Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All employees of the Shield Company are given the use of a company car. The car is theirs to use for both personal and

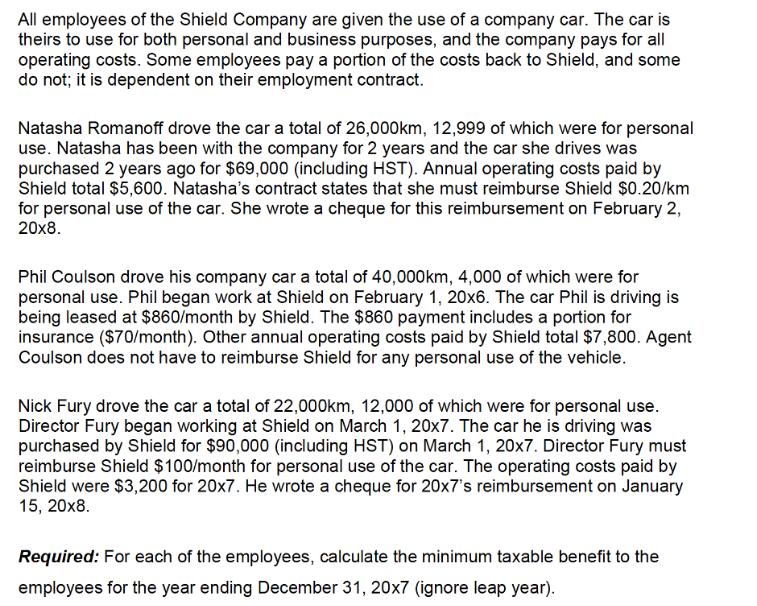

All employees of the Shield Company are given the use of a company car. The car is theirs to use for both personal and business purposes, and the company pays for all operating costs. Some employees pay a portion of the costs back to Shield, and some do not; it is dependent on their employment contract. Natasha Romanoff drove the car a total of 26,000km, 12,999 of which were for personal use. Natasha has been with the company for 2 years and the car she drives was purchased 2 years ago for $69,000 (including HST). Annual operating costs paid by Shield total $5,600. Natasha's contract states that she must reimburse Shield $0.20/km for personal use of the car. She wrote a cheque for this reimbursement on February 2, 20x8. Phil Coulson drove his company car a total of 40,000km, 4,000 of which were for personal use. Phil began work at Shield on February 1, 20x6. The car Phil is driving is being leased at $860/month by Shield. The $860 payment includes a portion for insurance ($70/month). Other annual operating costs paid by Shield total $7,800. Agent Coulson does not have to reimburse Shield for any personal use of the vehicle. Nick Fury drove the car a total of 22,000km, 12,000 of which were for personal use. Director Fury began working at Shield on March 1, 20x7. The car he is driving was purchased by Shield for $90,000 (including HST) on March 1, 20x7. Director Fury must reimburse Shield $100/month for personal use of the car. The operating costs paid by Shield were $3,200 for 20x7. He wrote a cheque for 20x7's reimbursement on January 15, 20x8. Required: For each of the employees, calculate the minimum taxable benefit to the employees for the year ending December 31, 20x7 (ignore leap year).

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Taxable benefit of Natasha Sr No Particulars Kms or Amount Formula used 1 Total Kms driven 26000 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started