Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All i need is the ledger accounts to be filled in correctly! thank you! please - June 1: Owner contributed ( $ 50,000 ) in

All i need is the ledger accounts to be filled in correctly! thank you!

please

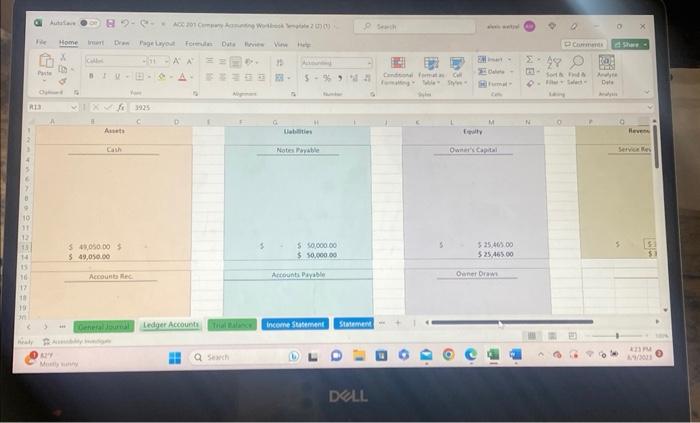

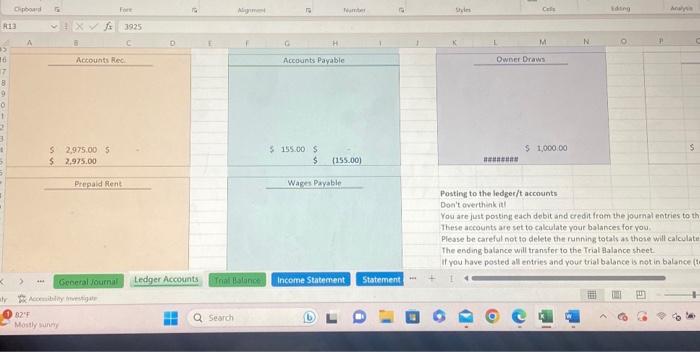

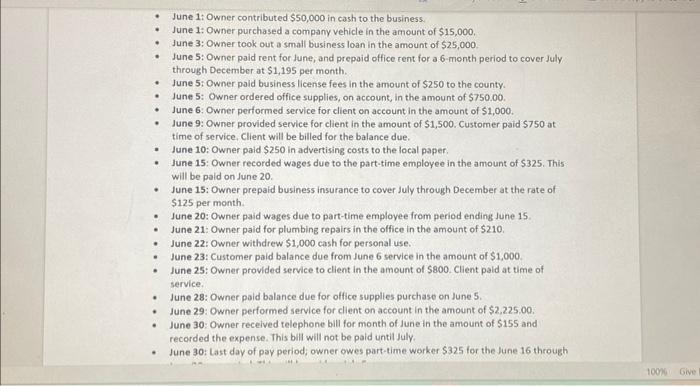

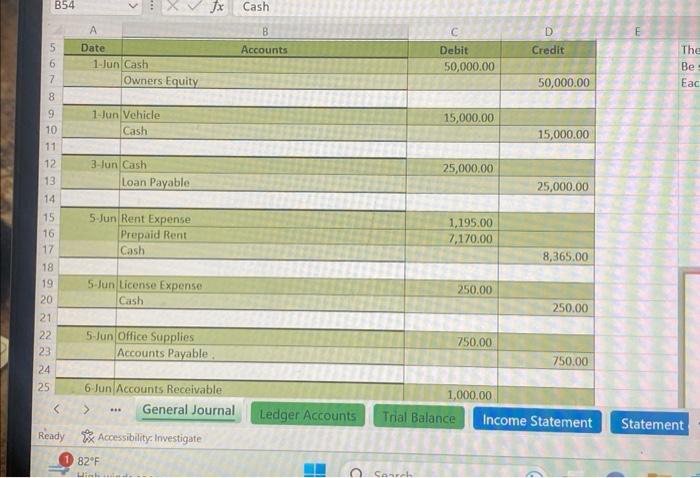

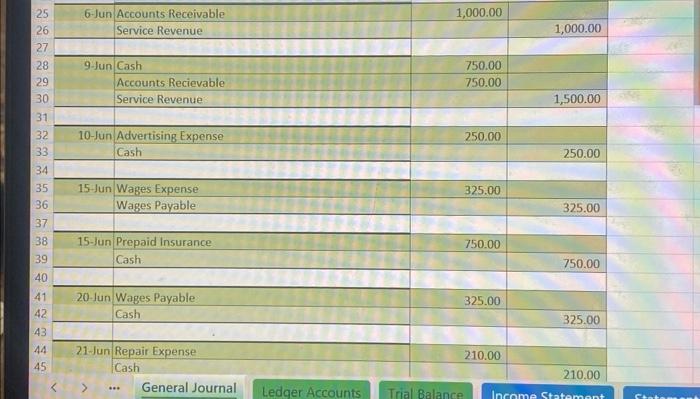

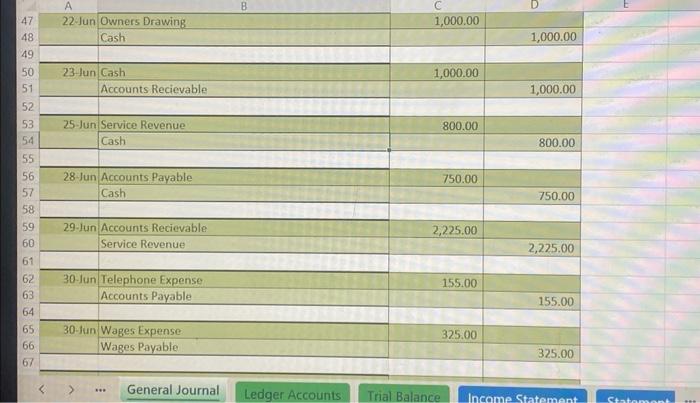

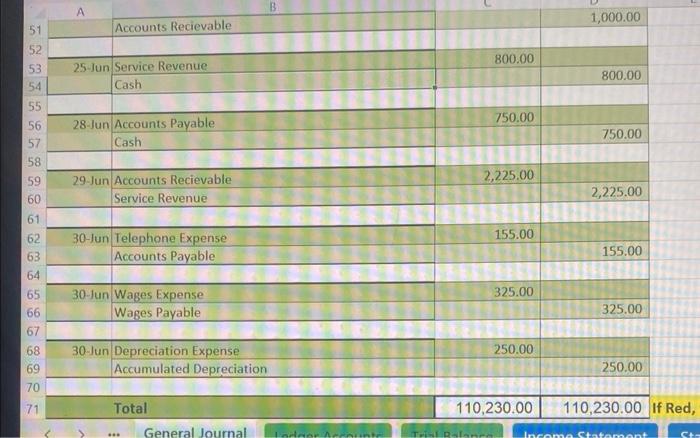

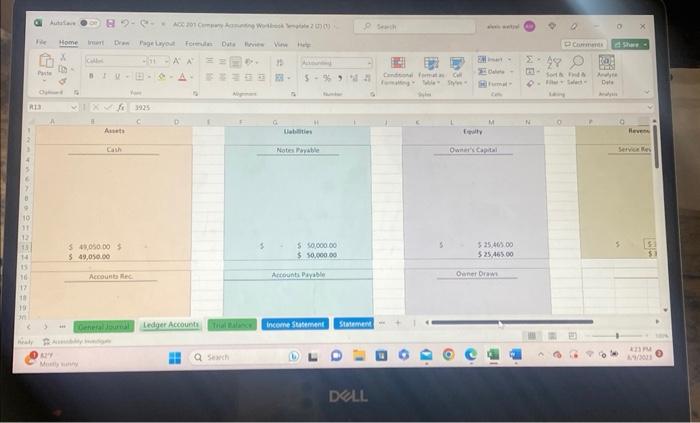

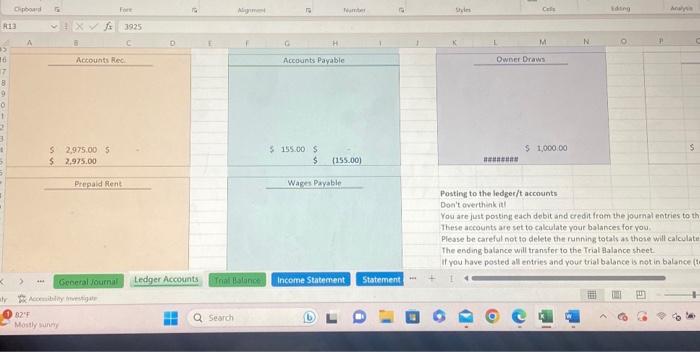

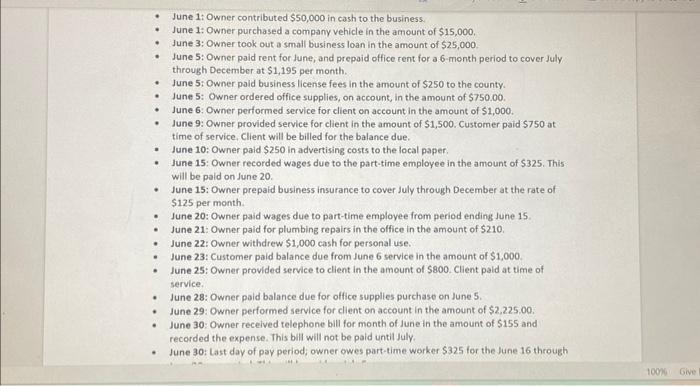

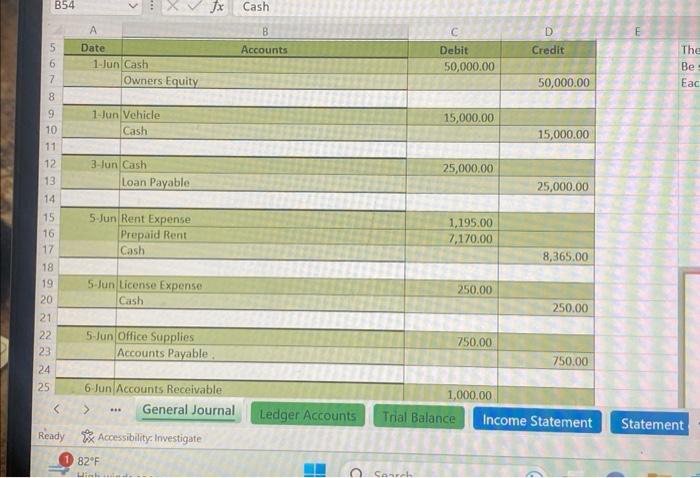

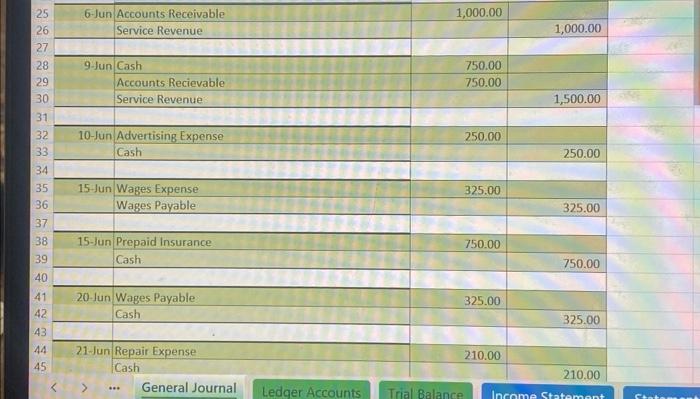

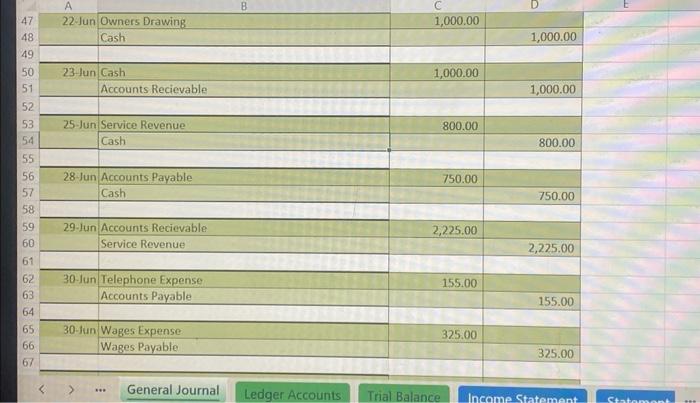

