Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all Inereat wmen o e of the deb be mued n a separae defered charge acoount and wen offequaly over 40year peod nene of m

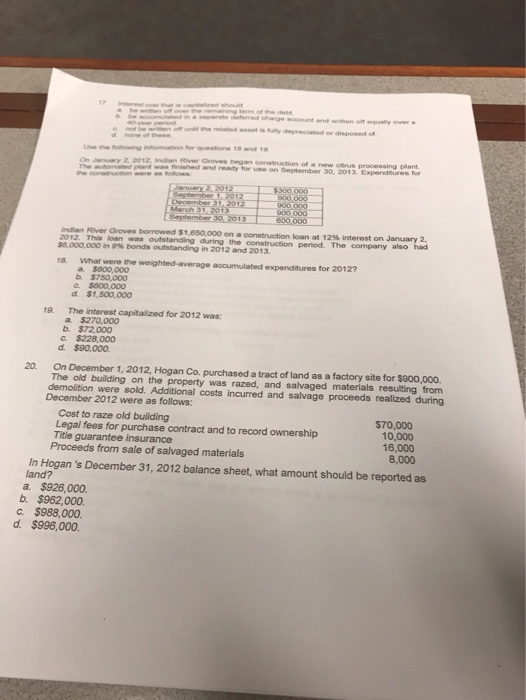

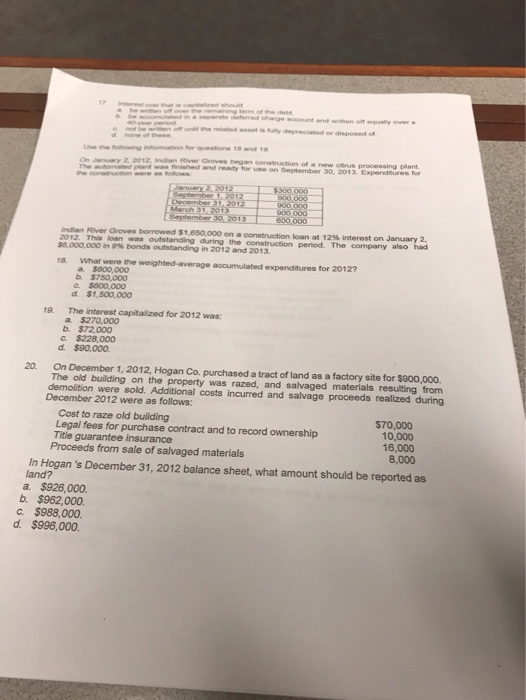

all Inereat wmen o e of the deb be mued n a separae defered charge acoount and wen offequaly over 40year peod nene of m unr the related anst is fully depreciated or disposed of Use the foloing information for questions 18 and 19 On January 2, 2012, Indian River Croves began construction of a new citrus processing plant The audomated plant was finished and ready for use on September 30, 2013 Expenditures for the construction were as follows January 2, 2012 September 1, 2012 December 31, 2012 March 31, 2013 September 30, 2013 $300,000 900,000 900,000 900 000 600,000 Indian River Groves borrowed $1.650.000 on a construction loan at 12% interest on January 2 2012. This s,000.000 in gu s outstanding during the construction period. The company also had bonds outstanding in 2012 and 2013. What were the weighted-average accumulated expenditures for 20127 a. $800,000 b $750,000 c $600,000 d $1,500,000 18 The interest capitalized for 2012 was a $270,000 b. $72.000 c $228,000 d. $90,000 19. On December 1, 2012, Hogan Co. purchased a tract of land as a factory site for $900,000. The old building on thee property was razed, and salvaged materials resulting from demolition were sold. Additional costs incurred and salvage proceeds realized during December 2012 were as follows: 20. Cost to raze old building Legal fees for purchase contract and to record ownership Title guarantee insurance Proceeds from sale of salvaged materials In Hogan 's December 31, 2012 balance sheet, what amount should be reported as land? a. $926,000 $70,000 10,000 16,000 8,000 b. $962,000 c $988,000. d. $996,000

all Inereat wmen o e of the deb be mued n a separae defered charge acoount and wen offequaly over 40year peod nene of m unr the related anst is fully depreciated or disposed of Use the foloing information for questions 18 and 19 On January 2, 2012, Indian River Croves began construction of a new citrus processing plant The audomated plant was finished and ready for use on September 30, 2013 Expenditures for the construction were as follows January 2, 2012 September 1, 2012 December 31, 2012 March 31, 2013 September 30, 2013 $300,000 900,000 900,000 900 000 600,000 Indian River Groves borrowed $1.650.000 on a construction loan at 12% interest on January 2 2012. This s,000.000 in gu s outstanding during the construction period. The company also had bonds outstanding in 2012 and 2013. What were the weighted-average accumulated expenditures for 20127 a. $800,000 b $750,000 c $600,000 d $1,500,000 18 The interest capitalized for 2012 was a $270,000 b. $72.000 c $228,000 d. $90,000 19. On December 1, 2012, Hogan Co. purchased a tract of land as a factory site for $900,000. The old building on thee property was razed, and salvaged materials resulting from demolition were sold. Additional costs incurred and salvage proceeds realized during December 2012 were as follows: 20. Cost to raze old building Legal fees for purchase contract and to record ownership Title guarantee insurance Proceeds from sale of salvaged materials In Hogan 's December 31, 2012 balance sheet, what amount should be reported as land? a. $926,000 $70,000 10,000 16,000 8,000 b. $962,000 c $988,000. d. $996,000

all

allStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started