Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All my answers are correct. A. My current financial NEEDS I require the following income to support my current lifestyle. Do not include what others

All my answers are correct.

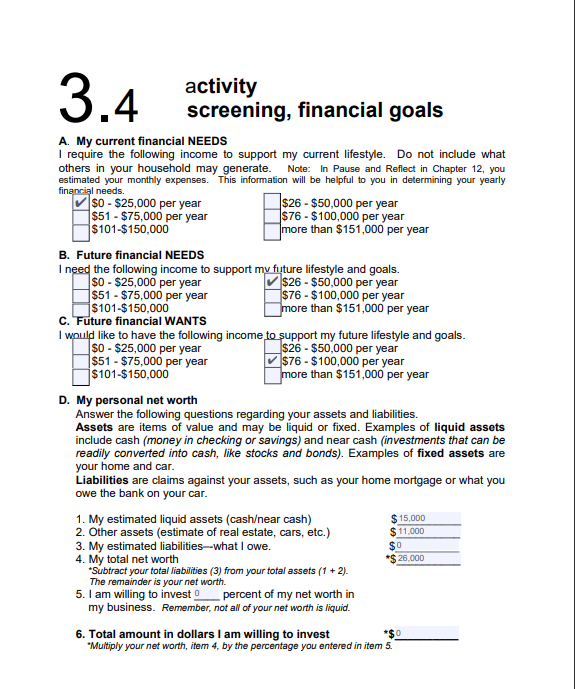

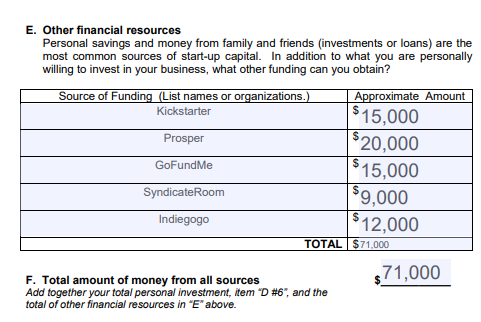

A. My current financial NEEDS I require the following income to support my current lifestyle. Do not include what others in your household may generate. Note: In Pause and Reflect in Chapter 12, you estimated your monthly expenses. This information will be helpful to you in determining your yearly financial needs. \begin{tabular}{|l|l} $0$25,000 per year \\ $51$75,000 per year \\ $101$150,000 \end{tabular}$26$50,000peryear$76$100,000peryearmorethan$151,000peryear B. Future financial NEEDS I need the following income to support mu future lifestyle and goals. C. Future financial WANTS I would like to have the following income to support my future lifestyle and goals. D. My personal net worth Answer the following questions regarding your assets and liabilities. Assets are items of value and may be liquid or fixed. Examples of liquid assets include cash (money in checking or savings) and near cash (investments that can be readily converted into cash, like stocks and bonds). Examples of fixed assets are your home and car. Liabilities are claims against your assets, such as your home mortgage or what you owe the bank on your car. 1. My estimated liquid assets (cashear cash) 2. Other assets (estimate of real estate, cars, etc.) 3. My estimated liabilities-what I owe. 4. My total net worth "Subtract your total liabiitites (3) from your total assets (1+2). The remainder is your net worth. 5. I am willing to invest 0 percent of my net worth in my business. Remember, not all of your net worth is liquid. 6. Total amount in dollars I am willing to invest $0 "Muliply your net worth, item 4 , by the percentage you entered in item 5. E. Other financial resources Personal savings and money from family and friends (investments or loans) are the most common sources of start-up capital. In addition to what you are personally willing to invest in your business, what other funding can you obtain? F. Total amount of money from all sources Add together your total personal investment, item " D6", and the total of other financial resources in "E" above. A. My current financial NEEDS I require the following income to support my current lifestyle. Do not include what others in your household may generate. Note: In Pause and Reflect in Chapter 12, you estimated your monthly expenses. This information will be helpful to you in determining your yearly financial needs. \begin{tabular}{|l|l} $0$25,000 per year \\ $51$75,000 per year \\ $101$150,000 \end{tabular}$26$50,000peryear$76$100,000peryearmorethan$151,000peryear B. Future financial NEEDS I need the following income to support mu future lifestyle and goals. C. Future financial WANTS I would like to have the following income to support my future lifestyle and goals. D. My personal net worth Answer the following questions regarding your assets and liabilities. Assets are items of value and may be liquid or fixed. Examples of liquid assets include cash (money in checking or savings) and near cash (investments that can be readily converted into cash, like stocks and bonds). Examples of fixed assets are your home and car. Liabilities are claims against your assets, such as your home mortgage or what you owe the bank on your car. 1. My estimated liquid assets (cashear cash) 2. Other assets (estimate of real estate, cars, etc.) 3. My estimated liabilities-what I owe. 4. My total net worth "Subtract your total liabiitites (3) from your total assets (1+2). The remainder is your net worth. 5. I am willing to invest 0 percent of my net worth in my business. Remember, not all of your net worth is liquid. 6. Total amount in dollars I am willing to invest $0 "Muliply your net worth, item 4 , by the percentage you entered in item 5. E. Other financial resources Personal savings and money from family and friends (investments or loans) are the most common sources of start-up capital. In addition to what you are personally willing to invest in your business, what other funding can you obtain? F. Total amount of money from all sources Add together your total personal investment, item " D6", and the total of other financial resources in "E" aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started