Question

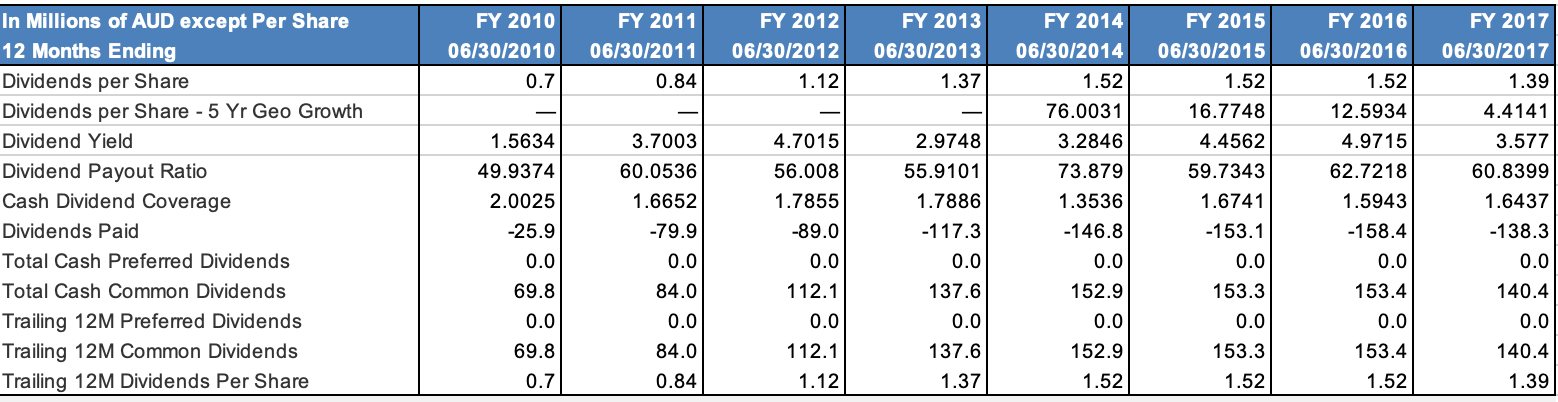

All financial statement numbers are in millions of dollars unless otherwise indicated. Assume today is 30th June 2017 and you have just been paid a

-

All financial statement numbers are in millions of dollars unless otherwise indicated.

-

Assume today is 30th June 2017 and you have just been paid a dividend and that the next

dividend will be received in exactly one year (assume dividend is paid annually).

-

The stock price as at 30th June 2017 was $38.30.

-

a) You expect Flight Centre Ltd. to maintain the same dividend payout ratio as at 30th June 2017 for the next three years. After three years, the company will increase the dividend payout ratio to 70%. Assume companys return on new investment is 16.6% and the required rate of return is 10%. Using the dividend discount model, calculate the intrinsic value for stock today.

(5 marks)

-

b) BasedonyouranswerinPart(a),wouldyourecommendtobuy,sellorholdthestock?Give the recommendation and briefly discuss the difference between the intrinsic value and stock price. (no more than 200 words) (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started