Answered step by step

Verified Expert Solution

Question

1 Approved Answer

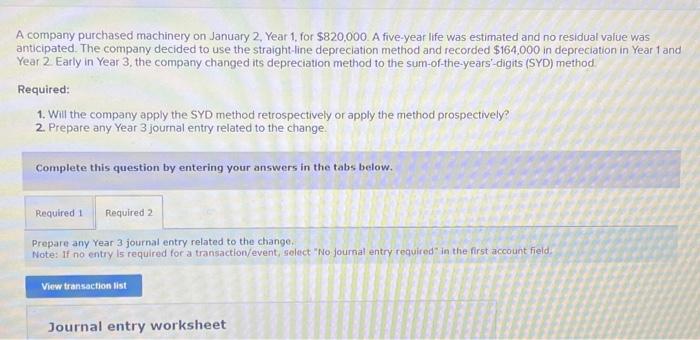

all information given! A company purchased machinery on January 2 , Year 1, for ( $ 820,000 ). A five-year life was estimated and no

all information given!

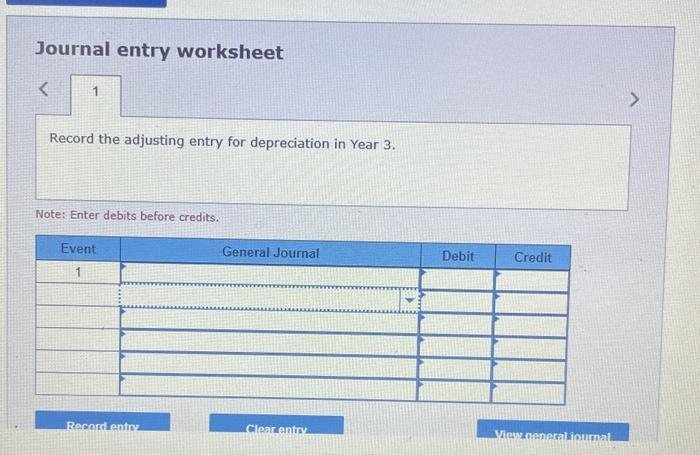

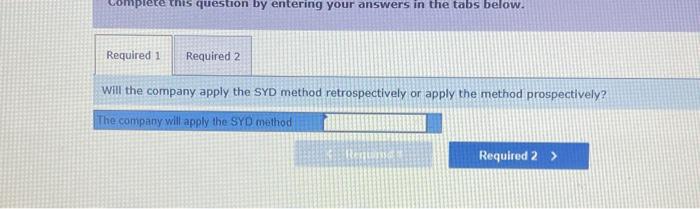

A company purchased machinery on January 2 , Year 1, for \\( \\$ 820,000 \\). A five-year life was estimated and no residual value was anticipated. The company decided to use the straight-line depreciation method and recorded \\( \\$ 164,000 \\) in depreciation in Year 1 and Year 2 . Early in Year 3, the company changed its depreciation method to the sum-of-the-years'-digits (SYD) method Required: 1. Will the company apply the SYD method retrospectively or apply the method prospectively? 2. Prepare any Year 3 journal entry related to the change. Complete this question by entering your answers in the tabs below. Prepare any Year 3 journal entry related to the change. Note: If no entry is required for a transaction/event, select \"No joursal entry required\" in the first account field. Journal entry worksheet Journal entry worksheet Record the adjusting entry for depreciation in Year 3. Note: Enter debits before credits. Nill the company apply the SYD method retrospectively or apply the method prospectively Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started