All needed information is given in the problem. That is all. Thank you.

All needed information is given in the problem. That is all. Thank you.

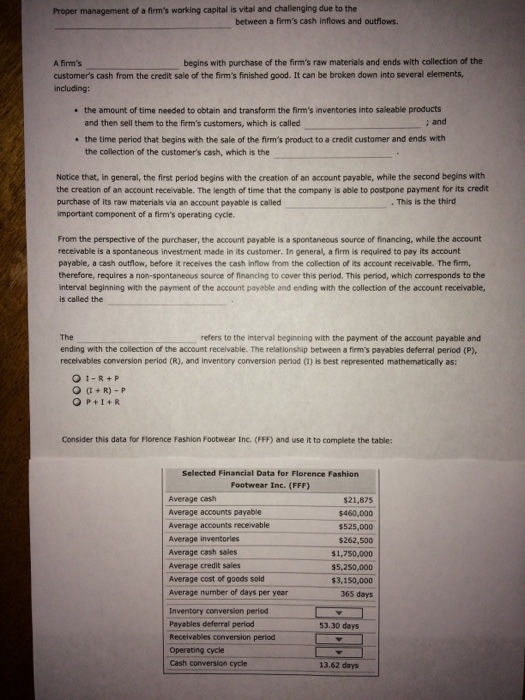

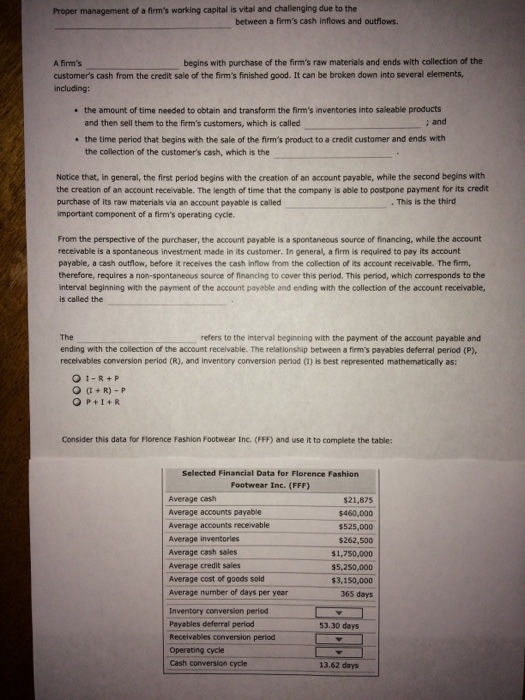

Proper management of a firm's working capital is vital and challenging due to the between a firm's cash inflows and outflows. A firm's begins with purchase of the firm's raw materials and ends with collection of the customer's cash from the credit sale of the frm's finished good. It can be broken down into several elements, including: the amount of time needed to obtain and transform the firm's inventories into saleable products and then sell them to the firm's customers, which is called the time period that begins with the sale of the firm's product to a credit customer and ends with the collection of the customer's cash, which is the : and Notice that, in general, the first period begins with the creation of an account payable, while the second begins with the creation of an account receivable. The length of time that the company is able to postpone payment for its credit purchase of its raw materials via an account payable is called important component of a firm's operating cycle. . This is the third From the perspective of the purchaser, the account payable is a spontaneous source of financing, while the account receivable is a spontaneous investment made in its customer. In general, a firm is required to pay its account payable, a cash outflow, before it receives the cash inflow from the collection of its account receivable. The firm, therefore, requires a non-spontaneous source of financing to cover this period. This period, which corresponds to the interval beginning with the payment of the account payeble and ending with the collection of the account receivable, is called the The ending with the collection of the account receivable. The relationship between a firm's payables deferral period (P). recelvables conversion period (R), and inventory conversion period (1) is best represented mathematically as: refers to the interval beginning with the payment of the account payable and OP+I+R Consider this data for Florence Fashion Footwear Inc. (FFF) and use it to complete the table: Selected Financial Data for Florence Fashion Footwear Inc. (FFF) Average cash Average accounts payable Average accounts receivable Average inventories Average cash sales Average credit sales Average cost of goods sold Average number of days per year $21,875 $460,000 $525,000 $262,500 $1,750,000 $5,250,000 $3,150,000 365 days Inventory conversion period Payables deferral period Receivables conversion period Operating cycle Cash conversion cycle 53.30 days 13.62 day

All needed information is given in the problem. That is all. Thank you.

All needed information is given in the problem. That is all. Thank you.