Answered step by step

Verified Expert Solution

Question

1 Approved Answer

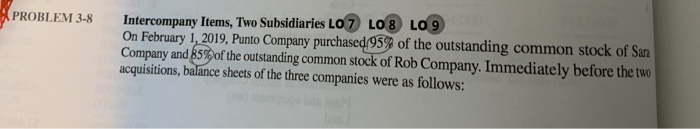

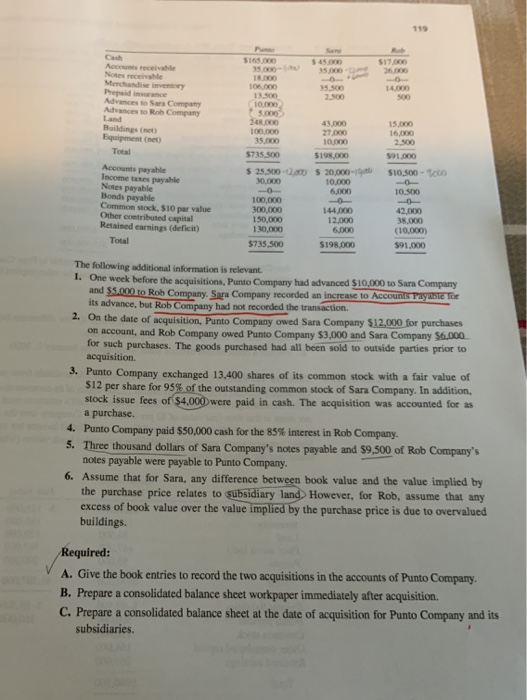

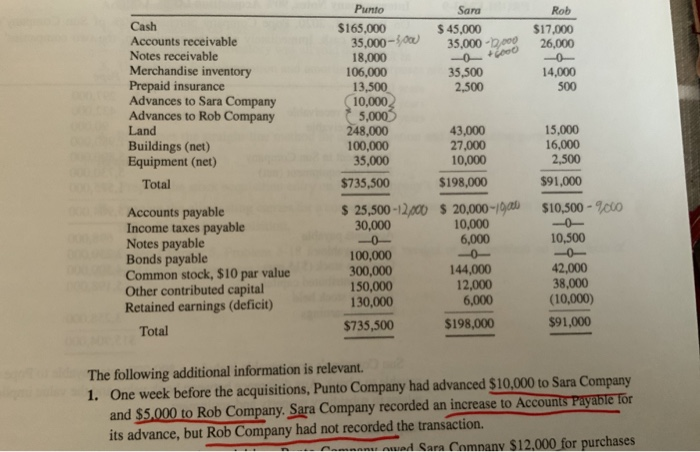

All information from my textbook is included. PROBLEM 3-8 Intercompany Items, Two Subsidiaries LO 7 LOS LO 9 On February 1, 2019, Punto Company purchased

All information from my textbook is included.

