all info needed help ):

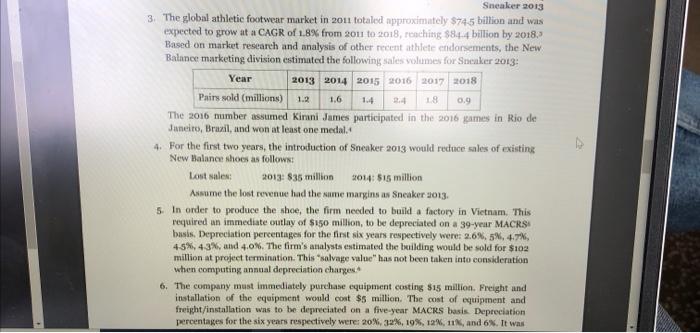

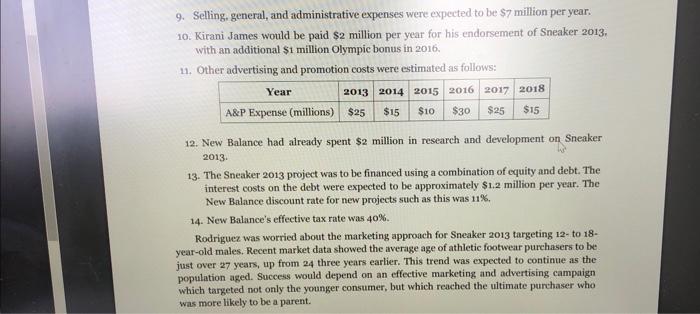

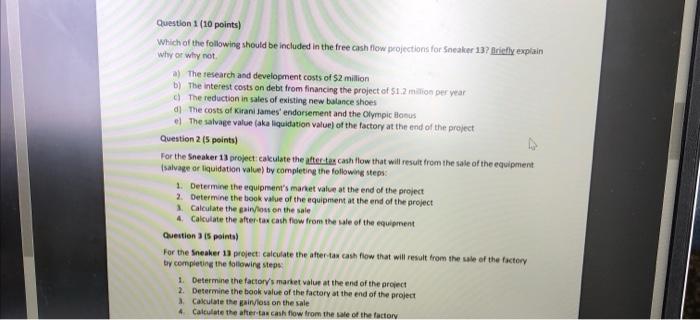

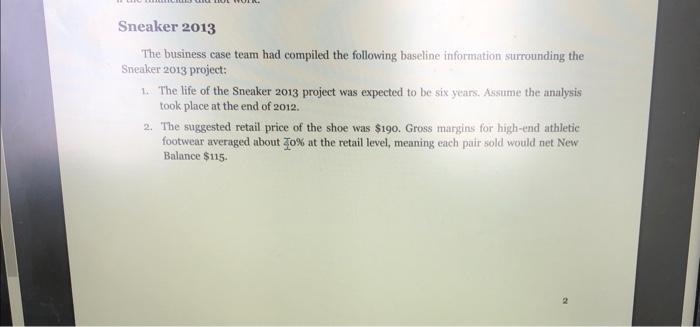

AL Sneaker 2013 The business case team had compiled the following baseline information surrounding the Sneaker 2013 project: 1. The life of the Sneaker 2013 project was expected to be six years. Assume the analysis took place at the end of 2012. 2. The suggested retail price of the shoe was $190. Gross margins for high-end athletic footwear averaged about 70% at the retail level, meaning each pair sold would net New Balance $115. Sneaker 2013 3. The global athletic footwear market in 2011 totaled approximately $745 billion and was expected to grow at a CAGR of 1.8% from 2011 to 2018, reaching $81.4 billion by 2018, Based on market research and analysis of other recent athlete endorsements, the New Balance marketing division estimated the following sales volumes for Sneaker 2013: Year 2013 2014 2015 2016 2017 2018 Pairs sold (millions) 1.2 1.6 1.4 18 0.9 The 2016 number assumed Kirani James participated in the 2016 games in Rio de Janeiro, Brazil, and won at least one medal. 4. For the first two years, the introduction of Sneaker 2013 would reduce sales of existing New Balance shoes as follows: Lost sales 2013: $35 million 2014: $16 million Assume the lost revenue had the same margins as Sneaker 2013. 5. In order to produce the shoe, the firm needed to build a factory in Vietnam. This required an immediate outlay of $150 million, to be depreciated on a 39-year MACRS basis. Depreciation percentages for the first six years respectively were: 2.6%, 5, 4.7%, 4-5%, 43%, and 4.0%. The firm's analysts estimated the building would be sold for $102 million at project termination. This salvage value has not been taken into consideration when computing annual depreciation charges 6. The company must immediately purchase equipment costing $15 million. Freight and installation of the equipment would cost $5 million. The cost of equipment and freight/installation was to be depreciated on a five-year MACRS basis. Depreciation percentages for the six years respectively were 20% 32%, 19%, 12% 11, and 6. It was 7. In order to manufacture Sneaker 2013, two of the firm's working capital accounts were expected to increase immediately. Approximately $15 million of inventory would be needed quickly to fill the supply chain, and accounts payable were expected to increase by $5 million. By the end of 2013, the accounts receivable balance would be 8% of project revenue; the inventory balance would be 35% of the project's variable costs; and accounts payable would be 20% of the project's variable costs. All working capital would be recovered at the end of the project by the end of the sixth year. 8. Variable costs were expected to be 55% of revenue http://www.prnewswire.comews-relates/global-footwear-market-expected-to-prach-uad-2115-billion 2016-transparency market research-170231636.html, accessed October 2014 By comparison, when Usain Bolt