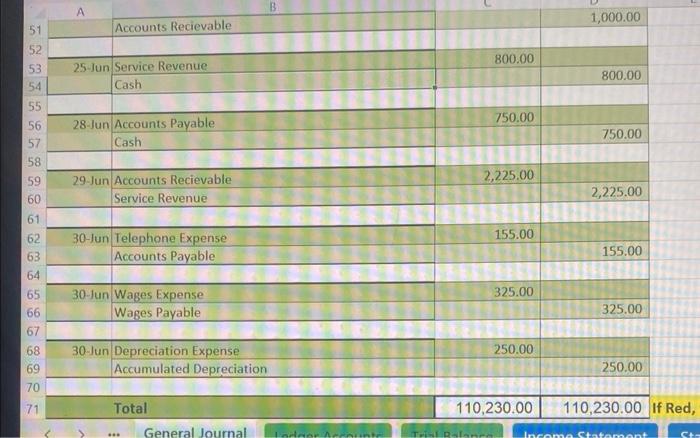

- June 1: Owner contributed \\( \\$ 50,000 \\) in cash to the business. - June 1: Owner purchased a company vehicle in the amount of \\( \\$ 15,000 \\). - June 3: Owner took out a small business loan in the amount of \\( \\$ 25,000 \\). - June 5: Owner paid rent for June, and prepaid office rent for a 6-month period to cover July through December at \\( \\$ 1,195 \\) per month. - June 5: Owner paid business license fees in the amount of \\( \\$ 250 \\) to the county. - June 5: Owner ordered office supplies, on account, in the amount of \\( \\$ 750.00 \\). - June 6: Owner performed service for client on account in the amount of \\( \\$ 1,000 \\). - June 9: Owner provided service for client in the amount of \\( \\$ 1,500 \\). Customer paid \\( \\$ 750 \\) at time of service. Client