Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all information in the post ! Question Completion Status: QUESTION 3 On May 31, 2020, GEO Company had a cash balance per books of AED

all information in the post !

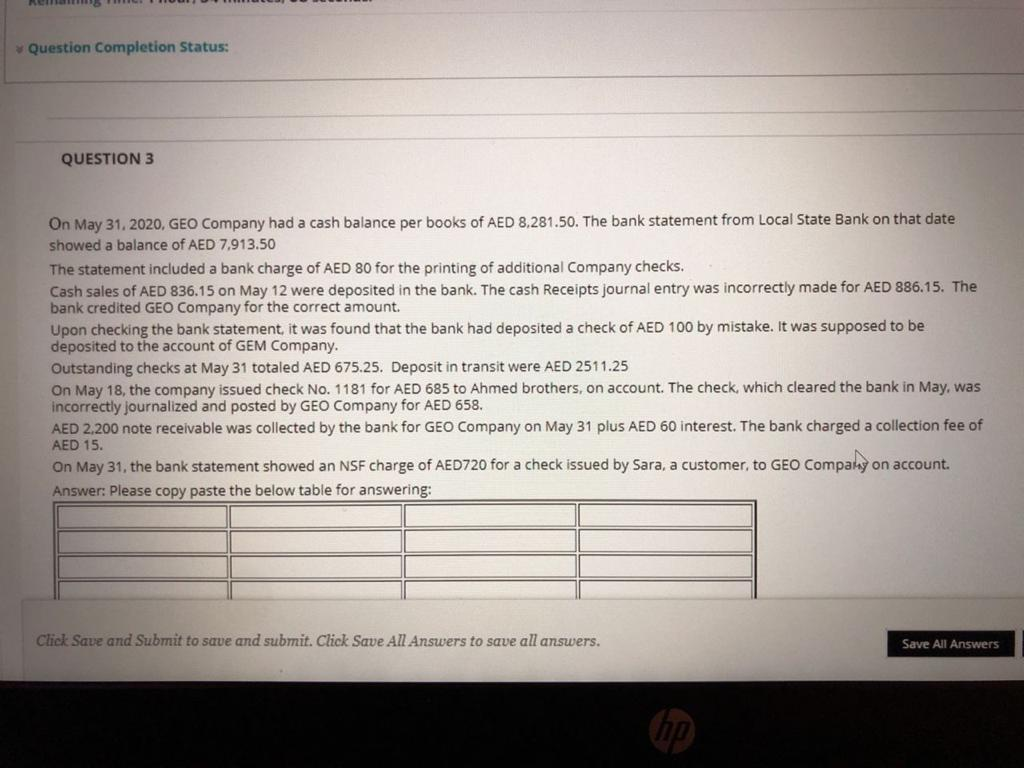

Question Completion Status: QUESTION 3 On May 31, 2020, GEO Company had a cash balance per books of AED 8.281.50. The bank statement from Local State Bank on that date showed a balance of AED 7.913.50 The statement included a bank charge of AED 80 for the printing of additional Company checks. Cash sales of AED 836.15 on May 12 were deposited in the bank. The cash Receipts journal entry was incorrectly made for AED 886.15. The bank credited GEO Company for the correct amount. Upon checking the bank statement it was found that the bank had deposited a check of AED 100 by mistake. It was supposed to be deposited to the account of GEM Company. Outstanding checks at May 31 totaled AED 675.25. Deposit in transit were AED 2511.25 On May 18, the company issued check No. 1181 for AED 685 to Ahmed brothers, on account. The check, which cleared the bank in May, was incorrectly journalized and posted by GEO Company for AED 658. AED 2.200 note receivable was collected by the bank for GEO Company on May 31 plus AED 60 interest. The bank charged a collection fee of AED 15. On May 31, the bank statement showed an NSF charge of AED720 for a check issued by Sara, a customer to GEO Company on account. Answer: Please copy paste the below table for answering: Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started