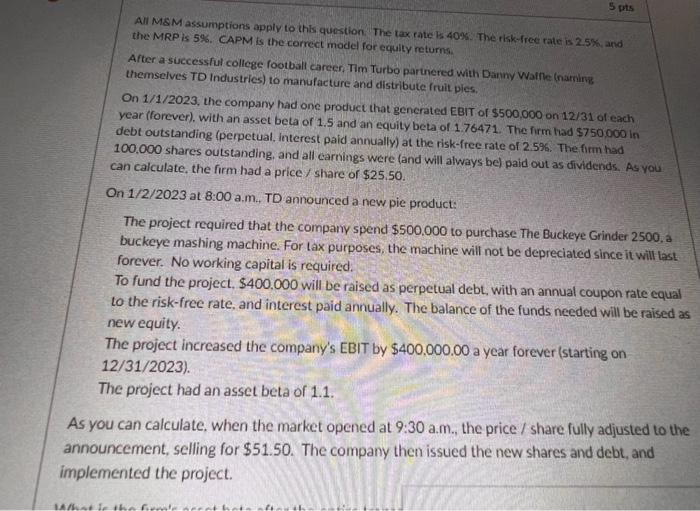

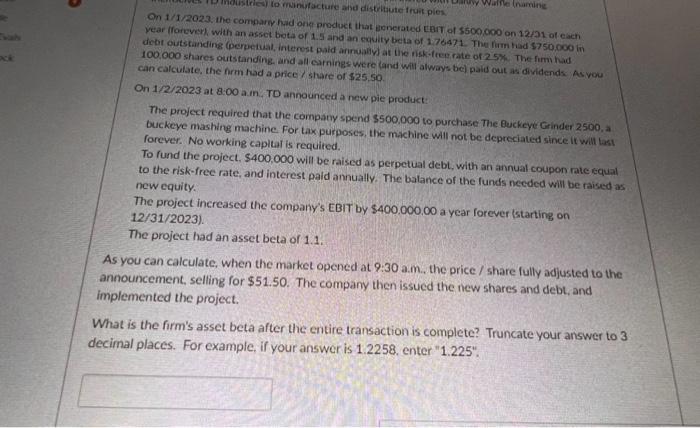

All MEM assumptions apply to this question. The tax tate is 40%. The risk-free rate is 2.5% and the MRP is 5\%. CAPM is the correct model for equily returns. After a successful college football careen Tim Turbo parunered With Danny Waifle (naminge themselves TD industries) to manufacture and distribute fruit ples. On 1/1/2023, the company had one product that gencrated EBIT of $500,000 on 12/31 of each year (forever), with an asset beta of 1.5 and an equity beta of 176471 . The firm had $750,000 in debt outstanding (perpetual, interest paid annually) at the risk-free rate of 2.5%. The firm had 100,000 shares outstanding, and all carnings were (and will always be) paid out as dividends. As you can calculate, the firm had a price / share of $25.50. On 1/2/2023 at 8:00 a.m. TD announced a new pie product: The project required that the company spend $500,000 to purchase The Buckeye Grinder 2500 . a buckeye mashing machine. For tax purposes, the machine will not be depreciated since it will last forever. No working capital is required. To fund the project, $400,000 will be raised as perpetual debt, with an annual coupon rate equal to the risk-free rate, and interest paid annually. The balance of the funds needed will be raised as new equity. The project increased the company's EBIT by $400,000.00 a year forever (starting on 12/31/2023) The project had an asset beta of 1.1 . you can calculate, when the market opened at 9:30 a.m., the price/ share fully adjusted to the ouncement, selling for $51.50. The company then issued the new shares and debt, and emented the project. On 1/1/2023, the compary had onk product ihat gonerated cart of 5500000 on 12 21 of each year (foreveri, with an assei bota of 1.5 and an cquity beta of 176471. The firm had 5750,000mn debt outstanding (perpetuat, interest paid annualiyl at the risk-teeerate of 25%. The fim had 100,000 shares outstanding, and all camings were (and will always be) paid out as dividends As vou can calculate, the frrm had a price / share of $25,50. On 1/2/2023 at 8.00 a.m. TD announced a new pie product: The project required that the company spend $500,000 to purchase The Buckeye Grinder 2500, a buckeye mashing machine for tax purposes, the machine will not be depreciated since it will tast forever. No working capital is required. To fund the project, $400,000 will be raised as perpetual debt, with an annual coupon rate requal to the risk-free rate, and interest paid annually. The balance of the funds needed will be raised as new equity. The project increased the company's EBIT by $400,000.00 a year forever (starting on 12/31/2023). The project had an asset beta of 1.1 . you can calculate, when the market opened at 9:30 a.m. the price / share fully adjusted to the nouncement, selling for $51.50. The company then issued the new shares and debt, and lemented the project. is the firm's asset beta after the entire transaction is complete? Truncate your answer to 3 nal places. For example, if your answer is 1:2258. enter "1.225". All MEM assumptions apply to this question. The tax tate is 40%. The risk-free rate is 2.5% and the MRP is 5\%. CAPM is the correct model for equily returns. After a successful college football careen Tim Turbo parunered With Danny Waifle (naminge themselves TD industries) to manufacture and distribute fruit ples. On 1/1/2023, the company had one product that gencrated EBIT of $500,000 on 12/31 of each year (forever), with an asset beta of 1.5 and an equity beta of 176471 . The firm had $750,000 in debt outstanding (perpetual, interest paid annually) at the risk-free rate of 2.5%. The firm had 100,000 shares outstanding, and all carnings were (and will always be) paid out as dividends. As you can calculate, the firm had a price / share of $25.50. On 1/2/2023 at 8:00 a.m. TD announced a new pie product: The project required that the company spend $500,000 to purchase The Buckeye Grinder 2500 . a buckeye mashing machine. For tax purposes, the machine will not be depreciated since it will last forever. No working capital is required. To fund the project, $400,000 will be raised as perpetual debt, with an annual coupon rate equal to the risk-free rate, and interest paid annually. The balance of the funds needed will be raised as new equity. The project increased the company's EBIT by $400,000.00 a year forever (starting on 12/31/2023) The project had an asset beta of 1.1 . you can calculate, when the market opened at 9:30 a.m., the price/ share fully adjusted to the ouncement, selling for $51.50. The company then issued the new shares and debt, and emented the project. On 1/1/2023, the compary had onk product ihat gonerated cart of 5500000 on 12 21 of each year (foreveri, with an assei bota of 1.5 and an cquity beta of 176471. The firm had 5750,000mn debt outstanding (perpetuat, interest paid annualiyl at the risk-teeerate of 25%. The fim had 100,000 shares outstanding, and all camings were (and will always be) paid out as dividends As vou can calculate, the frrm had a price / share of $25,50. On 1/2/2023 at 8.00 a.m. TD announced a new pie product: The project required that the company spend $500,000 to purchase The Buckeye Grinder 2500, a buckeye mashing machine for tax purposes, the machine will not be depreciated since it will tast forever. No working capital is required. To fund the project, $400,000 will be raised as perpetual debt, with an annual coupon rate requal to the risk-free rate, and interest paid annually. The balance of the funds needed will be raised as new equity. The project increased the company's EBIT by $400,000.00 a year forever (starting on 12/31/2023). The project had an asset beta of 1.1 . you can calculate, when the market opened at 9:30 a.m. the price / share fully adjusted to the nouncement, selling for $51.50. The company then issued the new shares and debt, and lemented the project. is the firm's asset beta after the entire transaction is complete? Truncate your answer to 3 nal places. For example, if your answer is 1:2258. enter "1.225