All information that was provided was given.

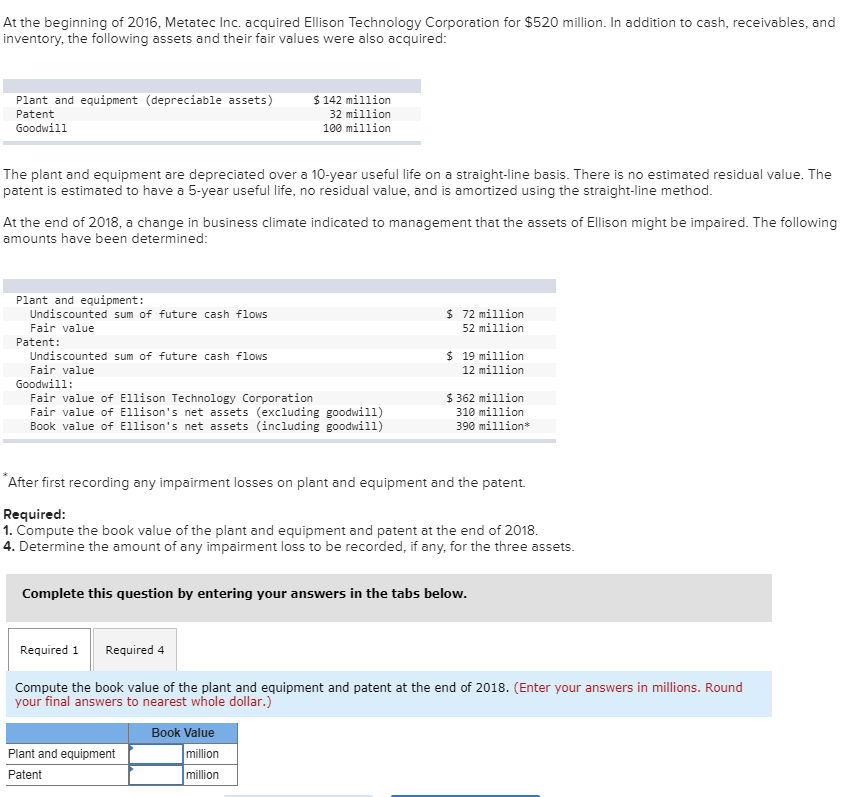

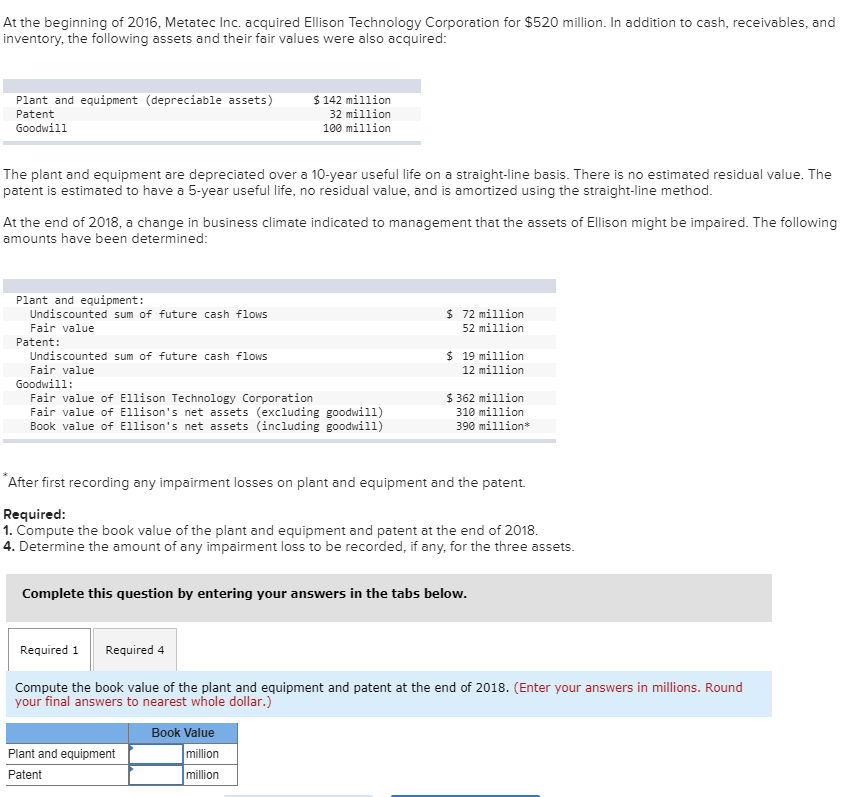

At the beginning of 2016, Metatec Inc. acquired Ellison Technology Corporation for $520 million. In addition to cash, receivables, and inventory, the following assets and their fair values were also acquired Plant and equipment (depreciable assets) Patent $142 million 32 million 100 million The plant and equipment are depreciated over a 10-year useful life on a straight-line basis. There is no estimated residual value. The patent is estimated to have a 5-year useful life, no residual value, and is amortized using the straight-line method At the end of 2018, a change in business climate indicated to management that the assets of Ellison might be impaired. The following amounts have been determined Plant and equipment: Undiscounted sum of future cash flows Fair value $ 72 million 2 million Patent: Undiscounted sum of future cash flows Fair value $ 19 million 12 million Goodwil1: Fair value of Ellison Technology Corporation Fair value of Ellison's net assets (excluding goodwill) Book value of Ellison's net assets (including goodwill) S 362 million 310 million 390 million* After first recording any impairment losses on plant and equipment and the patent. Required 1. Compute the book value of the plant and equipment and patent at the end of 2018. 4. Determine the amount of any impairment loss to be recorded, if any, for the three assets Complete this question by entering your answers in the tabs below Required 1 Required 4 Compute the book value of the plant and equipment and patent at the end of 2018. (Enter your answers in millions. Round your final answers to nearest whole dollar.) Book Value million million Plant and equipment Patent At the beginning of 2016, Metatec Inc. acquired Ellison Technology Corporation for $520 million. In addition to cash, receivables, and inventory, the following assets and their fair values were also acquired Plant and equipment (depreciable assets) Patent $142 million 32 million 100 million The plant and equipment are depreciated over a 10-year useful life on a straight-line basis. There is no estimated residual value. The patent is estimated to have a 5-year useful life, no residual value, and is amortized using the straight-line method At the end of 2018, a change in business climate indicated to management that the assets of Ellison might be impaired. The following amounts have been determined Plant and equipment: Undiscounted sum of future cash flows Fair value $ 72 million 2 million Patent: Undiscounted sum of future cash flows Fair value $ 19 million 12 million Goodwil1: Fair value of Ellison Technology Corporation Fair value of Ellison's net assets (excluding goodwill) Book value of Ellison's net assets (including goodwill) S 362 million 310 million 390 million* After first recording any impairment losses on plant and equipment and the patent. Required 1. Compute the book value of the plant and equipment and patent at the end of 2018. 4. Determine the amount of any impairment loss to be recorded, if any, for the three assets Complete this question by entering your answers in the tabs below Required 1 Required 4 Compute the book value of the plant and equipment and patent at the end of 2018. (Enter your answers in millions. Round your final answers to nearest whole dollar.) Book Value million million Plant and equipment Patent