Answered step by step

Verified Expert Solution

Question

1 Approved Answer

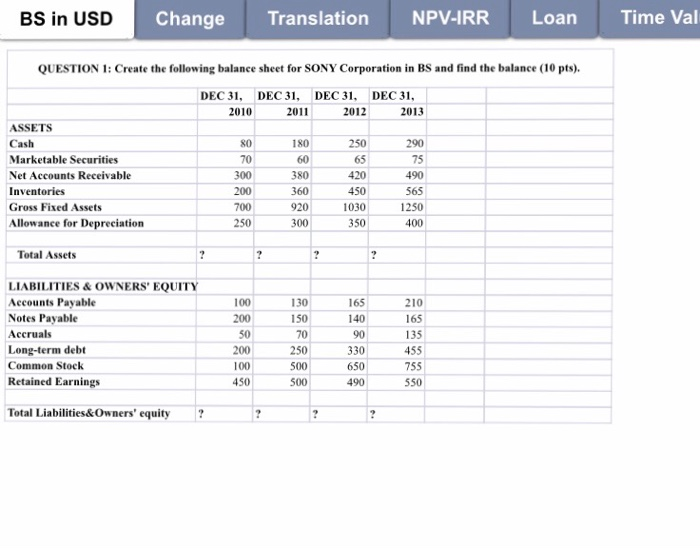

all information has been provided in the pictures BS in USD Change Translation NPV-IRR Loan Time Val QUESTION 1: Create the following balance sheet for

