All I need the last two pictures completed, just journalizing the adjustments. You can use the numbers I provided. #3 is cut off but 3% is the number of month end receivables.

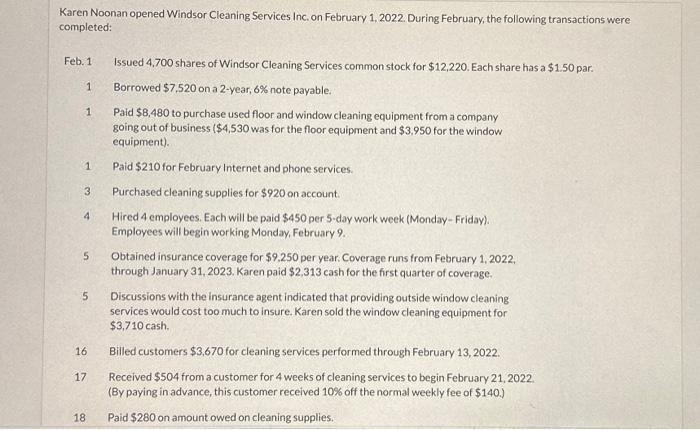

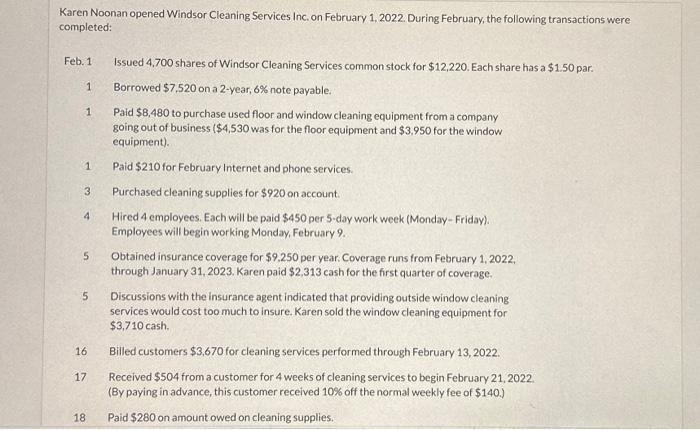

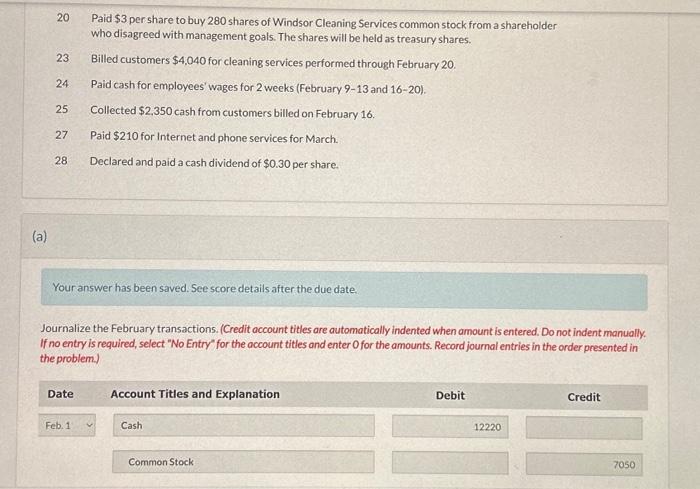

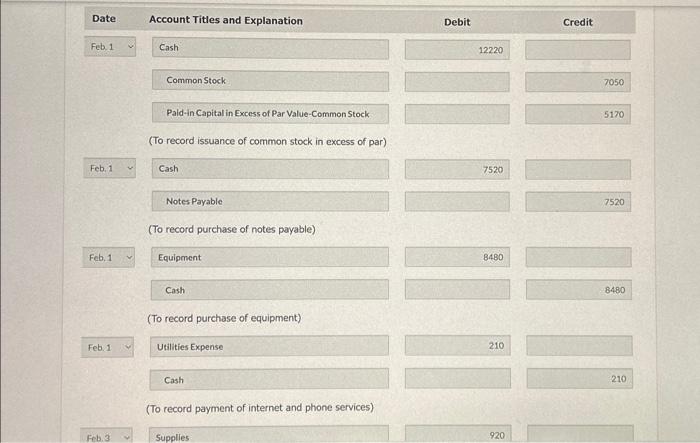

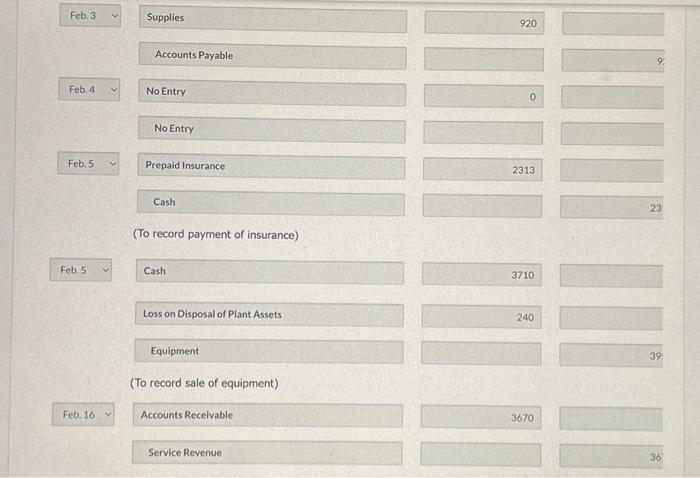

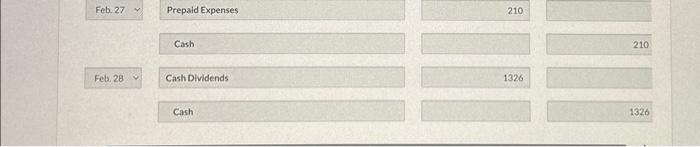

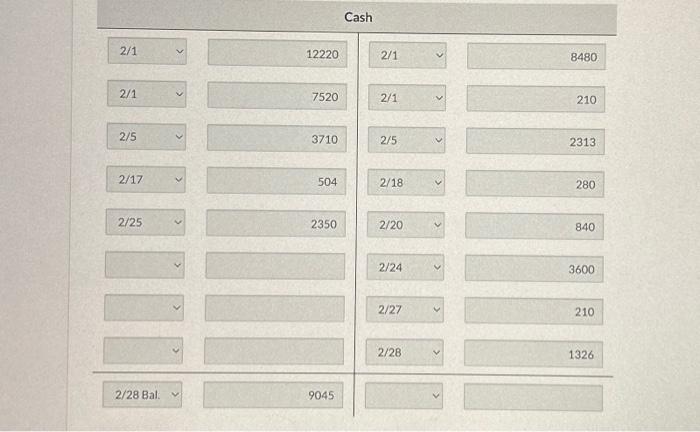

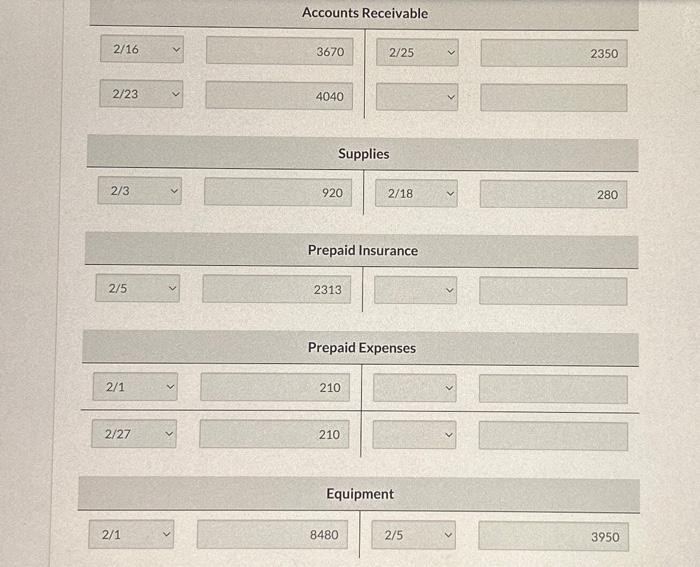

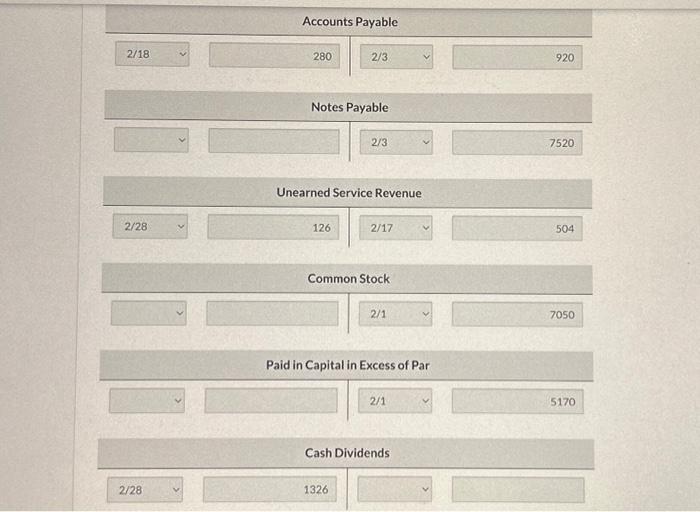

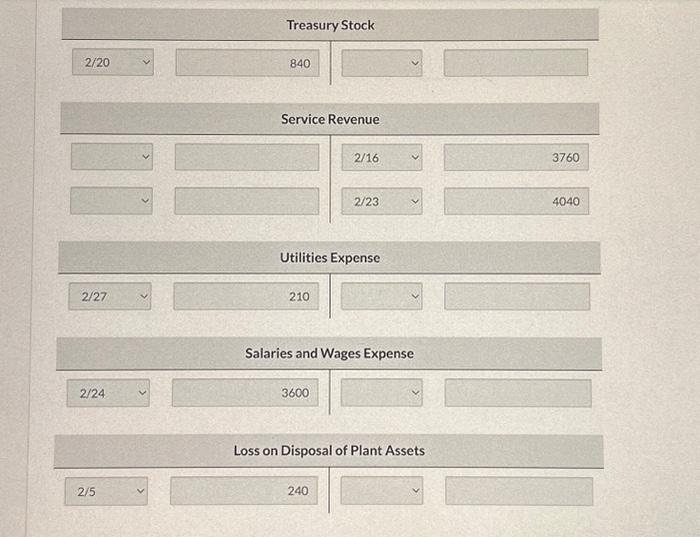

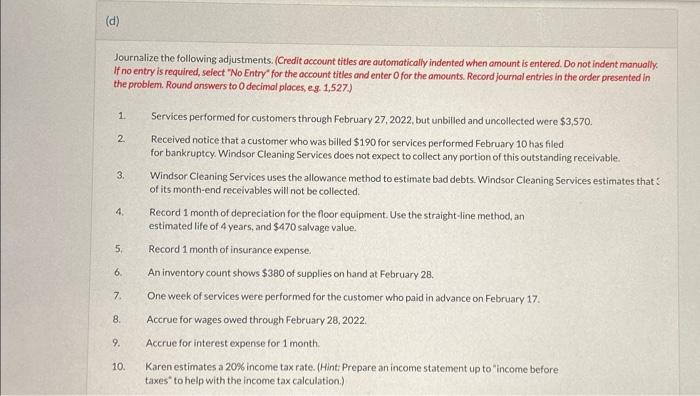

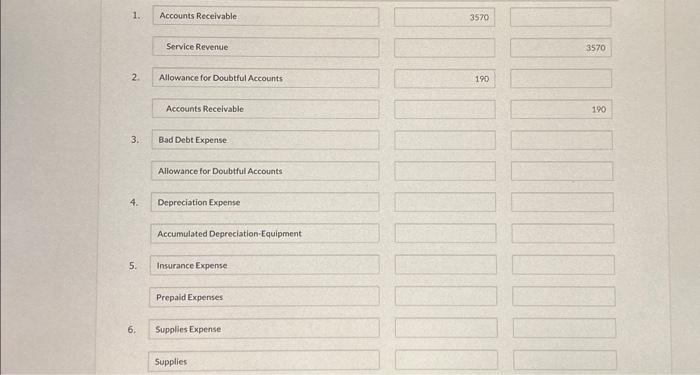

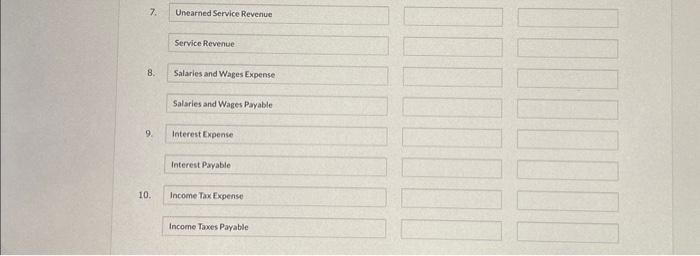

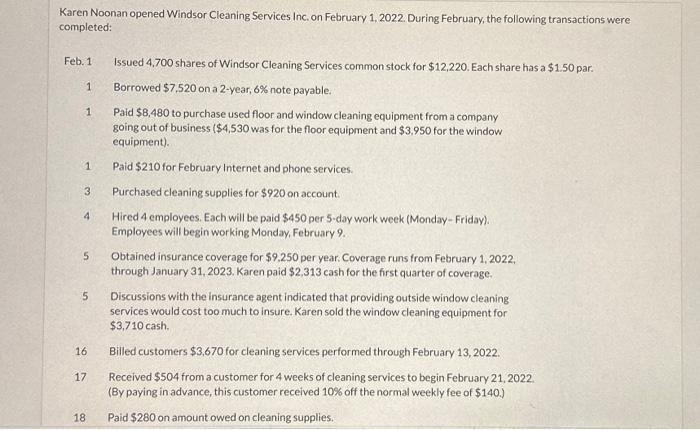

Feb. 3 Supplies 920 Accounts Payable Feb. 4 No Entry No Entry Feb.5 Prepaid Insurance 9. (To record payment of insurance) Feb. 5 Cash 3710 Loss on Disposal of Plant Assets Equipment (To record sale of equipment) Feb. 16 Accounts Receivable 3670 Service Revenue 36 Karen Noonan opened Windsor Cleaning Services Inc, on February 1, 2022. During February, the following transactions were completed: Feb.1 Issued 4,700 shares of Windsor Cleaning Services common stock for $12,220. Each share has a $1.50 par. 1 Borrowed $7,520 on a 2 -year, 6% note payable. 