Expert Solution

Question

1 Approved Answer

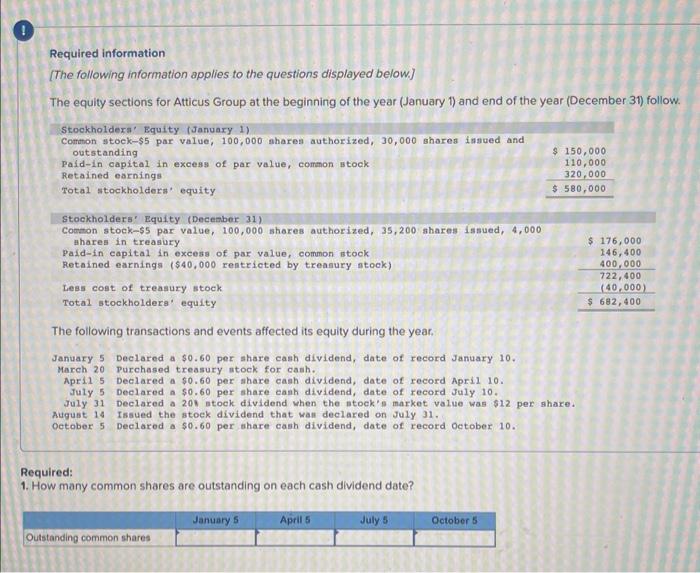

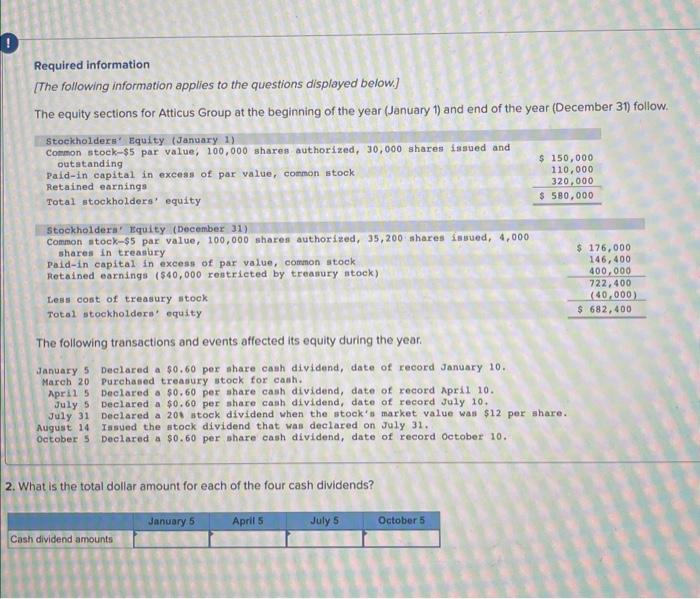

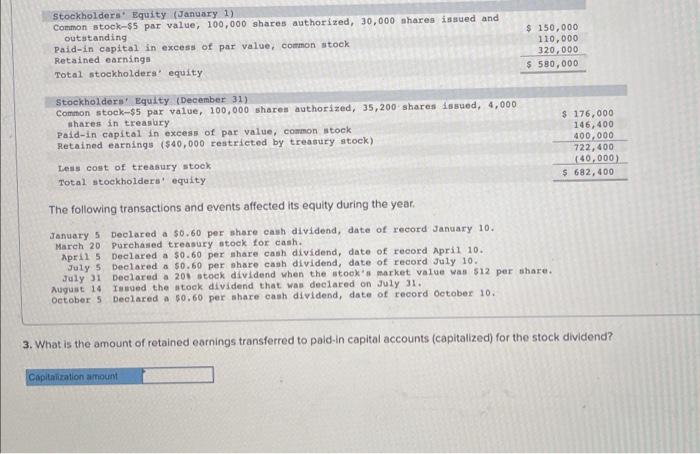

all considered 1 question, please help! Required information [The following information applies to the questions displayed below] The equity sections for Atticus Group at the

all considered 1 question, please help!