all information has been provided in the pictures

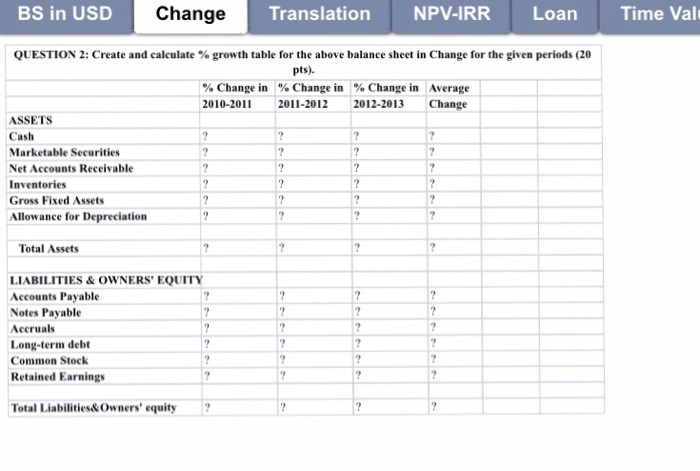

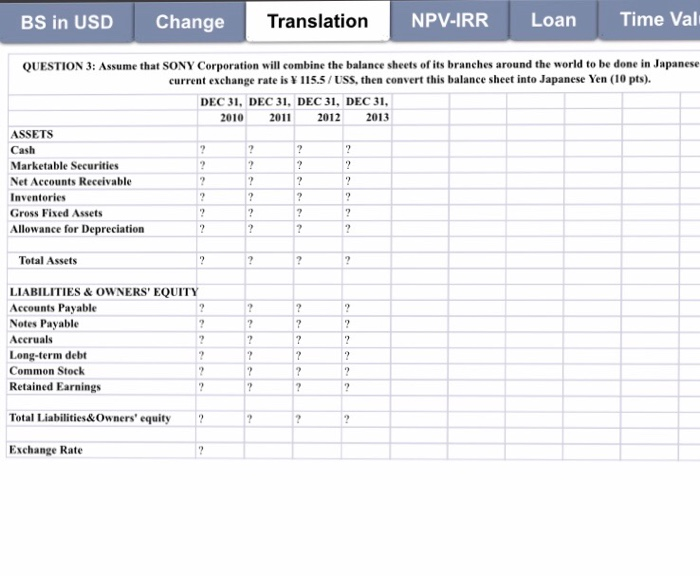

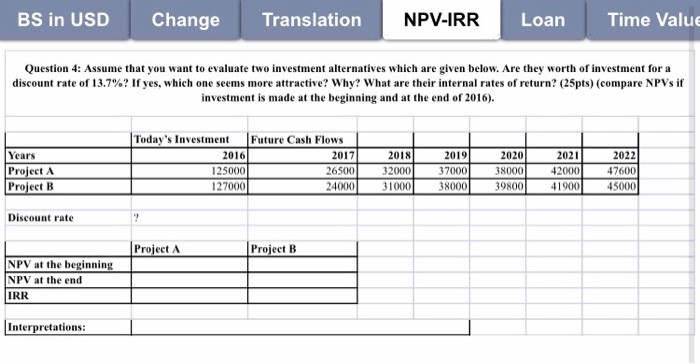

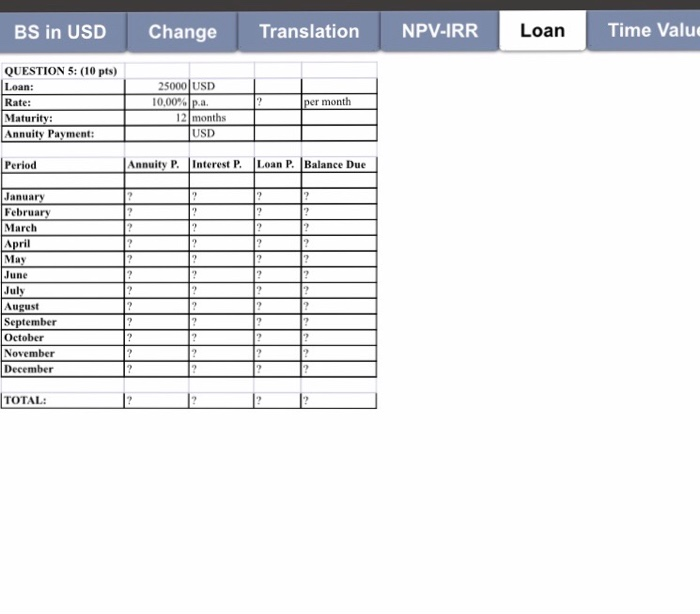

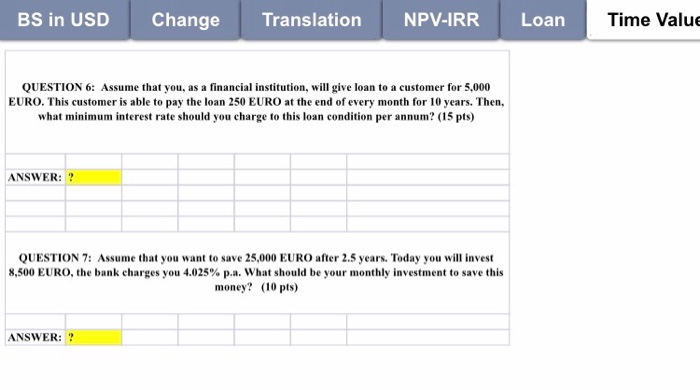

BS in USD Change Translation NPV-IRR Loan Time Val QUESTION 1: Create the following balance sheet for SONY Corporation in BS and find the balance (10 pts). DEC 31, DEC 31, DEC 31, DEC 31, 2010 2011 2012 2013 ASSETS Cash 80 180 250 290 Marketable Securities 70 60 65 75 Net Accounts Receivable 300 380 420 490 Inventories 200 360 450 565 Gross Fixed Assets 700 920 1030 1250 Allowance for Depreciation 250 300 350 400 Total Assets ? ? ? ? LIABILITIES & OWNERS' EQUITY Accounts Payable Notes Payable Accruals Long-term debt Common Stock Retained Earnings 210 165 135 100 200 50 200 100 450 130 150 70 250 500 500 165 140 90 330 650 490 455 755 550 Total Liabilities&Owners' equity ? ? ? ? BS in USD Change Translation NPV-IRR Loan Time Valu QUESTION 2: Create and calculate % growth table for the above balance sheet in Change for the given periods (20 pts). % Change in % Change in % Change in Average 2010-2011 2011-2012 2012-2013 Change ASSETS Cash Marketable Securities Net Accounts Receivable Inventories Gross Fixed Assets Allowance for Depreciation 2 ? ? 2 ? ? 2 ? ? 2 ? ? ? ? ? ? ? 2 ? ? 2 ? ? 2 Total Assets ? ? ? ? ? ? LIABILITIES & OWNERS' EQUITY Accounts Payable ? Notes Payable ? Accruals ? Long-term debt Common Stock Retained Earnings ? ? ? ? ? ? ? ? ? ? 2 ? ? ? ? ? ? ? Total Liabilities& Owners' equity ? ? ? 2 BS in USD Change Translation NPV-IRR Loan Time Vali QUESTION 3: Assume that SONY Corporation will combine the balance sheets of its branches around the world to be done in Japanese current exchange rate is 115.5/USS, then convert this balance sheet into Japanese Yen (10 pts). DEC 31, DEC 31, DEC 31, DEC 31, 2010 2011 2012 2013 ASSETS Cash Marketable Securities Net Accounts Receivable Inventories Gross Fixed Assets Allowance for Depreciation ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Total Assets ? ? ? ? ? ? LIABILITIES & OWNERS' EQUITY Accounts Payable Notes Payable Accruals Long-term debt 2 Common Stock 2 Retained Earnings 2 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? 2 ? ? ? Total Liabilities&Owners' equity ? ? ? ? Exchange Rate ? BS in USD Change Translation NPV-IRR Loan Time Value Question 4: Assume that you want to evaluate two investment alternatives which are given below. Are they worth of investment for a discount rate of 13.7%? If yes, which one seems more attractive? Why? What are their internal rates of return? (25pts) (compare NPVs if investment is made at the beginning and at the end of 2016). 2018 Years Project A Project B Today's Investment 2016 125000 127000 Future Cash Flows 2017 26500 24000 32000 31000 2019 37000 38000 2020 38000 39800 2021 42000 41900 20221 47600 45000 Discount rate ? Project A Project B NPV at the beginning NPV at the end IRR Interpretations: BS in USD Change Translation NPV-IRR Loan Time Value QUESTION 5: (10 pts) Loan: Rate: Maturity: Annuity Payment: 25000 USD 10,00% p.a. 12 months USD per month Period Annuity P. Interest P. Loan P. Balance Due 2 ? ? ? ? ? ? ? January February March April May June July August September October November December 2 2 ? ? ? ? 2 ? TOTAL: BS in USD Change Translation NPV-IRR Loan Time Valu QUESTION 6: Assume that you, as a financial institution, will give loan to a customer for 5,000 EURO. This customer is able to pay the loan 250 EURO at the end of every month for 10 years. Then, what minimum interest rate should you charge to this loan condition per annum? (15 pts) ANSWER: QUESTION 7: Assume that you want to save 25,000 EURO after 2.5 years. Today you will invest 8,500 EURO, the bank charges you 4.025% pa. What should be your monthly investment to save this money? (10 pts) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started