All information is based on 2017 Federal Tax Tables

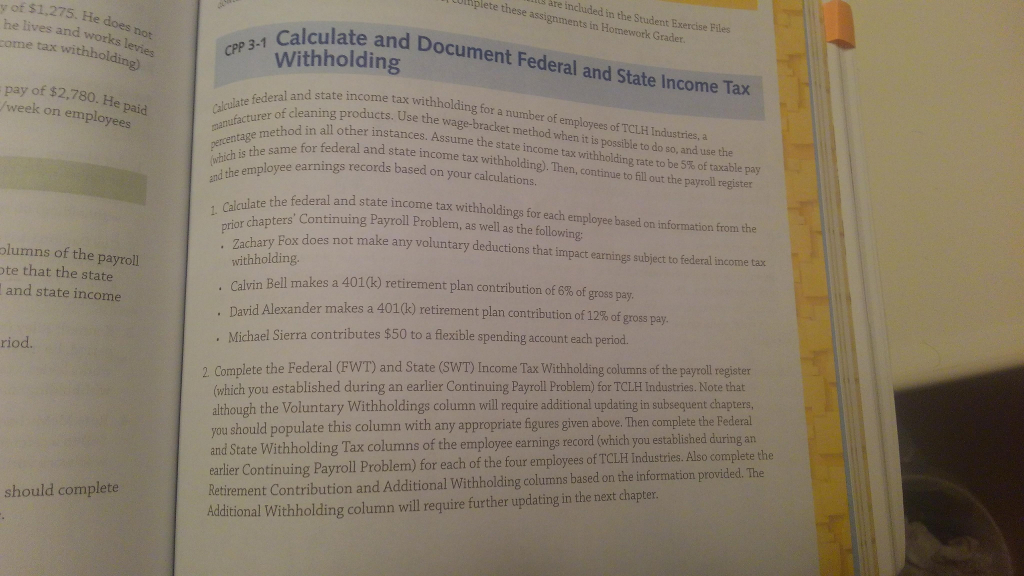

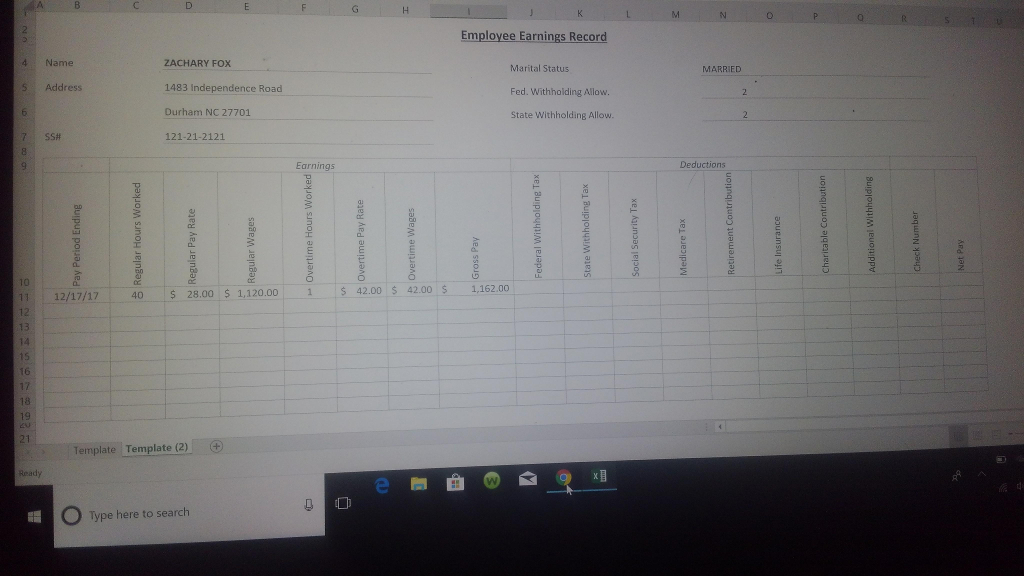

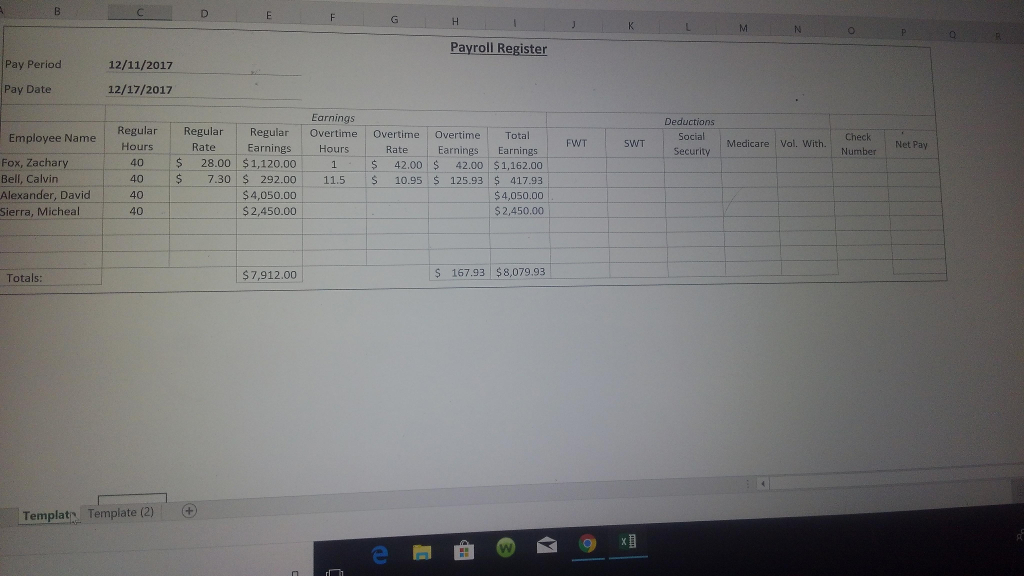

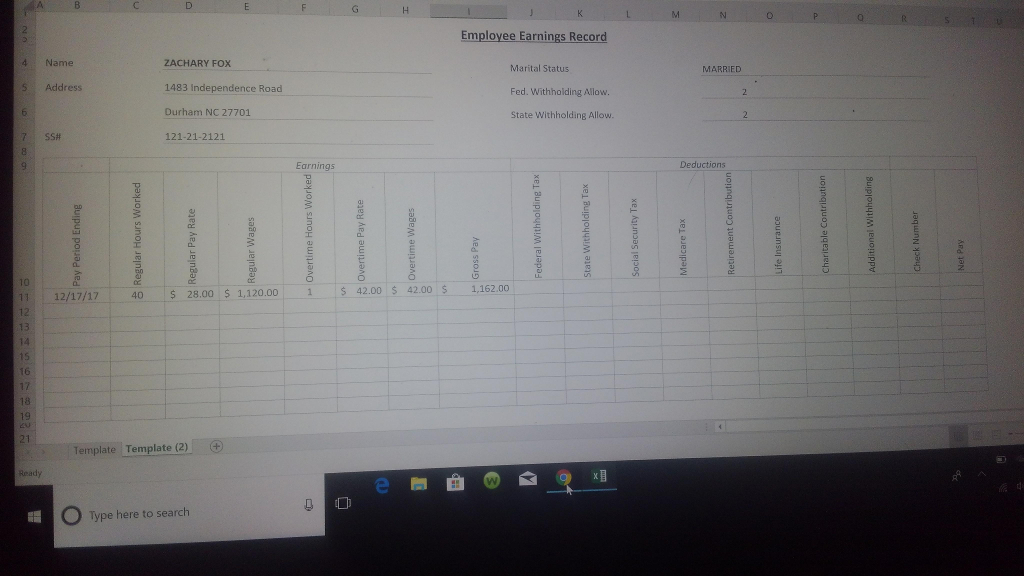

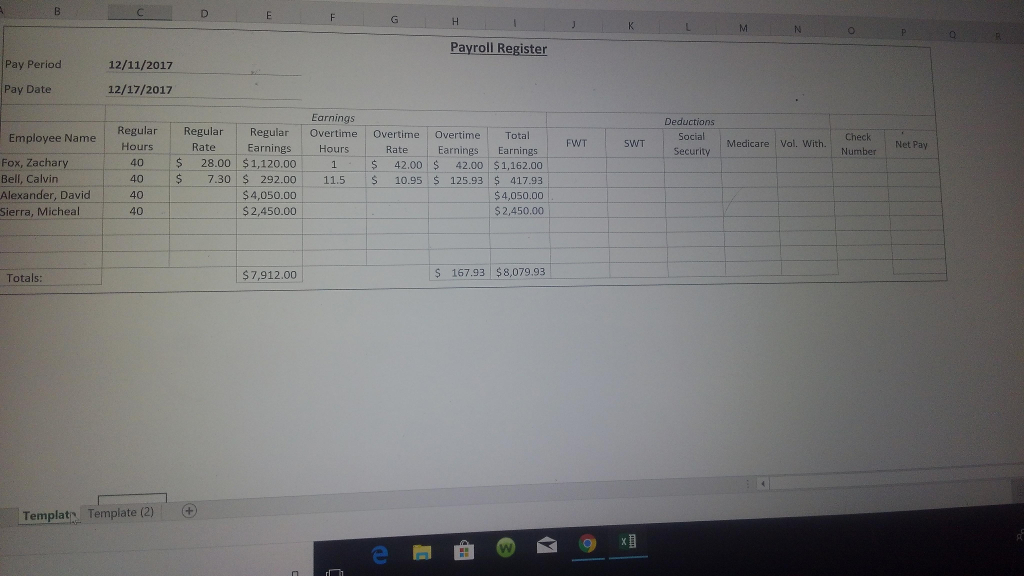

plete these assignments in Homework Grader. Are included in the Student Exercise Files y of $1.275. He does he lives and works levies come tax wi culate and Document Federal and State Income Tax Withholding and state income tax withholding for a number of pay of $2.780. He paid /week on employees ate federal aeaning products. Use the wage bracket method when tis posble to do so, and use the ufactur thod in all other instances. Assume the state income tax withholding rate to be 5% of taxable pay Calulate it is possible to do so, and use the me for federal and state income tax withholding). Then, continue to fill out the payroll register earnings records based on your calculations federal and state income tax withholdings for each employee based on information from the s Continuing Payroll Problem, as well as the following and the employee chapters Zachary withholding Calvin David Alexander makes a 401(k) retirement plan contribution of 12% of gross pay Michael Sierra contributes $50 to a flexible spending account each period. olumns of the payroll te that the state and state income Bell makes a 401(k) retirement plan