Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ALL INFORMATION IS PROVIDE IN THE QUESTION. THANK YOU FOR YOUR TIME. Q4. A Q5. A Q7. B. Please use the problem statement data here

ALL INFORMATION IS PROVIDE IN THE QUESTION. THANK YOU FOR YOUR TIME.

Q4. A

Q5. A

Q7. B.

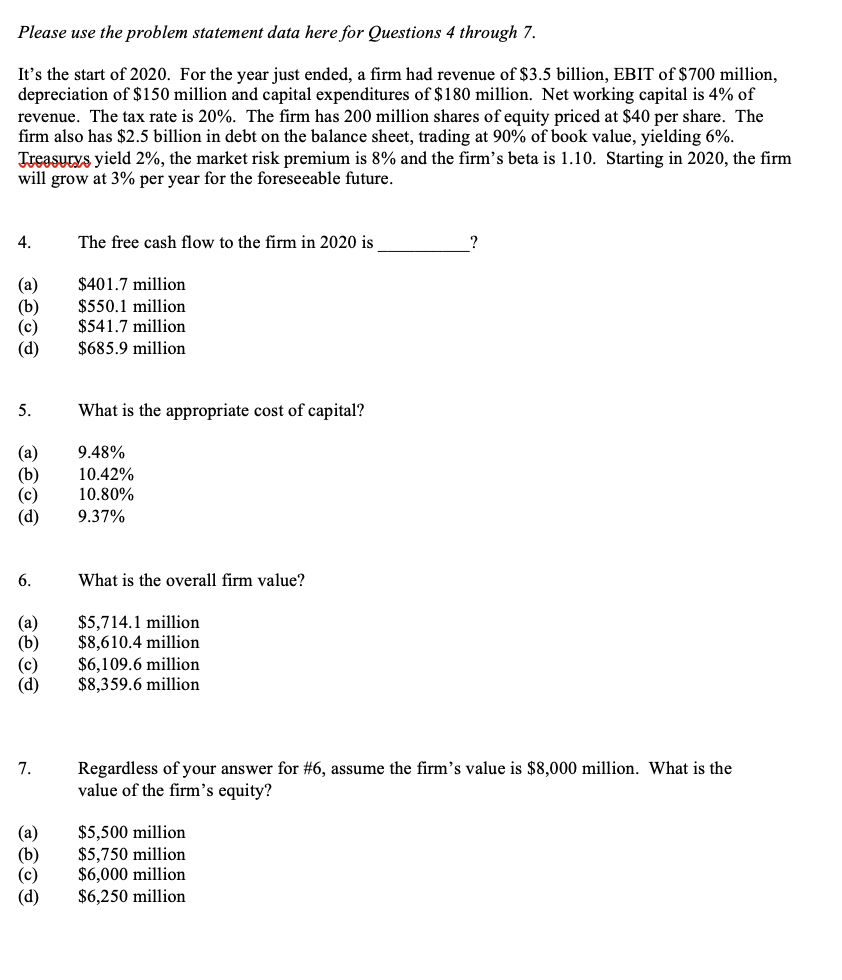

Please use the problem statement data here for Questions 4 through 7. It's the start of 2020. For the year just ended, a firm had revenue of $3.5 billion, EBIT of $700 million, depreciation of $150 million and capital expenditures of $180 million. Net working capital is 4% of revenue. The tax rate is 20%. The firm has 200 million shares of equity priced at $40 per share. The firm also has $2.5 billion in debt on the balance sheet, trading at 90% of book value, yielding 6%. Treasurys yield 2%, the market risk premium is 8% and the firm's beta is 1.10. Starting in 2020, the firm will grow at 3% per year for the foreseeable future. 4. The free cash flow to the firm in 2020 is (a) (b) (c) (d) $401.7 million $550.1 million $541.7 million $685.9 million 5. What is the appropriate cost of capital? (a) (b) (C) (d) 9.48% 10.42% 10.80% 9.37% 6. What is the overall firm value? (a) (b) (C) (d) $5,714.1 million $8,610.4 million $6,109.6 million $8,359.6 million 7. Regardless of your answer for #6, assume the firm's value is $8,000 million. What is the value of the firm's equity? (a) (b) (C) (d) $5,500 million $5,750 million $6,000 million $6,250 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started