Answered step by step

Verified Expert Solution

Question

1 Approved Answer

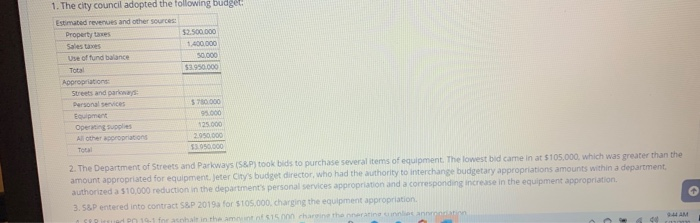

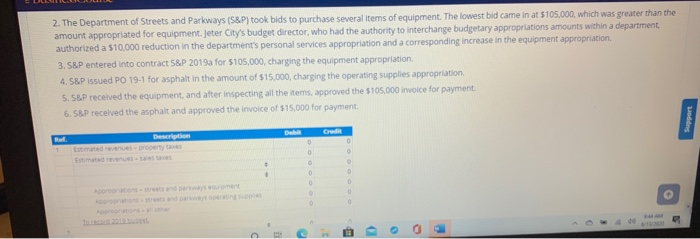

all information is there the general entries that can be used are the very last picture. 1. The city council adopted the following budget Estimated

all information is there the general entries that can be used are the very last picture.

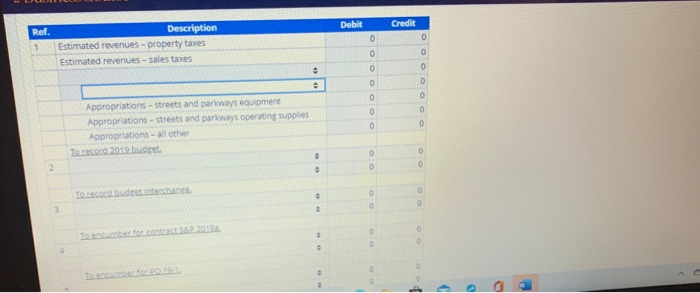

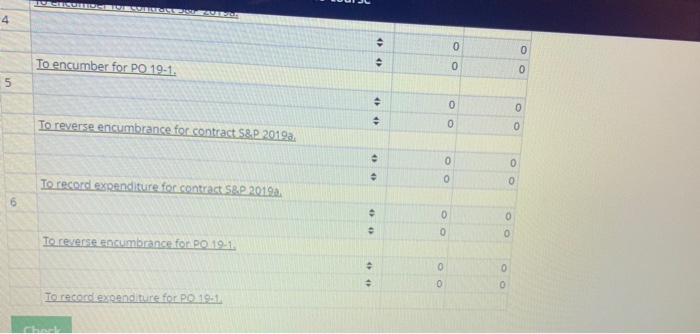

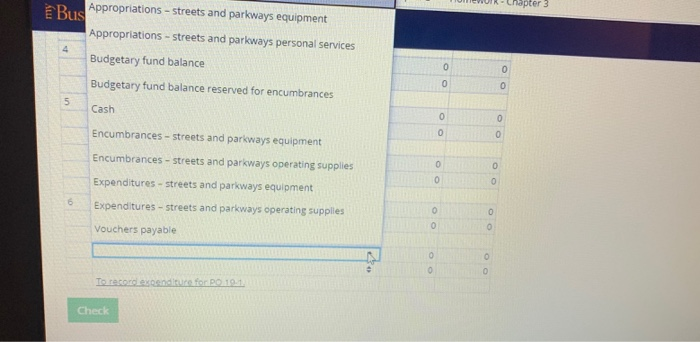

1. The city council adopted the following budget Estimated revenues and other sources: Property taxes $2.500.000 Sales taxes 1.500.000 Use of fund balance 50.000 Total $3.950.000 Appropriation Streets and para Personal services 5760000 Equipment 95.000 Operating Supplies 125.000 All other appropriations 2.050.000 Total 53.050.000 2. The Department of Streets and Parkways (S&P) took bids to purchase several items of equipment. The lowest bid came in at $105,000, which was greater than the amount appropriated for equipment. Jeter City's budget director, who had the authority to interchange budgetary appropriations amounts within a department, authorized a $10,000 reduction in the departments personal services appropriation and a corresponding increase in the equipment appropriation 3.58P entered into contract S&P 2019 for $10.000. charging the equipment appropriation 1.1 for that in the min 515 charitha nainen 944 AM 2. The Department of Streets and Parkways (58P) took bids to purchase several items of equipment. The lowest bid came in at $105.000, which was greater than the amount appropriated for equipment. Jeter City's budget director, who had the authority to interchange budgetary appropriations amounts within a department authorized a 510,000 reduction in the department's personal services appropriation and a corresponding increase in the equipment appropriation 3. SBP entered into contract S&P 2019a for 5105,000, charging the equipment appropriation 4.58P issued PO 19-1 for asphalt in the amount of $15.000, charging the operating supplies appropriation 5. S&P received the equipment, and after inspecting all the items, approved the $105.000 invoice for payment. 6. S&P received the asphalt and approved the invoice of $15,000 for payment pert Description B Cred 0 0 Debit Credit Ref. 0 0 1 Description Estimated revenues - property taxes Estimated revenues - sales taxes 0 0 O 0 0 0 0 0 0 0 0 0 Appropriations - Streets and parkways equipment Appropriations - streets and parkways operating supplies Appropriations - all other To record 20119 badet 0 O 0 2 0 To record budestante che 0 0 > 4 . 0 0 To encumber for PO 19-1. . 0 0 5 0 0 To reverse encumbrance for contract S&P 2019a. 0 0 0 0 0 To record expenditure for contract S.P. 2019a. 0 6 0 0 0 0 To reverse encumbrance for PO 19-1 0 0 To recondexpenditure for PO 19.11 ch ter 3 Bus Appropriations - streets and parkways equipment Appropriations - streets and parkways personal services Budgetary fund balance Budgetary fund balance reserved for encumbrances 0 0 0 0 5 Cash O 0 0 Encumbrances - streets and parkways equipment 0 Encumbrances - streets and parkways operating supplies 0 0 Expenditures - streets and parkways equipment 6 Expenditures - streets and parkways operating supplies 0 0 Vouchers payable 0 O 0 0 0 To reconhecendo 19.1 Check Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started