1 Paid $8,480 to purchase used floor and window cleaning equipment from a company going out of business ($4,530 was for the floor equipment and $3,950 for the window equipment). 1 Paid $210 for February Internet and phone services. 3 Purchased cleaning supplies for $920 on account 4 Hired 4 employees. Each will be paid $450 per 5 -day work week (Monday-Friday). Employees will begin working Monday, February 9. 5 Obtained insurance coverage for $9.250 per year. Coverage runs from February 1, 2022, through January 31,2023. Karen paid \$2,313 cash for the first quarter of coverage. 5 Discussions with the insurance agent indicated that providing outside window cleaning services would cost too much to insure. Karen sold the window cleaning equipment for $3,710 cash. 16 Billed customers $3,670 for cleaning services performed through February 13, 2022. 17 Received $504 from a customer for 4 weeks of cleaning services to begin February 21, 2022 (By paying in advance, this customer received 10% off the normal weekly fee of $140. ) 18 Paid $280 on amount owed on cleaning supplies. Treasury Stock 2/20 840 Service Revenue 2/16 3760 2/23 4040 Utilities Expense 2/27 210 Salaries and Wages Expense 2/24 3600 Loss on Disposal of Plant Assets 2/5 240 Feb. 17 Cash 504 Unearned Service Revenue Feb. 18v Accounts Payable 280 Cash Feb. 20 Treasury Stock 840 Cash Feb. 23 Accounts Receivable Service Revenue \begin{tabular}{|r|r|} \hline 840 \\ \hline \end{tabular} \$1 Feb. 24% Salaries and Wages Expense 3600 Cash 2 1. Accounts Receivable 3570 Service Revenue 3570 2. Allowance for Doubtful Accounts 190 Accounts Receivable 190 3. Bad Debt Expense Allowance for Doubtful Accounts 4. Depreciation Expense Accumulated Depreciation-Equipment 5. Insurance Expense Prepaid Expenses 6. Supplies Expense Supplies Journalize the following adjustments. (Credit account titles are automotically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry' for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, eg. 1,527) 1. Services performed for customers through February 27,2022 , but unbilled and uncollected were $3,570. 2. Received notice that a customer who was billed $190 for services performed February 10 has filed for bankruptcy. Windsor Cleaning Services does not expect to collect any portion of this outstanding receivable. 3. Windsor Cleaning Services uses the allowance method to estimate bad debts. Windsor Cleaning Services estimates that: of its month-end receivables will not be collected. 4. Record 1 month of depreciation for the floor equipment. Use the straight-line method, an estimated life of 4 years, and $470 salvage value. 5. Record 1 month of insurance expense. 6. An inventory count shows $380 of supplies on hand at February 28. 7. One week of services were performed for the customer who paid in advance on February 17. 8. Accrue for wages owed through February 28, 2022. 9. Accrue for interest expense for 1 month. 10. Karen estimates a 20% income tax rate. (Hint: Prepare an income statement up to "income before taxes" to help with the income tax calculation.) 20 Paid $3 per share to buy 280 shares of Windsor Cleaning Services common stock from a shareholder who disagreed with management goals. The shares will be held as treasury shares. 23 Billed customers $4,040 for cleaning services performed through February 20. 24 Paid cash for employees' wages for 2 weeks (February 9-13 and 16-20). 25 Collected $2,350 cash from customers billed on February 16. 27 Paid \$210 for Internet and phone services for March. 28 Declared and paid a cash dividend of $0.30 per share. (a) Your answer has been saved. See score details after the due date. Journalize the February transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Accounts Receivable Accounts Payable 2/18 280 2/3 920 Notes Payable 2/3 7520 Unearned Service Revenue 2/28 126 2/17 504 Common Stock 2/1 7050 Paid in Capital in Excess of Par 2/1 5170 Cash Dividends 2/28 1326 7. Unearned Service Revenue Service Revenue 8. Salaries and Wages Expense Salaries and Wages Payable 9. Interest Expense Interest Payable 10. Income Tax Expense Income Taxes Payable