will be billed for the balance due. - June 10: Owner paid \\( \\$ 250 \\) in advertising costs to the local paper. - June 15: Owner recorded wages due to the part-time employee in the amount of \\$325. This will be paid on June 20 . - June 15: Owner prepaid business insurance to cover July through December at the rate of \\( \\$ 125 \\) per month. - June 20: Owner paid wages due to part-time employee from period ending June 15. - June 21: Owner paid for plumbing repairs in the office in the amount of \\( \\$ 210 \\). - June 22: Owner withdrew \\( \\$ 1,000 \\) cash for personal use. - June 23: Customer paid balance due from June 6 service in the amount of \\( \\$ 1,000 \\). - June 25: Owner provided service to client in the amount of \\( \\$ 800 \\). Client paid at time of service. - June 28: Owner poid balance due for office supplies purchase on June 5. - June 29: Owner performed service for client on account in the amount of \\( \\$ 2,225.00 \\). - June 30: Owner received telephone bill for month of June in the amount of \\( \\$ 155 \\) and recorded the expense. This bill will not be paid until July. - June 30: Last day of pay period; owner owes part-time worker \\( \\$ 325 \\) for the June 16 through p cominem: (a). \\( +1 \\) Cain. Notes Pruble Owincipal S. 45,05000 is S. 49,05000 \\( 5-\\quad 58000000 \\) 5. \\( \\begin{array}{r}\\$ 25,4600 \\\\ 525,46500\\end{array} \\) Aresuinti Parape Oiner Ornm Acrounte Ifec Ledger Accounta sinemen \\( a \\operatorname{sen} n \\) (1) Ready ix Accessibility Investigate (1) \\( 82^{\\circ} \\mathrm{F} \\) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started