Answered step by step

Verified Expert Solution

Question

1 Approved Answer

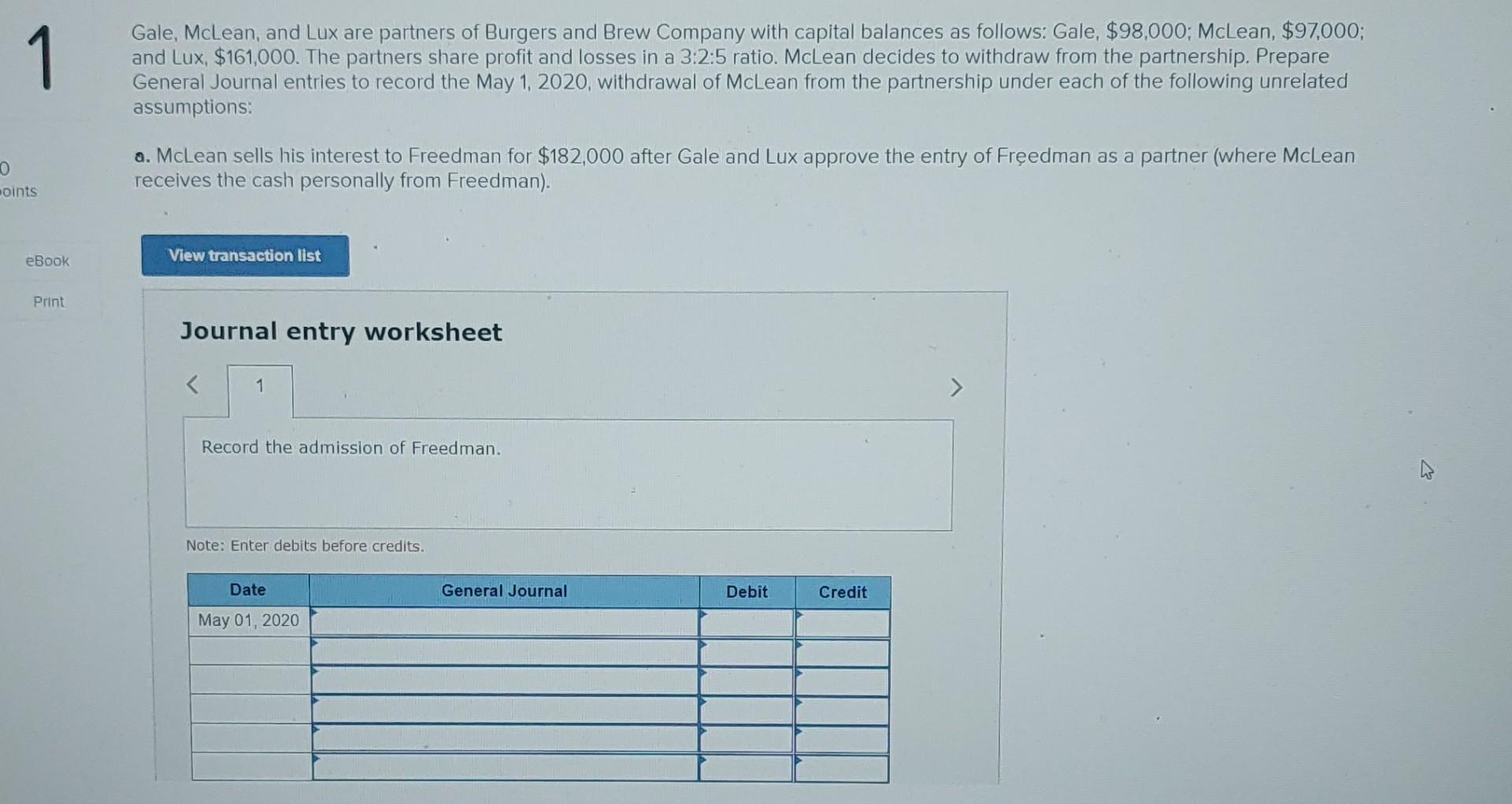

All is one question 1 Gale, McLean, and Lux are partners of Burgers and Brew Company with capital balances as follows: Gale, $98,000; McLean, $97,000;