set the then 100-meter world record of 9.69 seconds at the 2008 Beijing Olympic Puma sold two million pairs of his shoes in two days. http://www.mouhlog.com/2009/08/..cossed October 2014 *Modified Accelerated Cost Recovery System, the current U.S. tax depreciation method Including salvage value in depreciation computaties is done for financial reporting purposes. Here, the concem is for cash flow impacts of tacer. For tax purpenes, it is not necessary for firms to incorporate salvage value. 3 $15 9. Selling, general, and administrative expenses were expected to be $7 million per year. 10. Kirani James would be paid $2 million per year for his endorsement of Sneaker 2013 with an additional $1 million Olympic bonus in 2016, 11. Other advertising and promotion costs were estimated as follows: Year 2013 2014 2015 2016 2017 2018 A&P Expense (millions) $25 $10 $30 $25 $15 12. New Balance had already spent $2 million in research and development on Sneaker 2013 13. The Sneaker 2013 project was to be financed using a combination of equity and debt. The interest costs on the debt were expected to be approximately $1.2 million per year. The New Balance discount rate for new projects such as this was 11% 14. New Balance's effective tax rate was 40% Rodriguez was worried about the marketing approach for Sneaker 2013 targeting 12- to 18- year-old males. Recent market data showed the average age of athletic footwear purchasers to be just over 27 years, up from 24 three years earlier. This trend was expected to continue as the population aged. Success would depend on an effective marketing and advertising campaign which targeted not only the younger consumer, but which reached the ultimate purchaser who was more likely to be a parent. Question 1 (10 points) Which of the following should be included in the free cash flow projections for Sneaker 13? Briefly explain why or why not a) The research and development costs of $2 million b) The interest costs on debt from financing the project of $1.2 million per year The reduction in sales of existing new balance shoes d) The costs of Kirani James' endorsement and the Olympic Hous The salvage Value (aka liquitation value) of the factory at the end of the project Question 2 (5 points) For the Sneaker 13 project cakulate the aftertas cash flow that will result from the sale of the equipment salvage or liquidation value) by completing the following steps: 1. Determine the equipment's manet value at the end of the project 2. Determine the book value of the equipment at the end of the project 3. Calculate the gainions on the sale 4 Calculate the after tax cash flow from the sale of the equipment Question is points) For the Sneaker 13 project calculate the after tax cash flow that will result from the sale of the factory by completing the following steps 1. Determine the factory's market value at the end of the project 2. Determine the book value of the factory at the end of the project 3. Calculate the girloss on the sale 4. Calculate the after tax cash flow from the sale of the factory