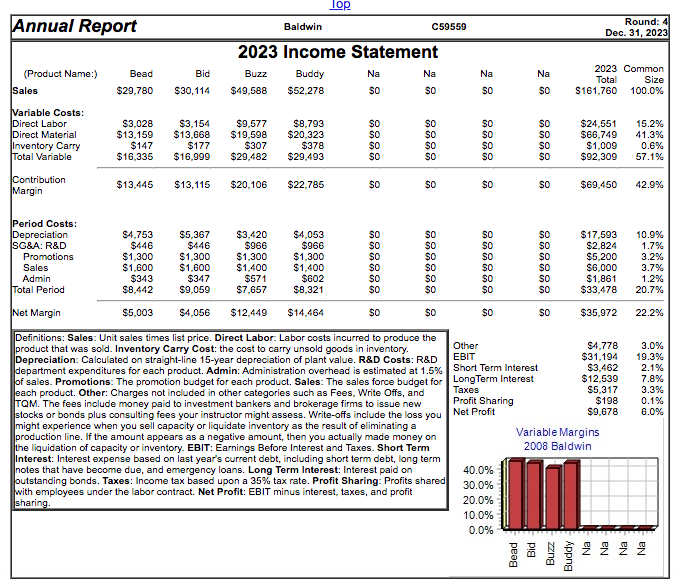

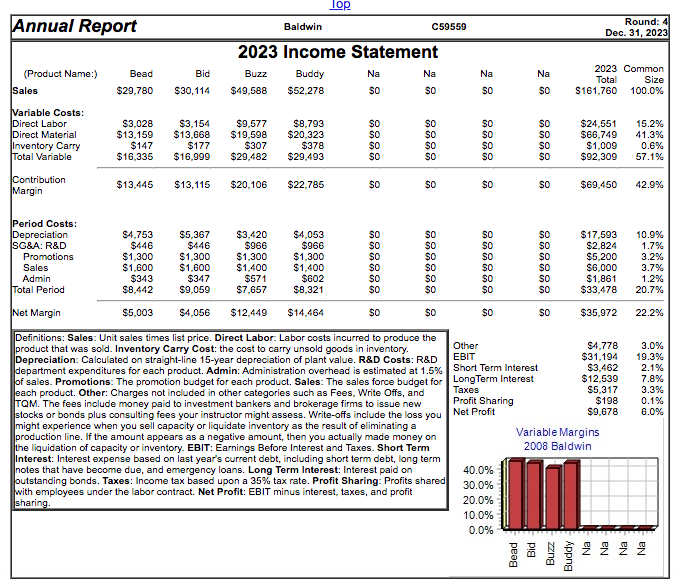

All else constant, what would Baldwins SG&A/Sales ratio be if the company had spent an additional $1,500,000 for Bids promotional budget and $750,000 for Bids sales budget? Select: 1 11.8% 8.4% 9.8% 11.2%

TOR Annual Report Baldwin C59559 Round: 4 Dec. 31, 2023 Na (Product Name:) Sales Na Bead $29.780 2023 Income Statement Buzz Buddy Na Na $49.588 $52,278 $0 $0 Bid $30,114 2023 Common Total Size $161.760 100.0% $0 SO Variable Costs: Direct Labor Direct Material Inventory Carry Total Variable $3,028 $13,159 $147 $16.335 $3,154 $13.668 $177 $16.999 $9.577 $19,598 $307 $29.482 $8.793 $20,323 $378 $29,493 SO $0 SO SO SO SO SO SO SO $0 SO SO $0 SO SO $O $24.551 $66.749 $1,009 $92,309 15.2% 41.39 0.6% 57.1% Contribution Margin $13,445 $13,115 $20,106 $22.785 SO SO SO $O $69,450 42.9% Period Costs: Depreciation SG&A: R&D Promotions Sales Admin Total Period $4.753 $446 $1,300 $1,600 $343 $8.442 $5,367 $446 $1,300 $1,600 $347 $9.059 $3,420 $966 $1,300 $1,400 $571 $7,657 $4,053 $966 $1,300 $1,400 $602 $8,321 $0 $0 SO SO SO SO SO $0 SO SO SO SO $0 SO SO $0 SO SO $0 SO SO SO SO SO $17.593 $2,824 $5,200 $6.000 $1,861 $33,478 10.9% 1.7% 3.2% 3.7% 1.2% 20.7% Net Margin $5,003 $4,056 $12.449 $14,464 SO $0 SO $0 $35.972 22.2% 3.0% 19.3% 2.1% 7.8% 3.3% 0.1% 6.0% Definitions: Sales: Unit sales times list price. Direct Labor: Labor costs incurred to produce the Other $4.778 product that was sold. Inventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D EBIT $31,194 department expenditures for each product. Admin: Administration overhead is estimated at 1.5% Short Term Interest $3,462 of sales. Promotions: The promotion budget for each product. Sales: The sales force budget for Long Term Interest $12,539 each product. Other: Charges not included in other categories such as Fees, Write Offs, and Taxes $5,317 TQM. The fees include money paid to investment bankers and brokerage firms to issue new Profit Sharing $198 stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you Net Profit $9,678 might experience when you sell capacity or liquidate inventory as the result of eliminating a oduc line. If the amount appears as a negative amount, en you actually made money on Variable Margins the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term 2008 Baldwin Interest: Interest expense based on last year's current debt, including short term debt, long term notes that have become due, and emergency loans. Long Term Interest: Interest paid on 40.0% outstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits shared 30.0% with employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit sharing. 20.0% 10.0% 0.0% Bid Bead Buzz Buddy