All formulas only

All formulas only

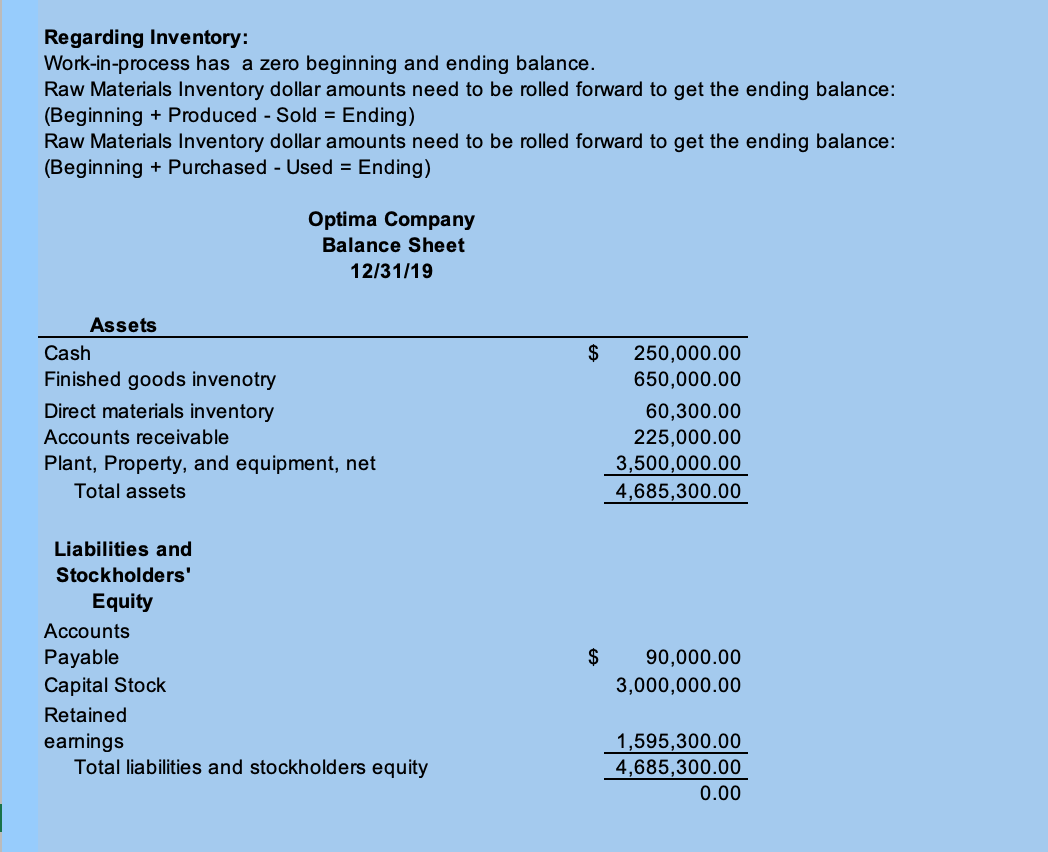

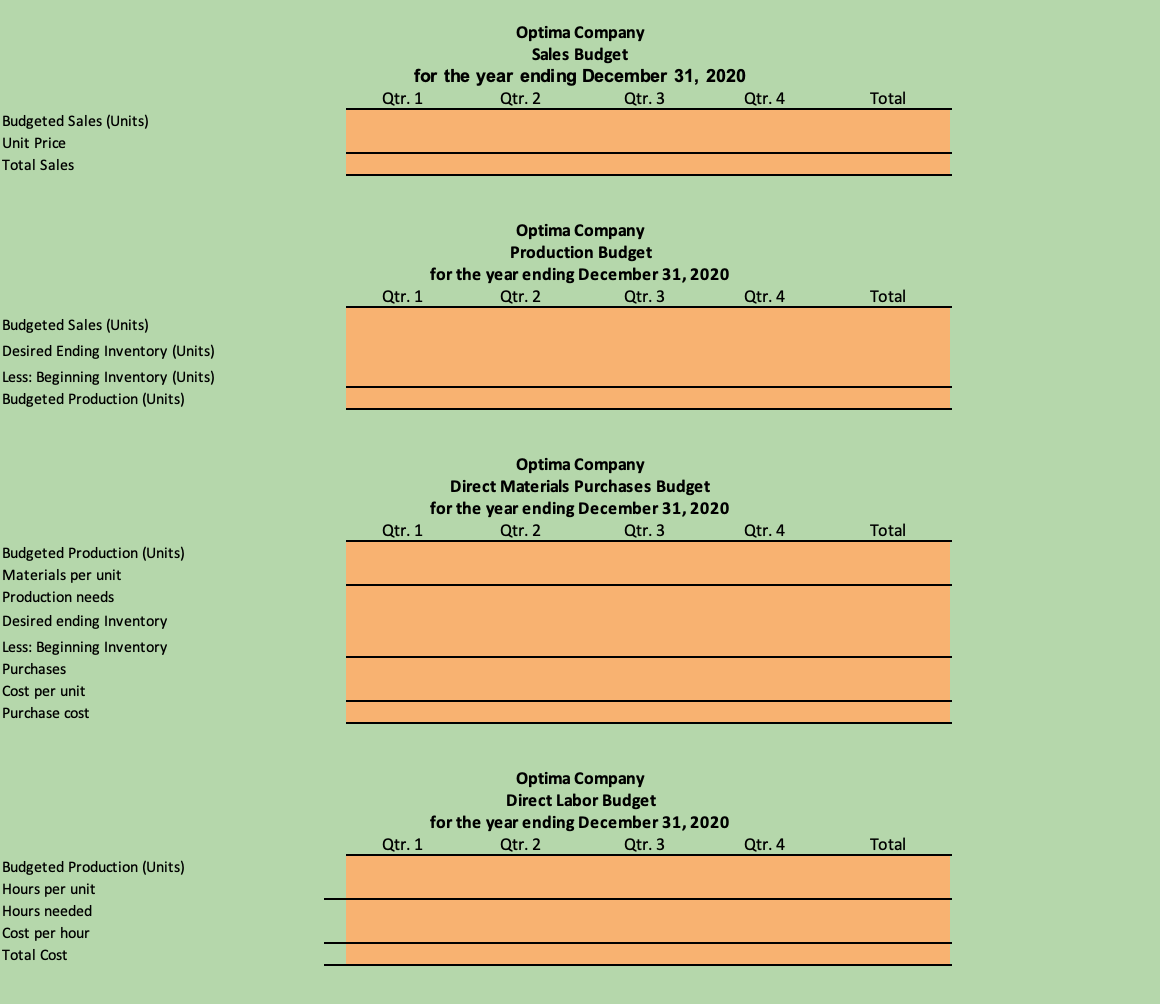

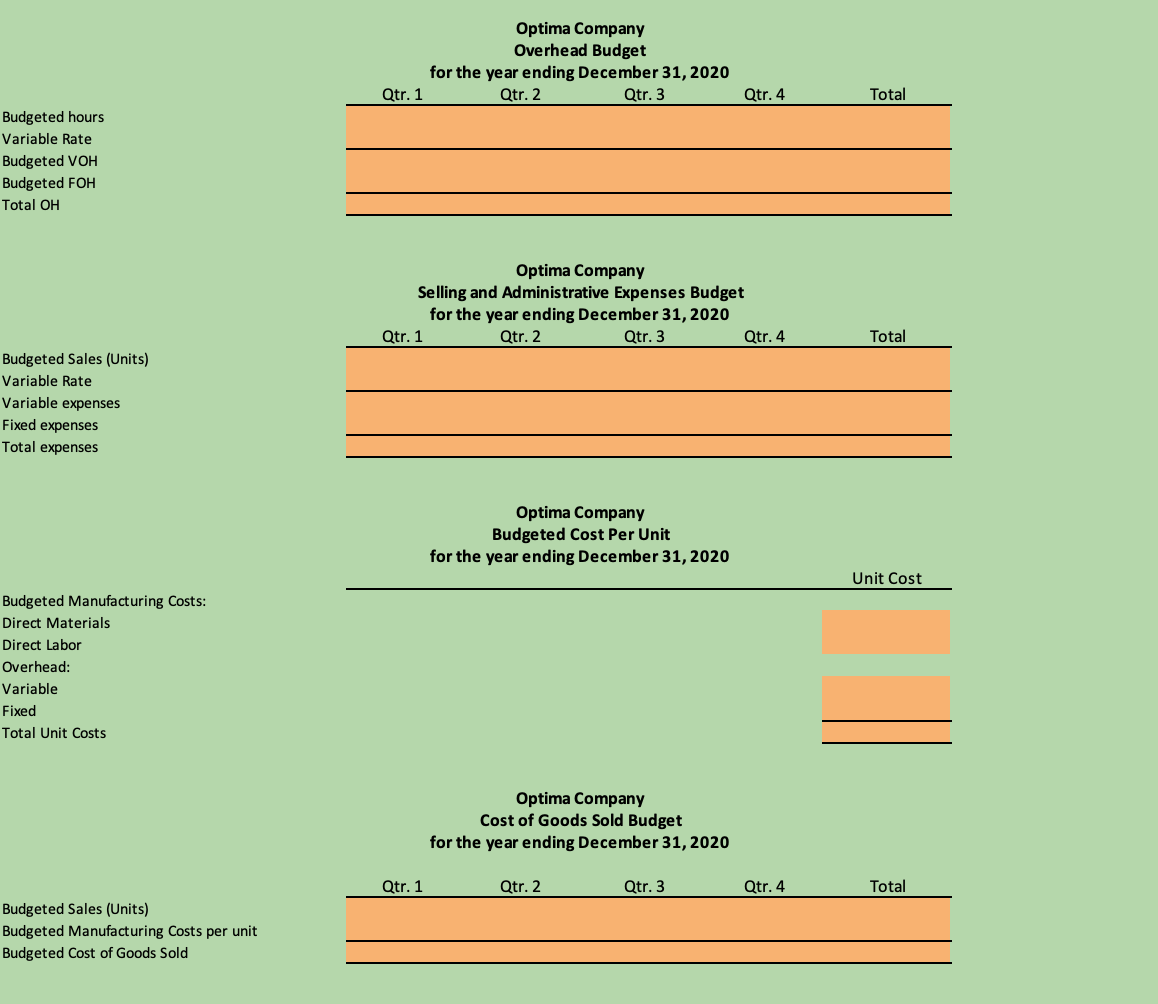

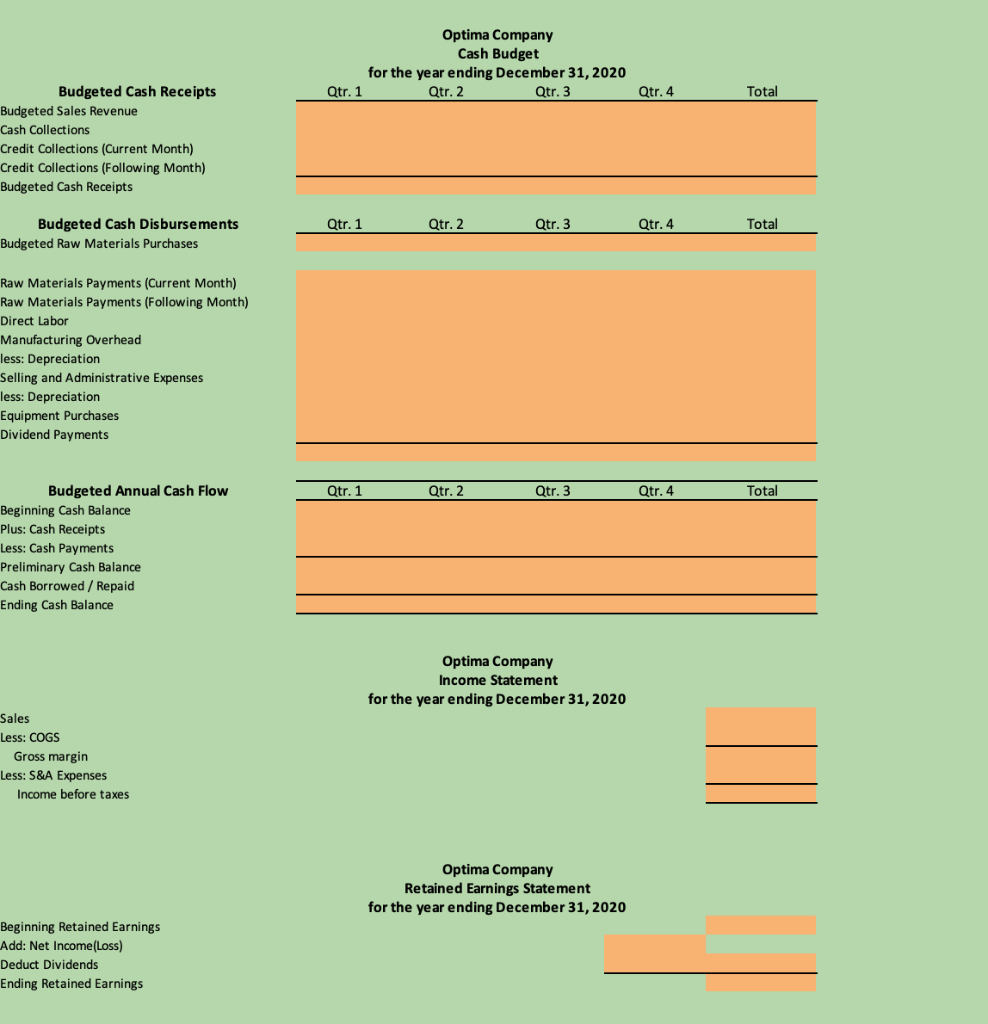

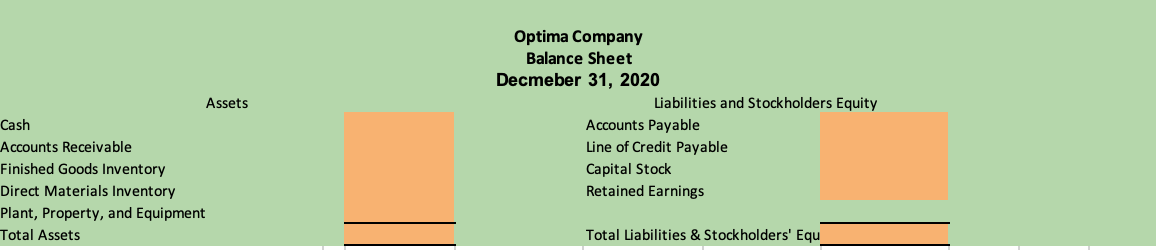

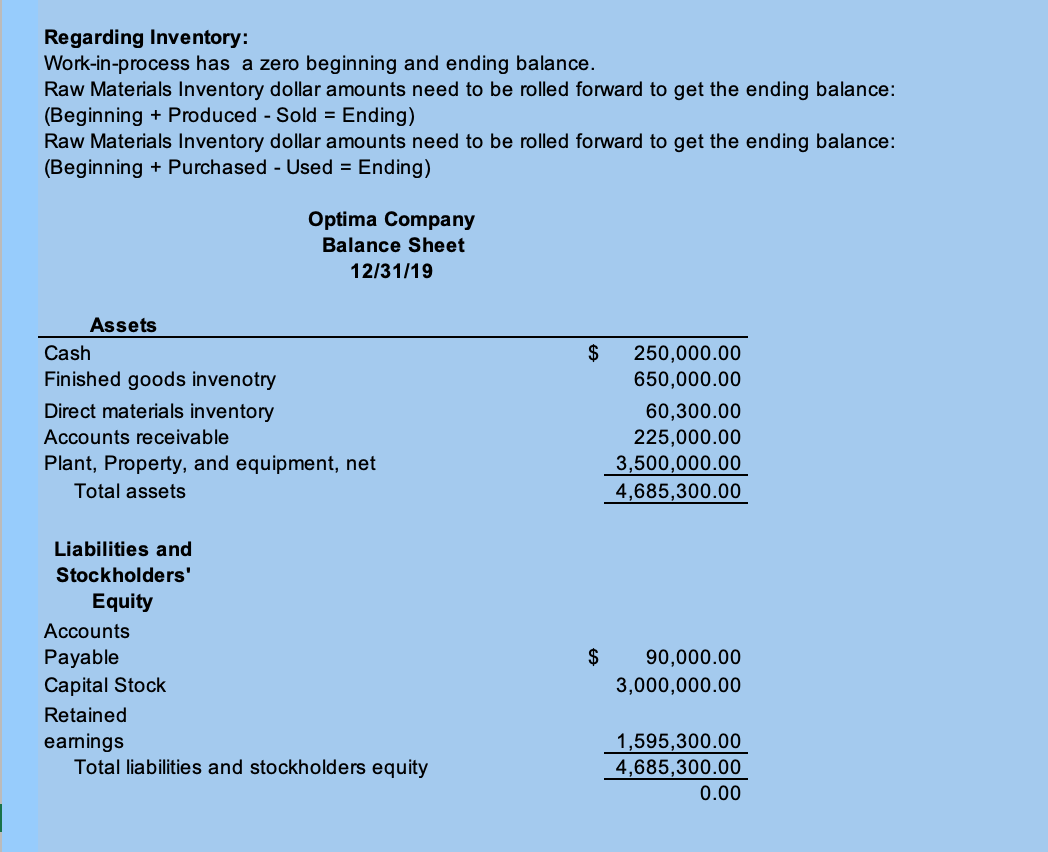

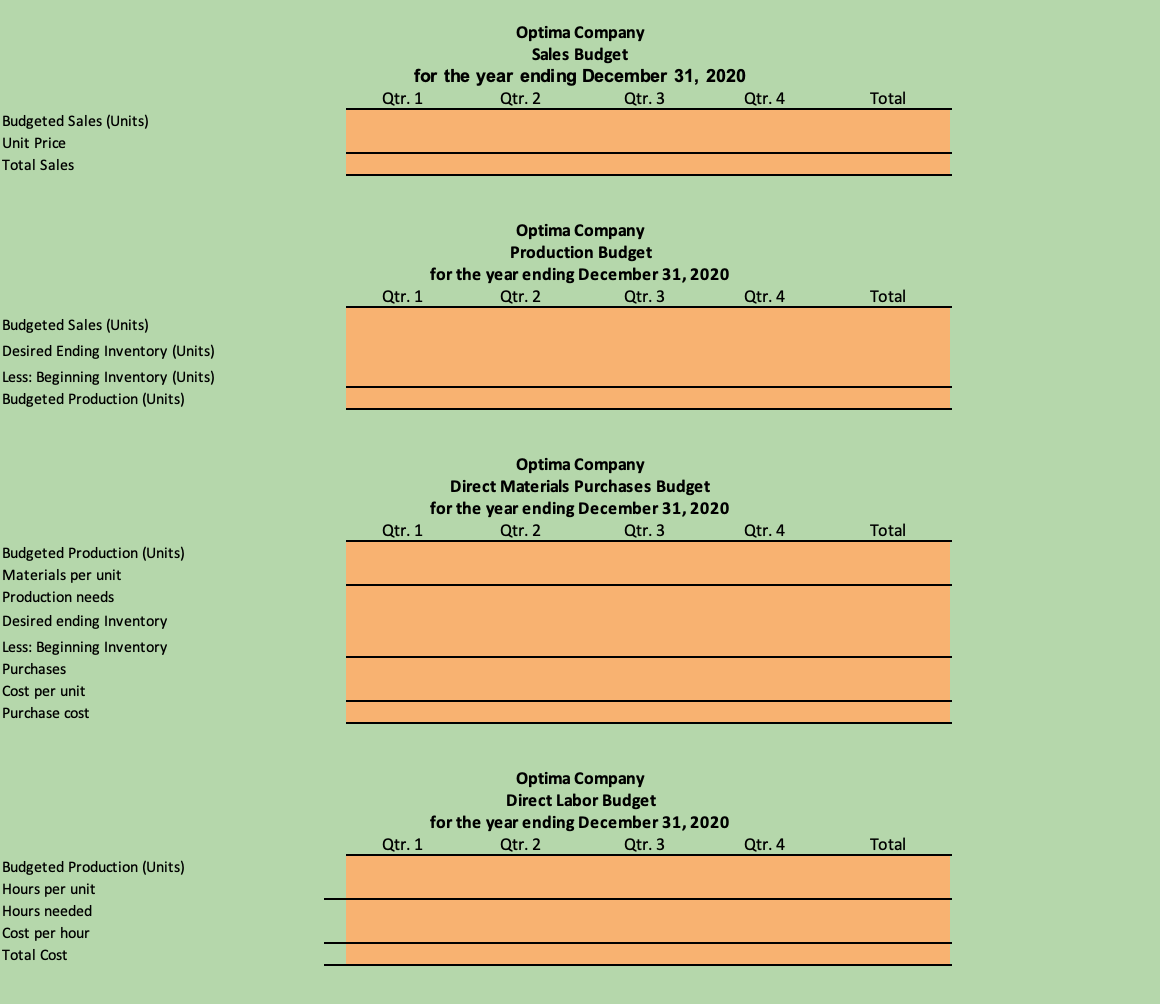

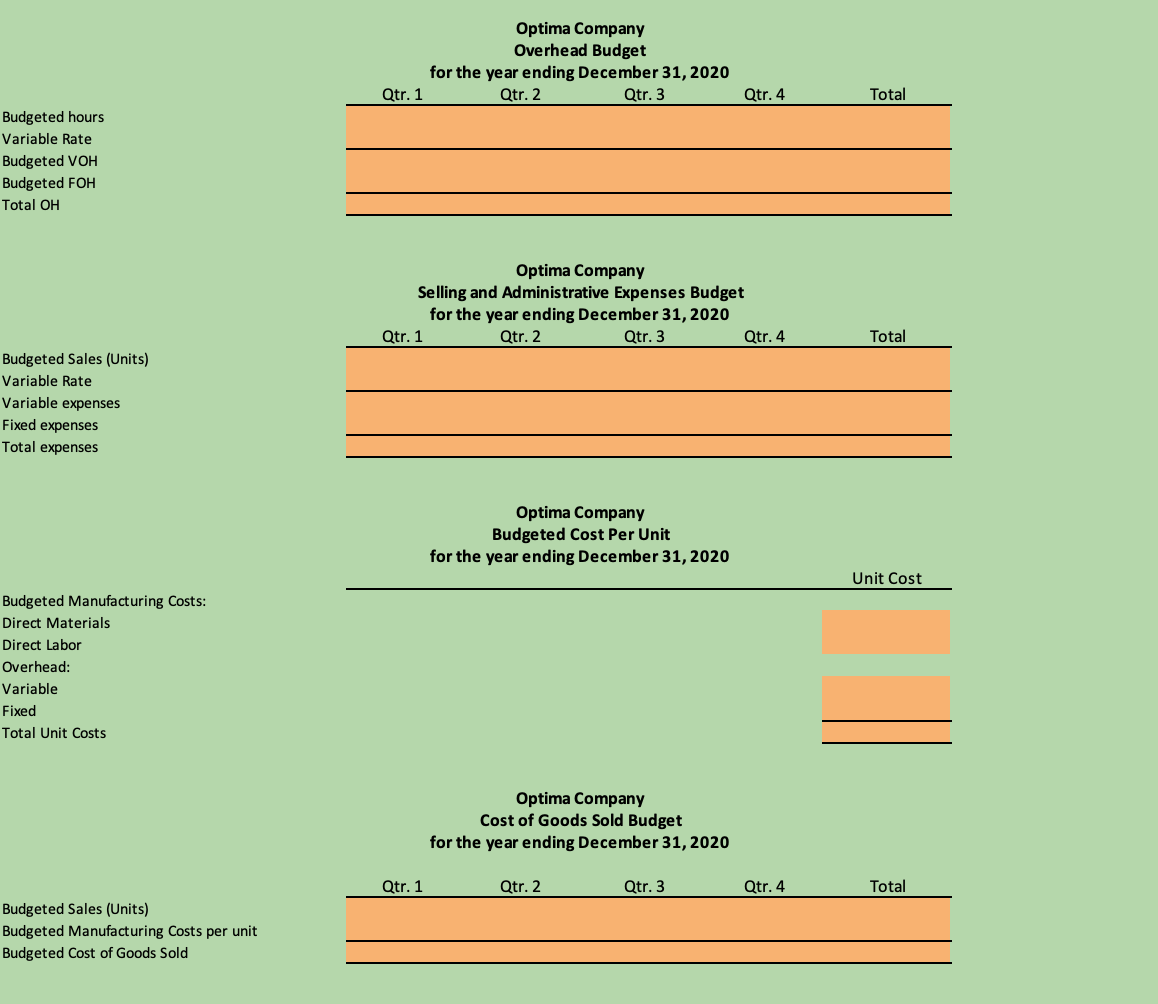

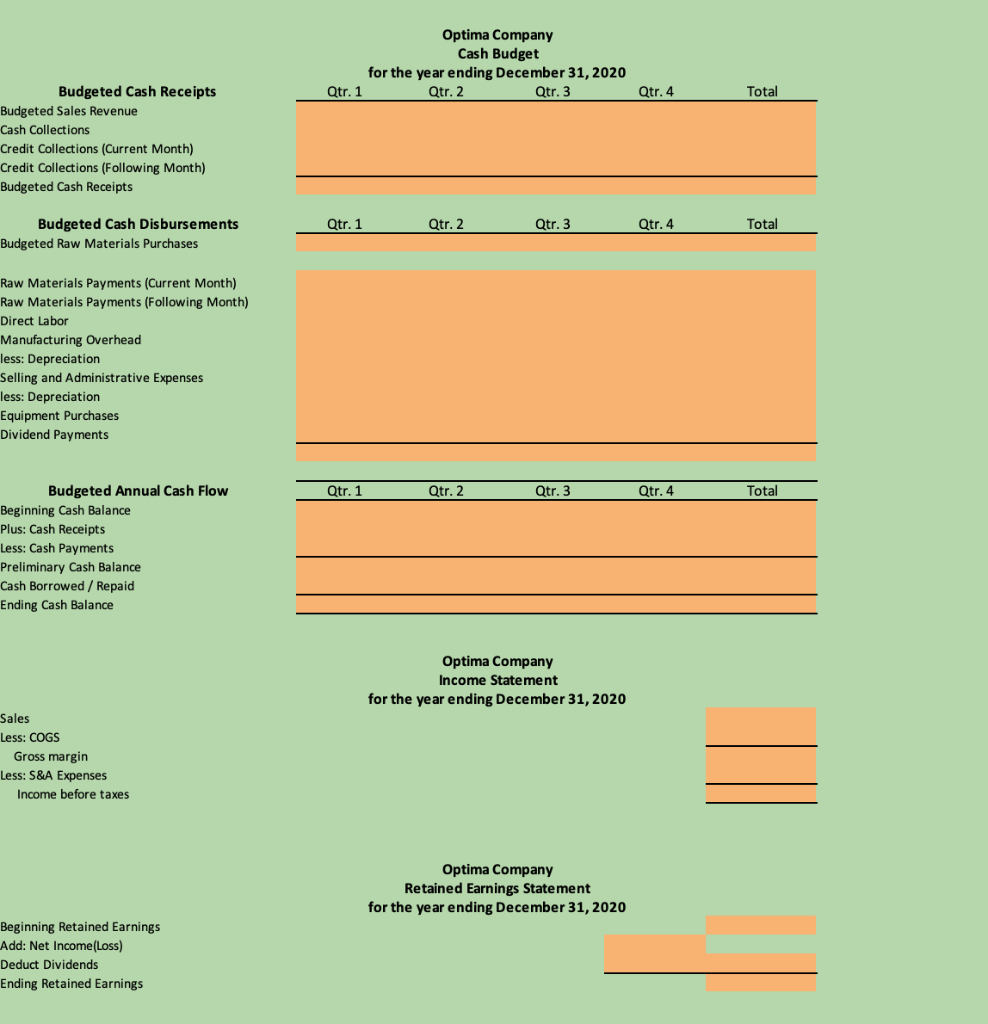

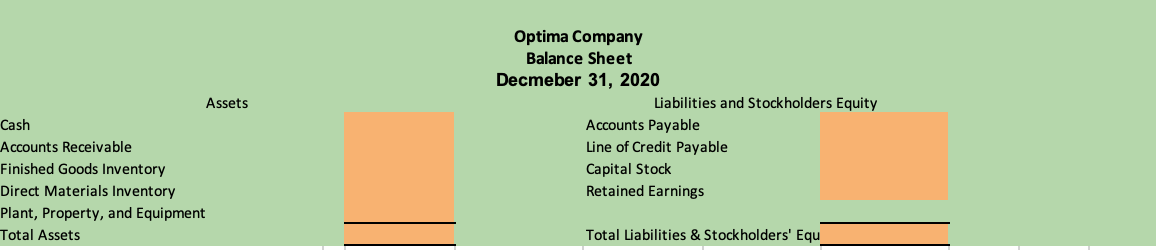

Regarding Inventory: Work-in-process has a zero beginning and ending balance. Raw Materials Inventory dollar amounts need to be rolled forward to get the ending balance: (Beginning + Produced Sold = Ending) Raw Materials Inventory