All is one question

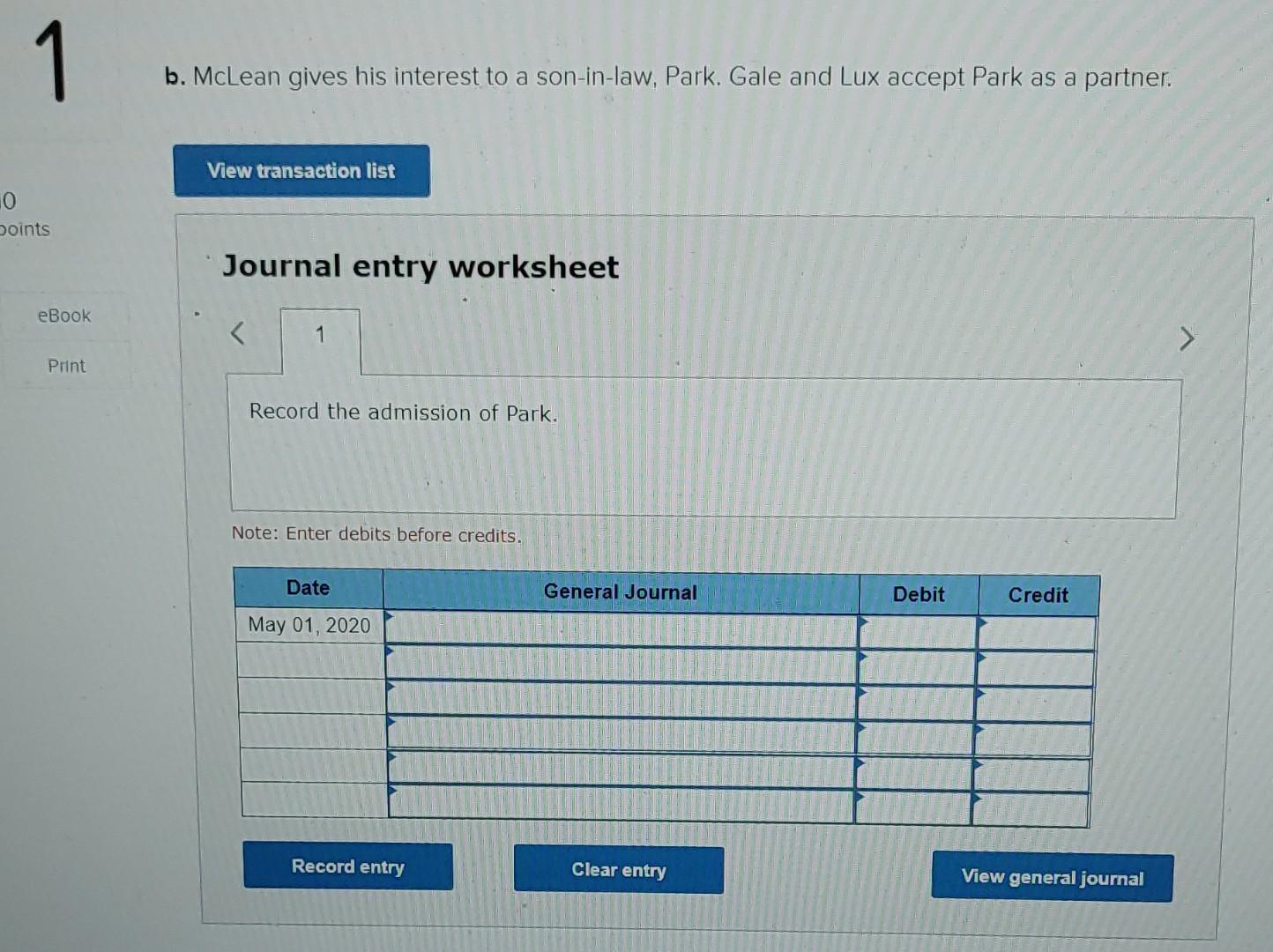

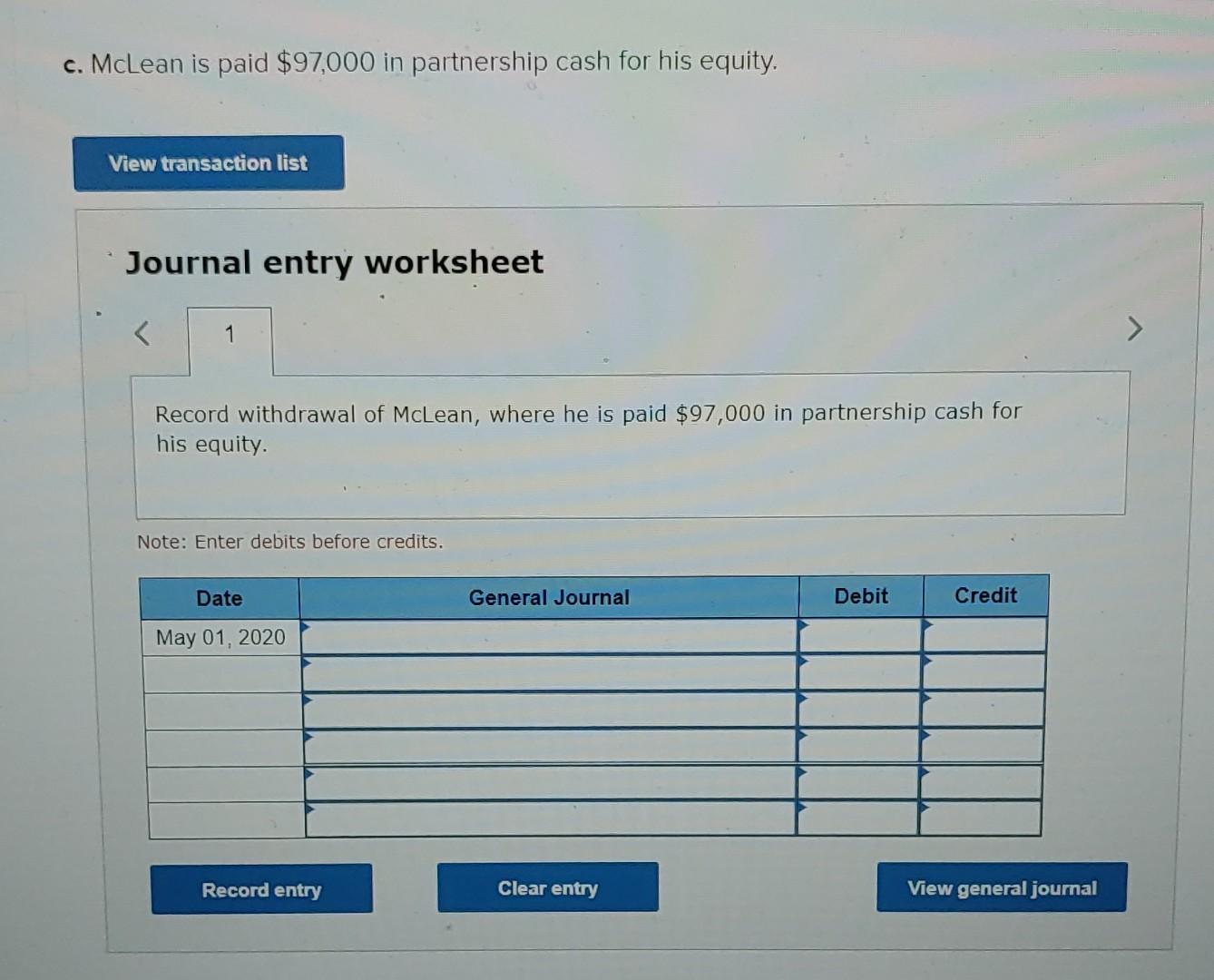

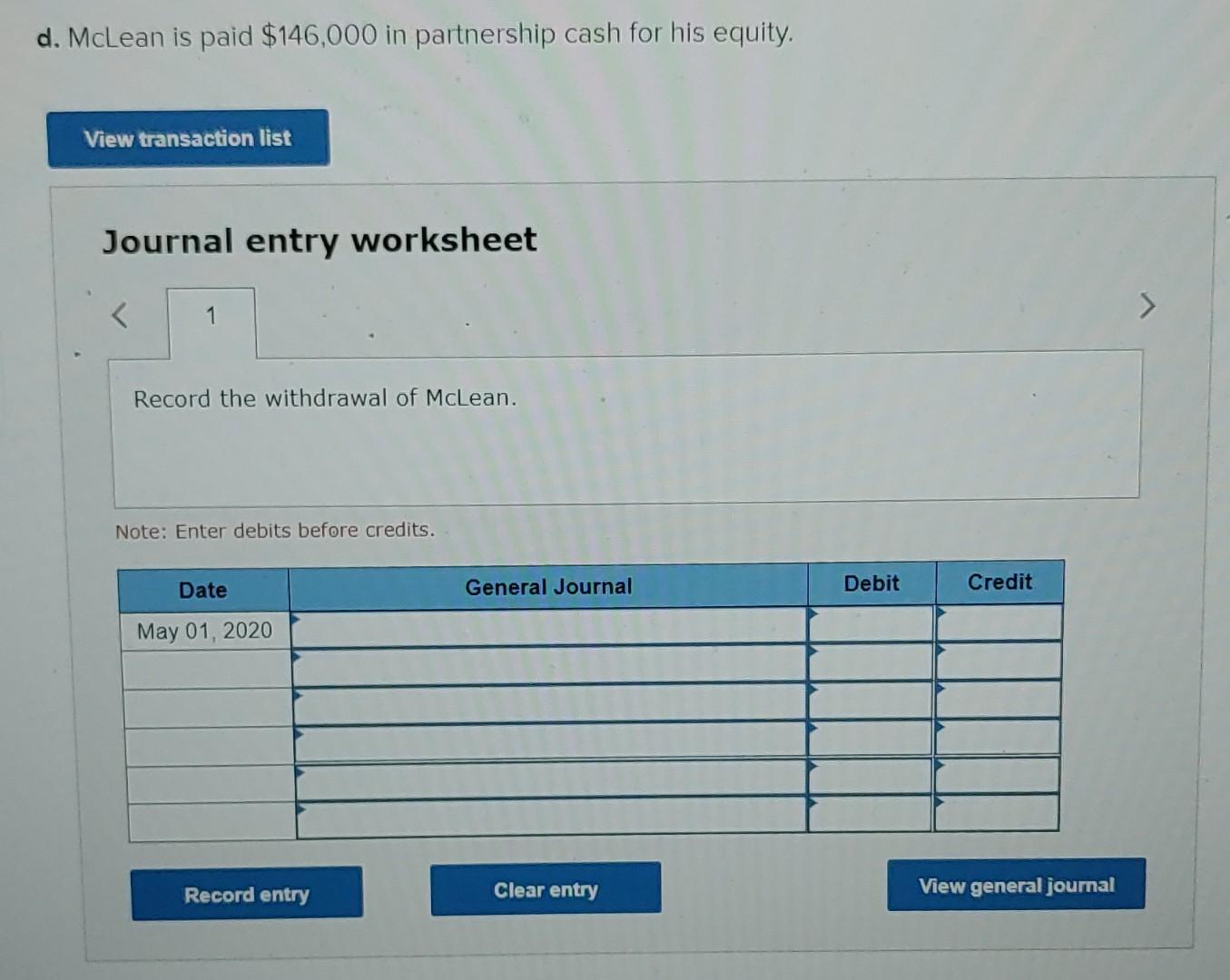

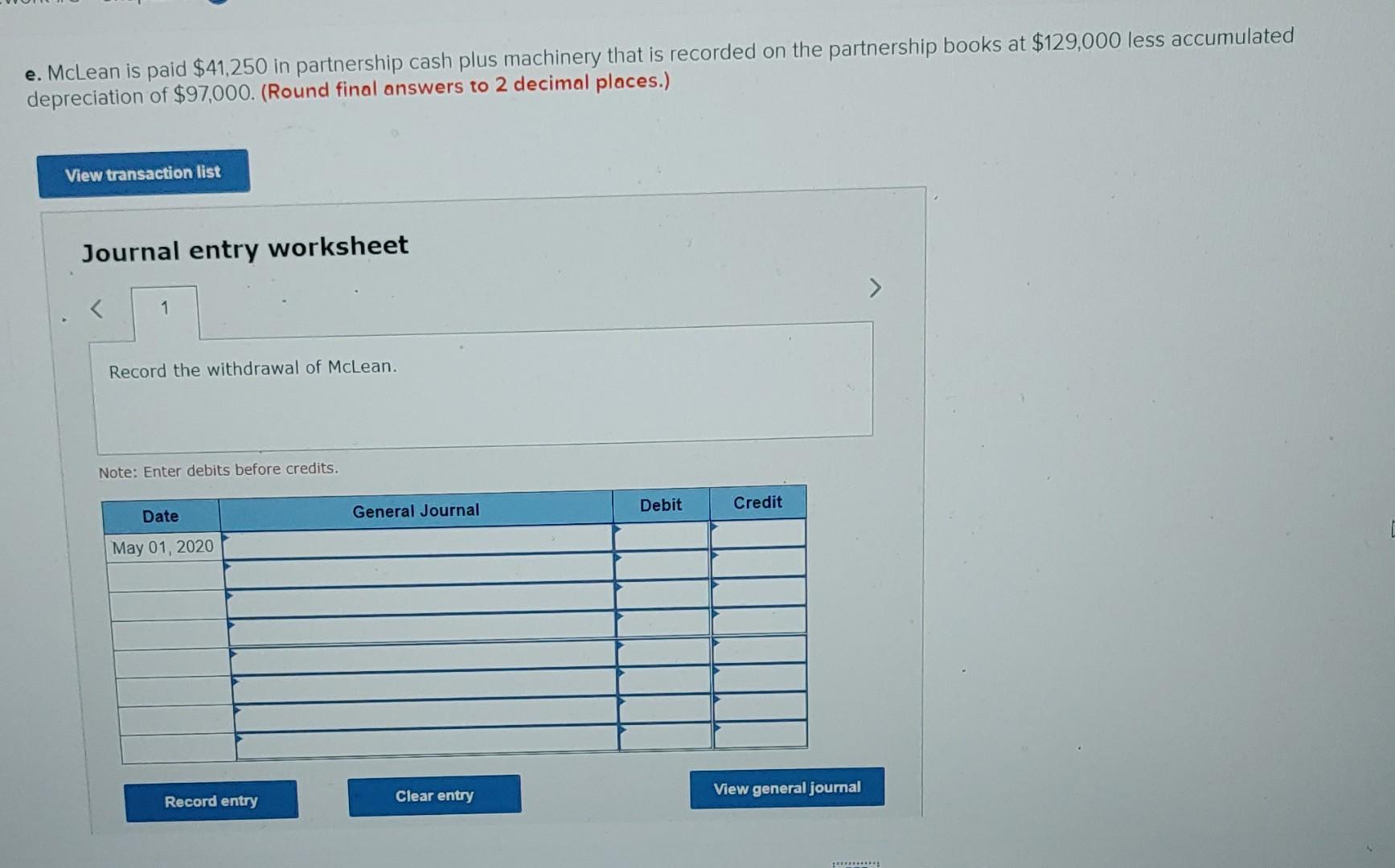

1 Gale, McLean, and Lux are partners of Burgers and Brew Company with capital balances as follows: Gale, $98,000; McLean, $97,000; and Lux, $161,000. The partners share profit and losses in a 3.2:5 ratio. McLean decides to withdraw from the partnership. Prepare General Journal entries to record the May 1, 2020, withdrawal of McLean from the partnership under each of the following unrelated assumptions: 0 Points a. McLean sells his interest to Freedman for $182,000 after Gale and Lux approve the entry of Freedman as a partner (where McLean receives the cash personally from Freedman). eBook View transaction list Print Journal entry worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started