Answered step by step

Verified Expert Solution

Question

1 Approved Answer

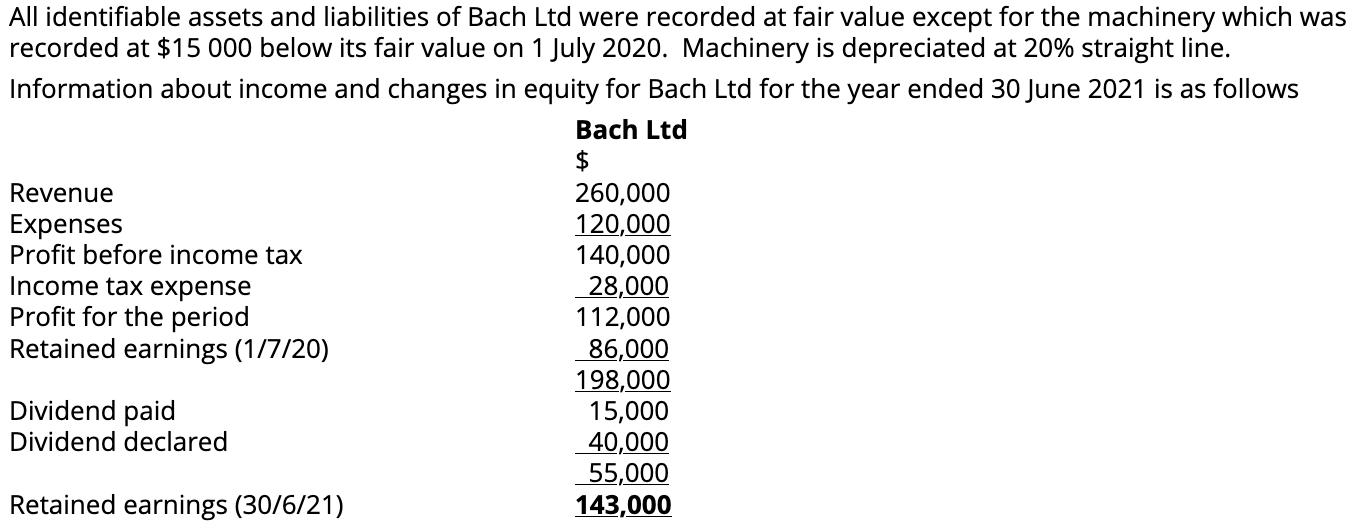

All identifiable assets and liabilities of Bach Ltd were recorded at fair value except for the machinery which was recorded at $15 000 below

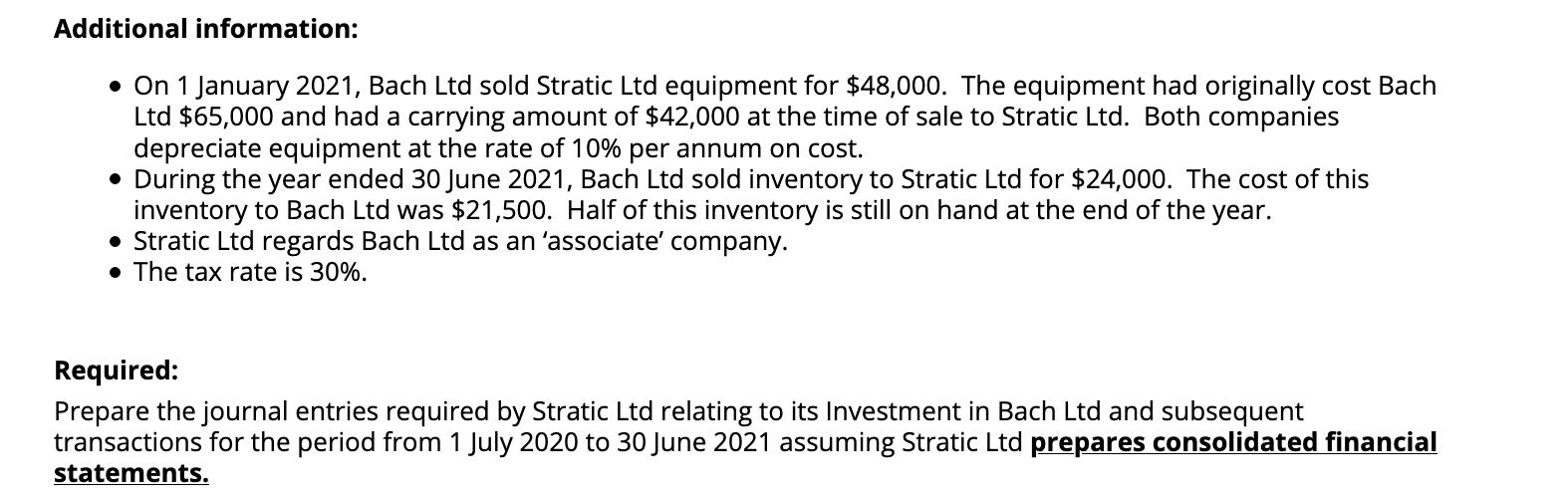

All identifiable assets and liabilities of Bach Ltd were recorded at fair value except for the machinery which was recorded at $15 000 below its fair value on 1 July 2020. Machinery is depreciated at 20% straight line. Information about income and changes in equity for Bach Ltd for the year ended 30 June 2021 is as follows Bach Ltd $ 260,000 120,000 140,000 28,000 112,000 86,000 198,000 15,000 40,000 55,000 143,000 Revenue Expenses Profit before income tax Income tax expense Profit for the period Retained earnings (1/7/20) Dividend paid Dividend declared Retained earnings (30/6/21) Additional information: On 1 January 2021, Bach Ltd sold Stratic Ltd equipment for $48,000. The equipment had originally cost Bach Ltd $65,000 and had a carrying amount of $42,000 at the time of sale to Stratic Ltd. Both companies depreciate equipment at the rate of 10% per annum on cost. During the year ended 30 June 2021, Bach Ltd sold inventory to Stratic Ltd for $24,000. The cost of this inventory to Bach Ltd was $21,500. Half of this inventory is still on hand at the end of the year. Stratic Ltd regards Bach Ltd as an 'associate' company. The tax rate is 30%. Required: Prepare the journal entries required by Stratic Ltd relating to its Investment in Bach Ltd and subsequent transactions for the period from 1 July 2020 to 30 June 2021 assuming Stratic Ltd prepares consolidated financial statements.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The journal entries required by Stratic Ltd relating to its inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started