dollar amounts need to be rolled forward to get the ending balance: (Beginning + Purchased Used = Ending) on astions an ansan has a Optima Company Overhead Budget for the year ending December 31,2020 Qtr. 1 Qtr. 3 Qtr. 4 Total Budgeted hours Variable Rate Budgeted VOH Budgeted FOH Total OH Optima Company Selling and Administrative Expenses Budget for the year ending December 31, 2020 Budgeted Sales (Units) Variable Rate Variable expenses Fixed expenses Total expenses Optima Company Budgeted Cost Per Unit for the year ending December 31,2020 Budgeted Manufacturing Costs: Unit Cost Direct Materials Direct Labor Overhead: Variable Fixed Total Unit Costs Optima Company Cost of Goods Sold Budget for the year ending December 31,2020 Budgeted Sales (Units) Budgeted Manufacturing Costs per unit Budgeted Cost of Goods Sold Optima Company Cash Budget for the year ending December 31,2020 Budgeted Cash Receipts Qtr. 1 Qtr. 2 Qtr. 3 Qtr. 4 Total Budgeted Sales Revenue Cash Collections Credit Collections (Current Month) Credit Collections (Following Month) Budgeted Cash Receipts Budgeted Cash Disbursements Qtr. 1 Qtr. 2 Qtr. 3 Qtr. 4 Total Budgeted Raw Materials Purchases Raw Materials Payments (Current Month) Raw Materials Payments (Following Month) Direct Labor Manufacturing Overhead less: Depreciation Selling and Administrative Expenses less: Depreciation Equipment Purchases