contribution of 6% of gross pay. riod. 2 Complete the Federal (FWT) and State (SWT) Income Tax Withholding columns of the payroll register although the Voluntary Withholdings column will require additional updating in subsequent chapters, you should populate this column with any appropriate figures given above. Then complete the Federal and State Withho (which you established during an earlier Continuing Payroll Problem) for TCLH Industries. Note that earlier Continuing Payroll Problem) for each of the four employees of TCLH Industries. Also complete the Retirement Contribution and Additional Withholding columns based on the information provided. The Additional Withholding column willrequire further updating in the next chapter. lding Tax columns of the employee earnings record (which you established during an should complete plete these assignments in Homework Grader. Are included in the Student Exercise Files y of $1.275. He does he lives and works levies come tax wi culate and Document Federal and State Income Tax Withholding and state income tax withholding for a number of pay of $2.780. He paid /week on employees ate federal aeaning products. Use the wage bracket method when tis posble to do so, and use the ufactur thod in all other instances. Assume the state income tax withholding rate to be 5% of taxable pay Calulate it is possible to do so, and use the me for federal and state income tax withholding). Then, continue to fill out the payroll register earnings records based on your calculations federal and state income tax withholdings for each employee based on information from the s Continuing Payroll Problem, as well as the following and the employee chapters Zachary withholding Calvin David Alexander makes a 401(k) retirement plan contribution of 12% of gross pay Michael Sierra contributes $50 to a flexible spending account each period. olumns of the payroll te that the state and state income Bell makes a 401(k) retirement plan contribution of 6% of gross pay. riod. 2 Complete the Federal (FWT) and State (SWT) Income Tax Withholding columns of the payroll register although the Voluntary Withholdings column will require additional updating in subsequent chapters, you should populate this column with any appropriate figures given above. Then complete the Federal and State Withho (which you established during an earlier Continuing Payroll Problem) for TCLH Industries. Note that earlier Continuing Payroll Problem) for each of the four employees of TCLH Industries. Also complete the Retirement Contribution and Additional Withholding columns based on the information provided. The Additional Withholding column willrequire further updating in the next chapter. lding Tax columns of the employee earnings record (which you established during an should complete