All five please

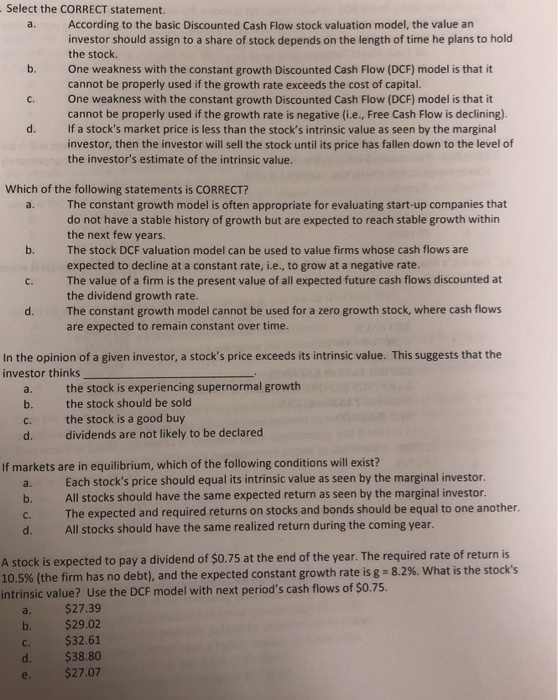

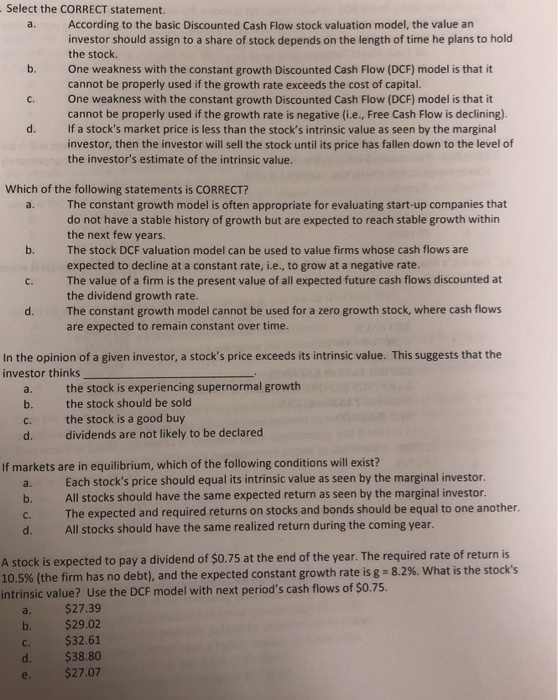

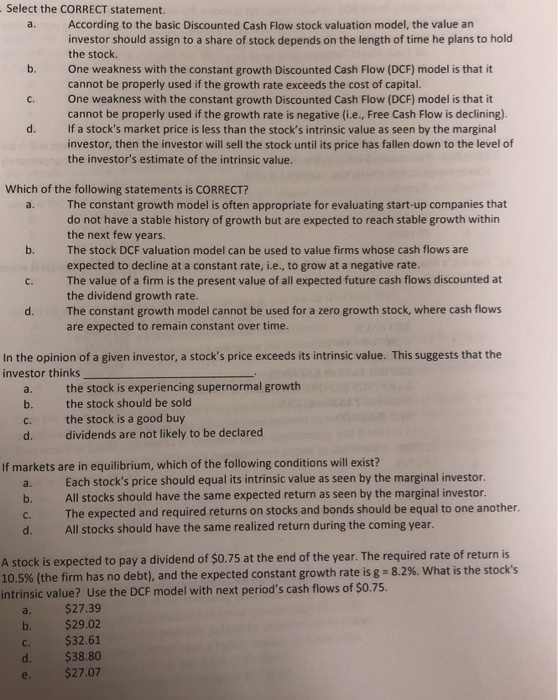

Select the CORRECT statement. According to the basic Discounted Cash Flow stock valuation model, the value an investor should assign to a share of stock depends on the length of time he plans to hold the stock One weakness with the constant growth Discounted Cash Flow (DCF) model is that it cannot be properly used if the growth rate exceeds the cost of capital. One weakness with the constant growth Discounted Cash Flow (DCF) model is that it cannot be properly used if the growth rate is negative (ie,Free Cash Flow is declining). Ifa stock's market price is less than the stock's intrinsic value as seen by the marginal investor, then the investor will sell the stock until its price has fallen down to the level of the investor's estimate of the intrinsic value. b. c. d. Which of the following statements is CORRECT? The constant growth model is often appropriate for evaluating start-up companies that do not have a stable history of growth but are expected to reach stable growth within the next few years. The stock DCF valuation model can be used to value firms whose cash flows are expected to decline at a constant rate, i.e., to grow at a negative rate. The value of a firm is the present value of all expected future cash flows discounted at the dividend growth rate. The constant growth model cannot be used for a zero growth stock, where cash flows are expected to remain constant over time. C. In the opinion of a given investor, a stoc's price exceeds its intrinsic value. This suggests that the investor thinks the stock is experiencing supernormal growth the stock should be sold c. the stock is a good buy d. dividends are not likely to be declared If markets are in equilibrium, which of the following conditions will exist? Each stock's price should equal its intrinsic value as seen by the marginal investor. All stocks should have the same expected return as seen by the marginal investor. The expected and required returns on stocks and bonds should be equal to one another. All stocks should have the same realized return during the coming year. C. d. A stock is expected to pay a dividend of $0.75 at the end of the year. The required rate of return is 10.5% (the firm has no debt), and the expected constant growth rate is g-8.2%, what is the stock's intrinsic value? Use the DCF model with next period's cash flows of $o.75. $27.39 b. $29.02 c. $32.61 $38.80 $27.07