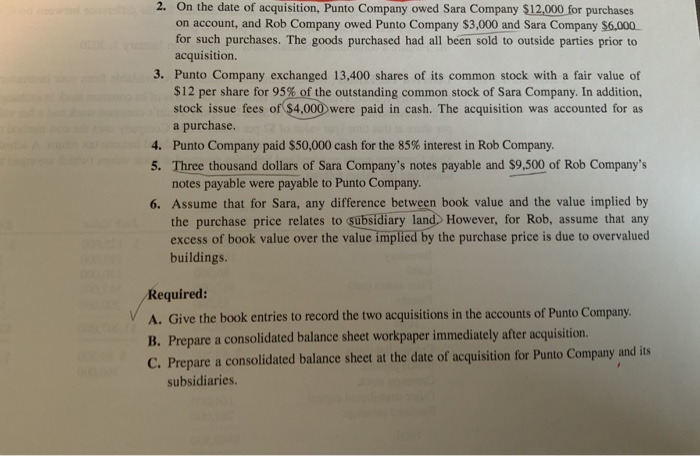

PROBLEM 3-8 Intercompany Items, Two Subsidiaries LO 7 LOS LO 9 On February 1, 2019, Punto Company purchased 95% of the outstanding common stock of Sara Company and 85% of the outstanding common stock of Rob Company. Immediately before the two acquisitions, balance sheets of the three companies were as follows: $17.000 26.000 14,000 2.500 C A receive Notes receive Merchandise inventory Prepaidinance Advances to Sara Company Advances to Rob Company Buildings met Equipment (net Total Accounts payable Income taxes payable Notes payable Bonds payable Common stock, S10 per value Other contributed capital Retained earnings (deficit) Total $165.000 35.000- 35.000 18.00 35.500 13500 10,000 5.000 248.000 43.000 100.000 27.000 35,000 10,000 $735.500 $198.000 $ 25,500-2.000 $ 20,000- 30.000 10.000 6,000 100,000 300.000 144.000 150,000 12,000 130,000 6,000 $735,500 $198.000 15.000 16,000 2.500 591.000 SIO 500 - 10.500 42.000 38.000 (10,000) 591.000 The following additional information is relevant 1. One week before the acquisitions, Punto Company had advanced $10,000 to Sara Company and $5.000 to Rob Company, Sara Company recorded an increase to Accounts Payaste Toe its advance, but Rob Company had not recorded the transaction. 2. On the date of acquisition, Punto Company owed Sara Company $12,000 for purchases on account, and Rob Company owed Punto Company $3,000 and Sara Company $6.000 for such purchases. The goods purchased had all been sold to outside parties prior to acquisition 3. Punto Company exchanged 13.400 shares of its common stock with a fair value of $12 per share for 95% of the outstanding common stock of Sara Company. In addition, stock issue fees of $4,000 were paid in cash. The acquisition was accounted for as a purchase. 4. Punto Company paid $50,000 cash for the 85% interest in Rob Company. 5. Three thousand dollars of Sara Company's notes payable and $9,500 of Rob Company's notes payable were payable to Punto Company. 6. Assume that for Sara, any difference between book value and the value implied by the purchase price relates to subsidiary land. However, for Rob, assume that any excess of book value over the value implied by the purchase price is due to overvalued buildings. Required: A. Give the book entries to record the two acquisitions in the accounts of Punto Company. B. Prepare a consolidated balance sheet workpaper immediately after acquisition C. Prepare a consolidated balance sheet at the date of acquisition for Punto Company and its subsidiaries. Rob $17.000 26,000 -OD 14,000 500 Cash Accounts receivable Notes receivable Merchandise inventory Prepaid insurance Advances to Sara Company Advances to Rob Company Land Buildings (net) Equipment (net) Total Accounts payable Income taxes payable Notes payable Bonds payable Common stock, $10 par value Other contributed capital Retained earnings (deficit) Total Punto Sara $165,000 $ 45,000 35,000-500 35,000 -2,000 18,000 106,000 35,500 13,500 2,500 10,000 5,0003 248,000 43,000 100,000 27,000 35,000 10,000 $735,500 $198,000 $ 25,500-12.000 $ 20,000-1900 30,000 10,000 -0- 6,000 100,000 300,000 144,000 150,000 12,000 130,000 6,000 $735,500 $198,000 15,000 16,000 2,500 $91,000 $10,500 - 9000 10,500 42,000 38,000 (10,000) $91,000 The following additional information is relevant 1. One week before the acquisitions, Punto Company had advanced $10,000 to Sara Company and $5,000 to Rob Company. Sara Company recorded an increase to Accounts Payable for its advance, but Rob Company had not recorded the transaction. - und Sara Camnany $12,000 for purchases 2. On the date of acquisition, Punto Company owed Sara Company $12,000 for purchases on account, and Rob Company owed Punto Company $3,000 and Sara Company $6,000 for such purchases. The goods purchased had all been sold to outside parties prior to acquisition. 3. Punto Company exchanged 13,400 shares of its common stock with a fair value of $12 per share for 95% of the outstanding common stock of Sara Company. In addition, stock issue fees of $4,000 were paid in cash. The acquisition was accounted for as a purchase. 4. Punto Company paid $50,000 cash for the 85% interest in Rob Company. 5. Three thousand dollars of Sara Company's notes payable and $9,500 of Rob Company's notes payable were payable to Punto Company. 6. Assume that for Sara, any difference between book value and the value implied by the purchase price relates to subsidiary land. However, for Rob, assume that any excess of book value over the value implied by the purchase price is due to overvalued buildings. Required: A. Give the book entries to record the two acquisitions in the accounts of Punto Company. B. Prepare a consolidated balance sheet workpaper immediately after acquisition C. Prepare a consolidated balance sheet at the date of acquisition for Punto Company and its subsidiaries Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started