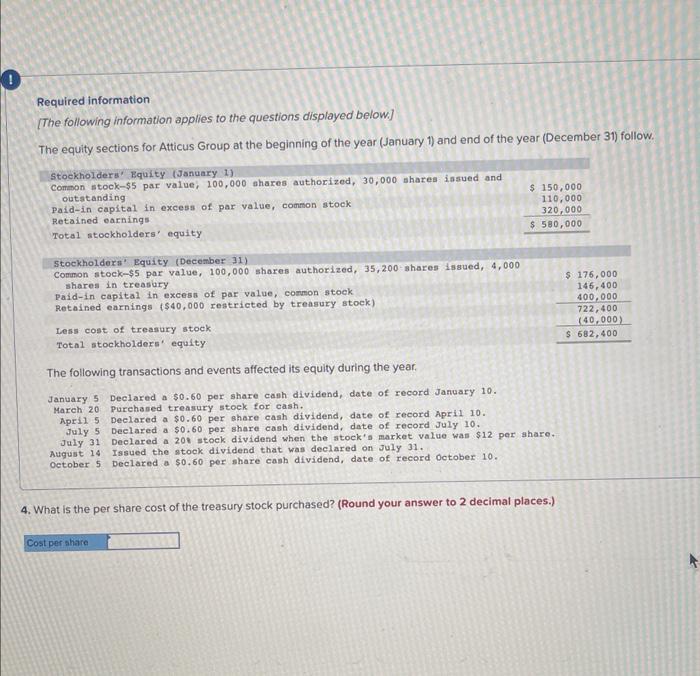

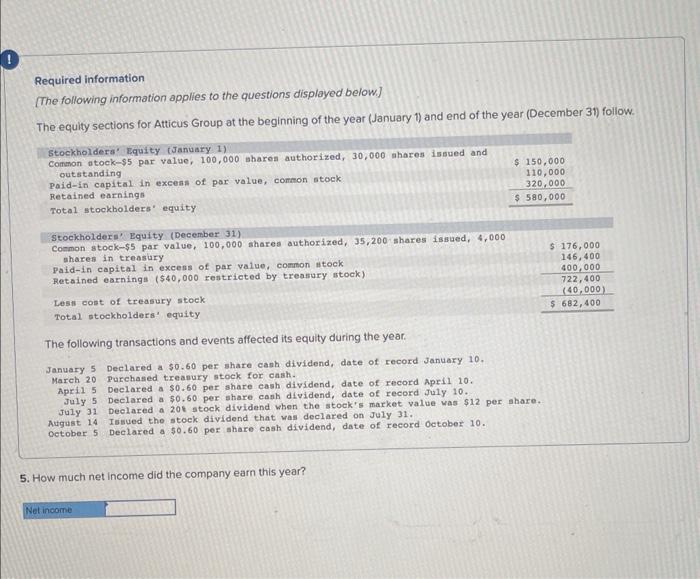

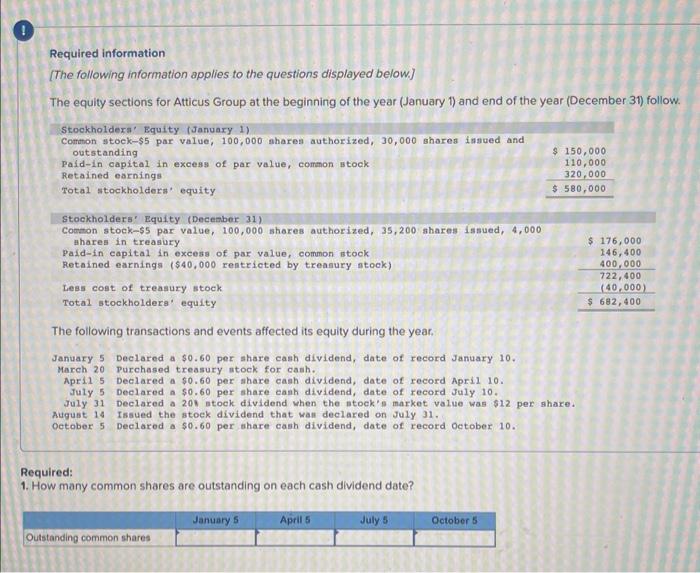

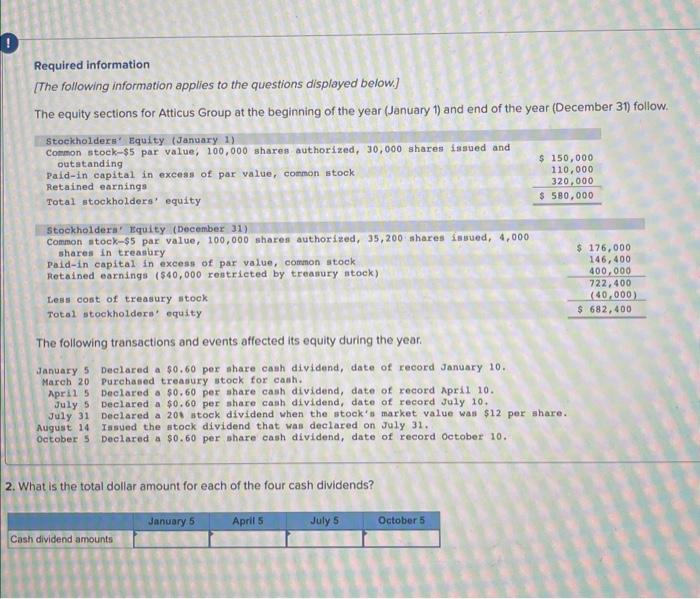

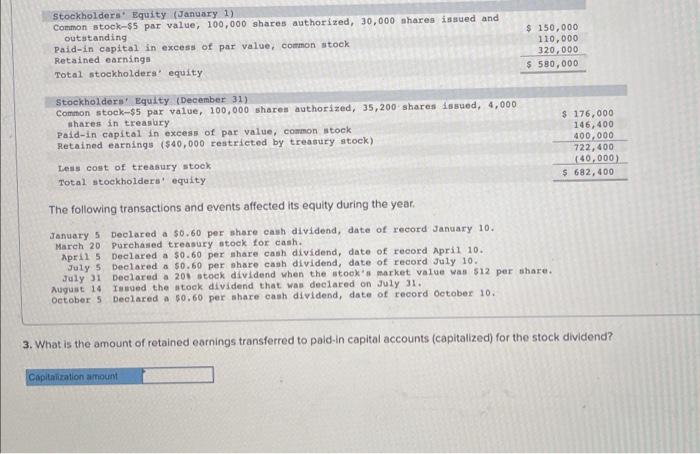

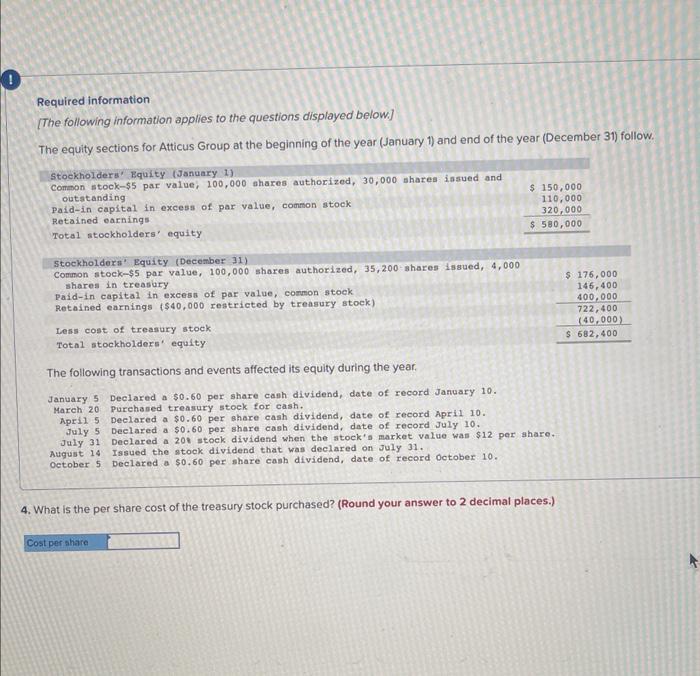

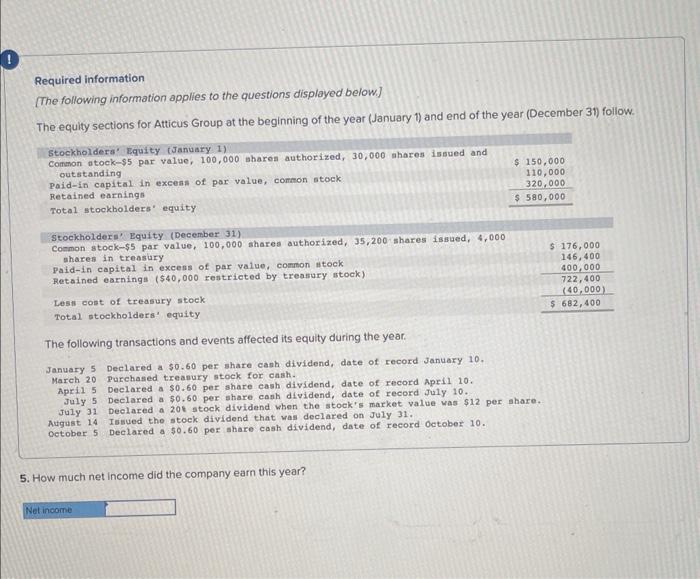

Required information [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. The following transactions and events affected its equity during the year. January 5 Declared a $0.60 per share cash dividend, date of record January 10. March 20 Purchased treasury atock for cash. Apri1 5 Declared a $0.60 per share caah dividend, date of record Apri1 10. July 5 Declared a $0.60 per share canh dividend, date of record July 10 . July 31 Declared a 201 stock dividend when the stock's market value was $12 per share. August 14 Issued the stock dividend that wai declared on July 31. october 5 Declared a $0.60 per share cash dividend, date of record ootober 10. Required: 1. How many common shares are outstanding on each cash dividend date? Required information [The following information applies to the questions displayed below.] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. The rollowing transactions and events anecte0 us vyury uumry ure yea January 5 Declared a $0.60 per ahare cash dividend, date of record January 10. March 20 purchased treasury stock for cash. Apri1 5 Declared