Dividend Payments Budgeted Annual Cash Flow \begin{tabular}{lllll} \hline Qtr. 1 & Qtr. 2 & Qtr. 3 & Qtr. 4 & Total \\ \hline \end{tabular} Beginning Cash Balance Plus: Cash Receipts Less: Cash Payments Preliminary Cash Balance Cash Borrowed / Repaid Ending Cash Balance Optima Company Income Statement for the year ending December 31,2020 Sales Less: COGS Gross margin Less: S\&A Expenses Income before taxes Optima Company Retained Earnings Statement for the year ending December 31,2020 Beginning Retained Earnings Add: Net Income(Loss) Deduct Dividends Ending Retained Earnings Optima Company Balance Sheet Decmeber 31, 2020 Assets Liabilities and Stockholders Equity Cash Accounts Payable Accounts Receivable Line of Credit Payable Finished Goods Inventory Capital Stock Direct Materials Inventory Retained Earnings Plant, Property, and Equipment Total Assets Total Liabilities \& Stockholders' Equ Regarding Inventory: Work-in-process has a zero beginning and ending balance. Raw Materials Inventory dollar amounts need to be rolled forward to get the ending balance: (Beginning + Produced Sold = Ending) Raw Materials Inventory dollar amounts need to be rolled forward to get the ending balance: (Beginning + Purchased Used = Ending) on astions an ansan has a Optima Company Overhead Budget for the year ending December 31,2020 Qtr. 1 Qtr. 3 Qtr. 4 Total Budgeted hours Variable