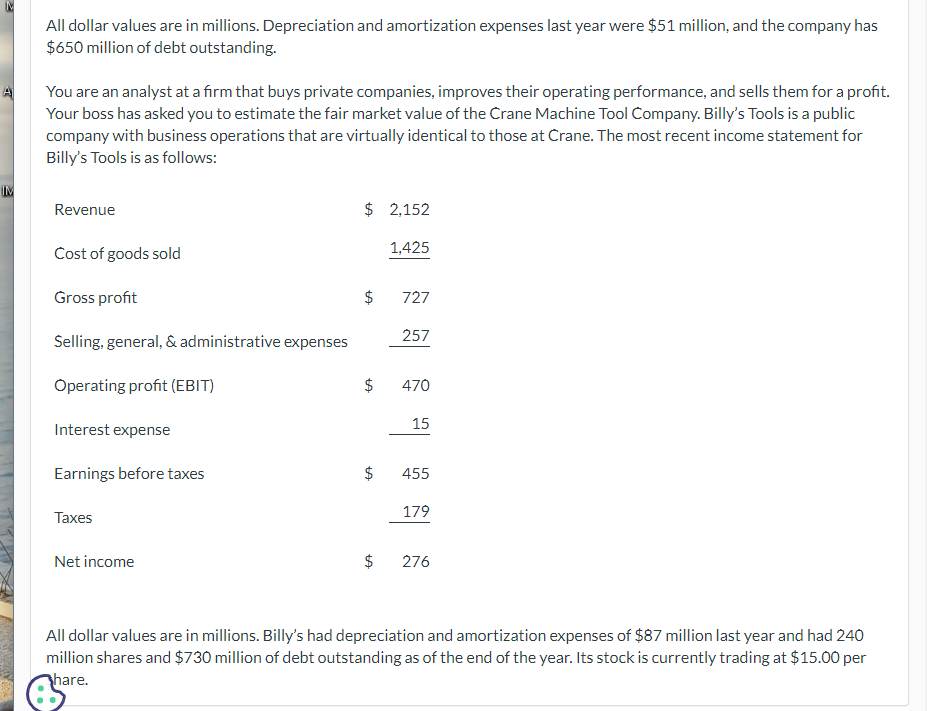

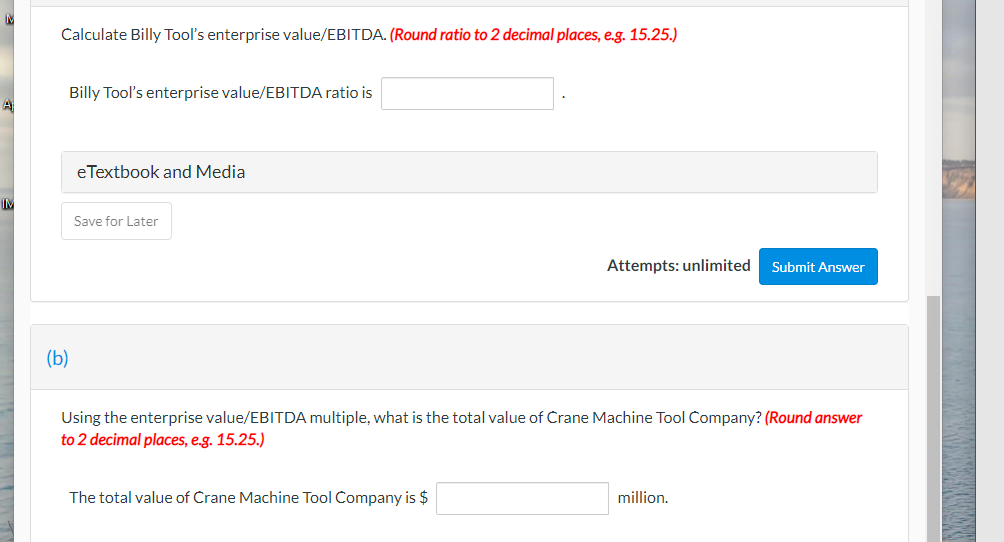

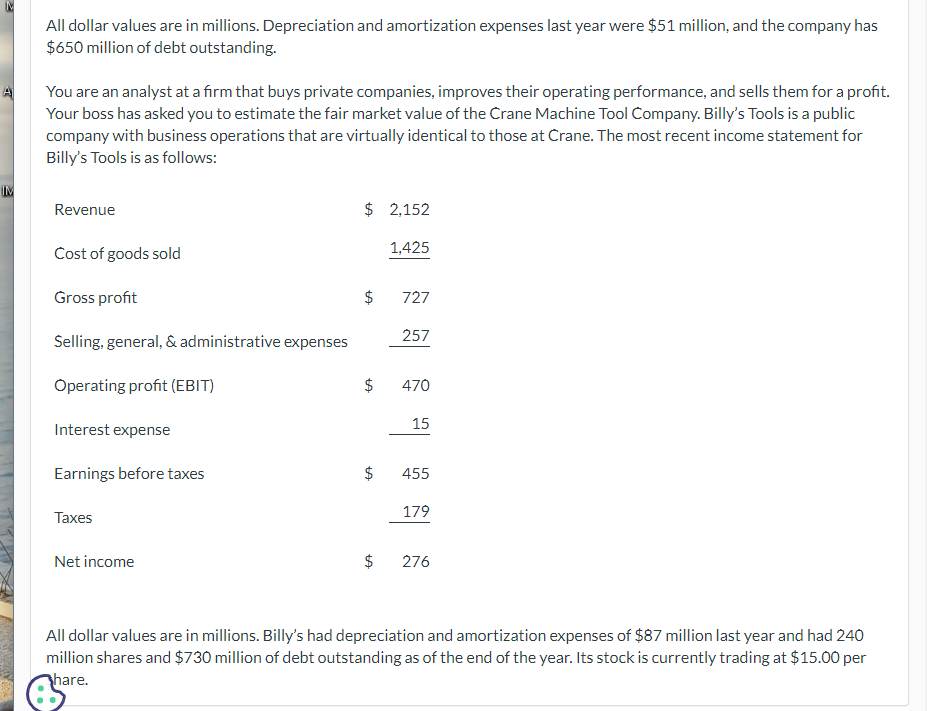

All dollar values are in millions. Depreciation and amortization expenses last year were $51 million, and the company has $650 million of debt outstanding. You are an analyst at a firm that buys private companies, improves their operating performance, and sells them for a profit. Your boss has asked you to estimate the fair market value of the Crane Machine Tool Company. Billy's Tools is a public company with business operations that are virtually identical to those at Crane. The most recent income statement for Billy's Tools is as follows: All dollar values are in millions. Billy's had depreciation and amortization expenses of $87 million last year and had 240 million shares and $730 million of debt outstanding as of the end of the year. Its stock is currently trading at $15.00 per hare. Calculate Billy Tool's enterprise value/EBITDA. (Round ratio to 2 decimal places, e.g. 15.25.) Billy Tool's enterprise value/EBITDA ratio is eTextbook and Media Attempts: unlimited (b) Using the enterprise value/EBITDA multiple, what is the total value of Crane Machine Tool Company? (Round answer to 2 decimal places, e.g. 15.25.) The total value of Crane Machine Tool Company is \$ million. What is the per share value of Crane's stock? (Round answer to 2 decimal places, e.g. 15.25.) The per share value of Crane's stock is \$ All dollar values are in millions. Depreciation and amortization expenses last year were $51 million, and the company has $650 million of debt outstanding. You are an analyst at a firm that buys private companies, improves their operating performance, and sells them for a profit. Your boss has asked you to estimate the fair market value of the Crane Machine Tool Company. Billy's Tools is a public company with business operations that are virtually identical to those at Crane. The most recent income statement for Billy's Tools is as follows: All dollar values are in millions. Billy's had depreciation and amortization expenses of $87 million last year and had 240 million shares and $730 million of debt outstanding as of the end of the year. Its stock is currently trading at $15.00 per hare. Calculate Billy Tool's enterprise value/EBITDA. (Round ratio to 2 decimal places, e.g. 15.25.) Billy Tool's enterprise value/EBITDA ratio is eTextbook and Media Attempts: unlimited (b) Using the enterprise value/EBITDA multiple, what is the total value of Crane Machine Tool Company? (Round answer to 2 decimal places, e.g. 15.25.) The total value of Crane Machine Tool Company is \$ million. What is the per share value of Crane's stock? (Round answer to 2 decimal places, e.g. 15.25.) The per share value of Crane's stock is \$