a $0,60 per share cash dividend, date of record April 10. July 5 beclared a $0.60 per share cash dividend, date of record July 10. July 31 Declared a 20s stock dividend when the stock's market value was $12 per share. August 14 Iasued the stock dividend that was declared on July 31 . october 5 beclared a $0.60 per share cash dividend, date of record october 10 . 2. What is the total dollar amount for each of the four cash dividends? The following transactions and events affected its equity during the year. January 5 Deolared a 50.60 per share cash dividend, date of record January 10. Mareh 20 Purchased treasury atock tor cash. Apri1 5 Declared a $0.60 per share cash dividend, date of record April 10 . July 5 Deelared a 50.60 per ohare cash dividend, date of record July 10 . July 31 Deelared a 20s stoek dividend when the stook' a market value vas $12 per share. August 14 Iasued the itoek dividend that wan declared on July 31 . october 5 Deelared a 50.60 per share cash dividend, date of record oetober 10. What is the amount of retained earnings transferred to paid-in capital accounts (capitalized) for the stock dividend? Required information [The following information applies to the questions displayed below]] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. The following transactions and events affected its equity during the year. January 5 Declared a $0.60 per share cash dividend, date of record January 10 . March 20 purehased treasury stock for eash. Apri1 5 Deelared a $0.60 per share cash dividend, date of record Apri1 10 . July 5 Deelared a $0,60 per share cash dividend, date of record July 10. July 31 Declared a 208 stock dividend when the stock's market value was \$12 per ahare. August 14 Issued the stock dividend that was declared on July 31. october 5 peclared a $0,60 per share cash dividend, date of record october 10 . Required information [The following information applies to the questions displayed below]) The equity sections for Atticus Group at the beginning of the year (January 1 ) and end of the year (December 31) follow. The following transactions and events affected its equity during the year. January 5 Declared a $0.60 per share cash dividend, date of record January 10. March 20 Purchased treasury stoek for cash. April 5 Declared a $0.60 per share cash dividend, date of record april 10. July 5 Deelared a $0.60 per share cash dividend, date of record July 10 . July 31 beclared a 20t stock dividend when the stock's market value was $12 per share. August 14 Issued the stock dividend that was declared on July 31. october 5 Declazed a $0.60 per ahare cash dividend, date of record october 10. 5. How much net income did the company earn this year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started