Rate Budgeted VOH Budgeted FOH Total OH Optima Company Selling and Administrative Expenses Budget for the year ending December 31, 2020 Budgeted Sales (Units) Variable Rate Variable expenses Fixed expenses Total expenses Optima Company Budgeted Cost Per Unit for the year ending December 31,2020 Budgeted Manufacturing Costs: Unit Cost Direct Materials Direct Labor Overhead: Variable Fixed Total Unit Costs Optima Company Cost of Goods Sold Budget for the year ending December 31,2020 Budgeted Sales (Units) Budgeted Manufacturing Costs per unit Budgeted Cost of Goods Sold Optima Company Cash Budget for the year ending December 31,2020 Budgeted Cash Receipts Qtr. 1 Qtr. 2 Qtr. 3 Qtr. 4 Total Budgeted Sales Revenue Cash Collections Credit Collections (Current Month) Credit Collections (Following Month) Budgeted Cash Receipts Budgeted Cash Disbursements Qtr. 1 Qtr. 2 Qtr. 3 Qtr. 4 Total Budgeted Raw Materials Purchases Raw Materials Payments (Current Month) Raw Materials Payments (Following Month) Direct Labor Manufacturing Overhead less: Depreciation Selling and Administrative Expenses less: Depreciation Equipment Purchases Dividend Payments Budgeted Annual Cash Flow \begin{tabular}{lllll} \hline Qtr. 1 & Qtr. 2 & Qtr. 3 & Qtr. 4 & Total \\ \hline \end{tabular} Beginning Cash Balance Plus: Cash Receipts Less: Cash Payments Preliminary Cash Balance Cash Borrowed / Repaid Ending Cash Balance Optima Company Income Statement for the year ending December 31,2020 Sales Less: COGS Gross margin Less: S\&A Expenses Income before taxes Optima Company Retained Earnings Statement for the year ending December 31,2020 Beginning Retained Earnings Add: Net Income(Loss) Deduct Dividends Ending Retained Earnings Optima Company Balance Sheet Decmeber 31, 2020 Assets Liabilities and Stockholders Equity Cash Accounts Payable Accounts Receivable Line of Credit Payable Finished Goods Inventory Capital Stock Direct Materials Inventory Retained Earnings Plant, Property, and Equipment Total Assets Total Liabilities \& Stockholders' Equ

All formulas only

All formulas only