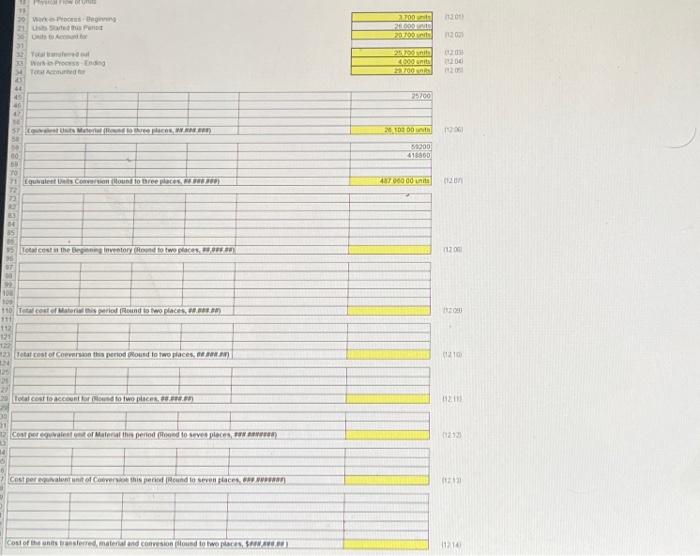

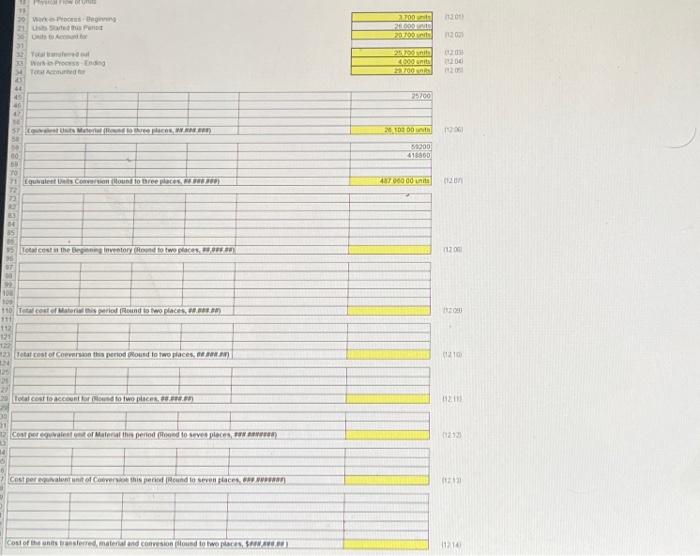

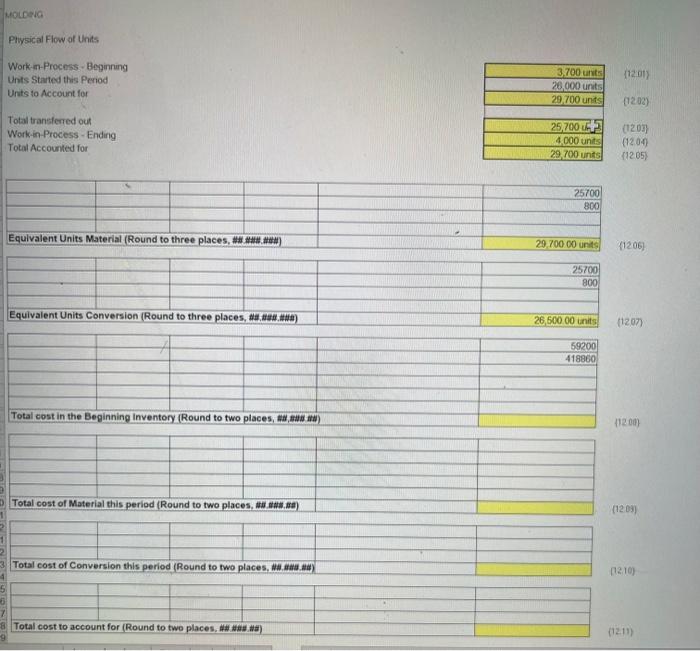

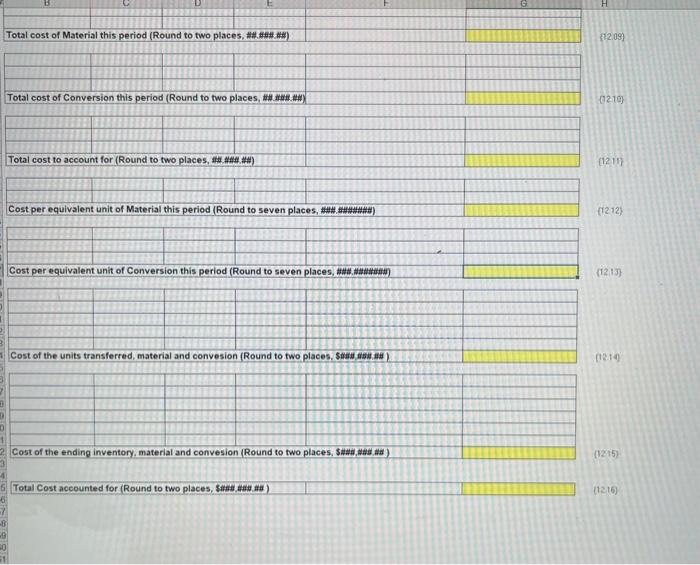

all of my numbers are incorrect besides 12.01 and 12.04. Please help!!!

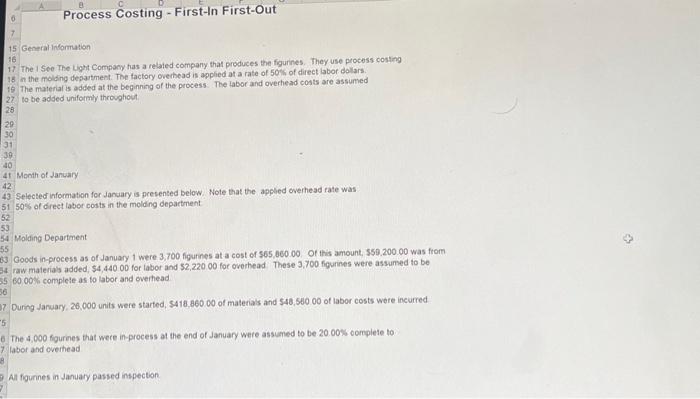

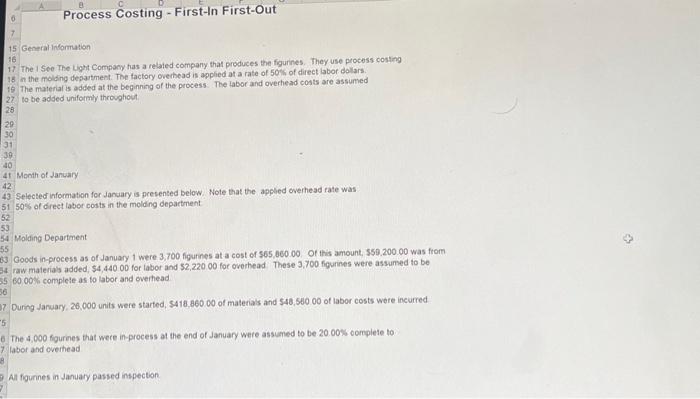

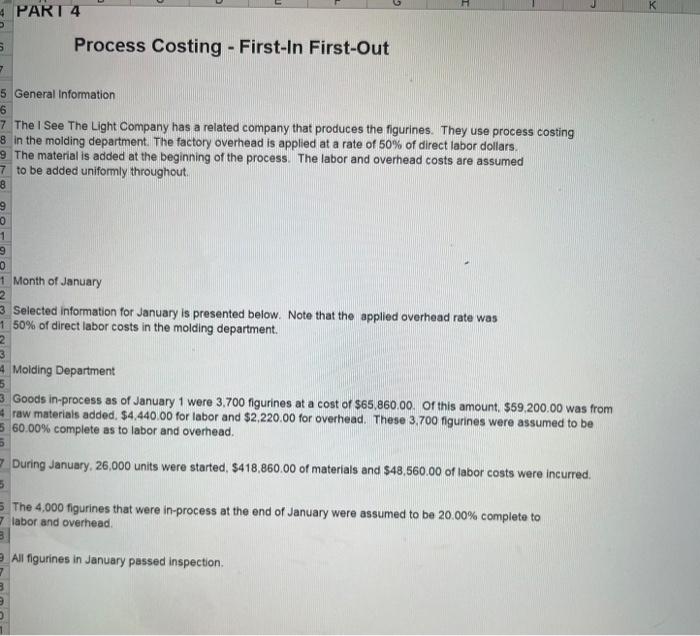

15 General information 16 The 1 See The Light Compony tas a related company that produces the figurines. They use process costing 17 The 1 See. The light Compony thas a resued company that produces the figurines. They use proces as an the molding department. The factory overhead is applied at a rate of 50 of of direct labor dollars. if The materiaf is added at the beginning of the process. The Jabor and overhead costs are assumed 27. io be added uniformly throughout. Menth of danuary 2. Selected informatien for January is presented below. Note that the appled overhead rate was 150 of dreet labor costs in the molding department Molding Department Goods in-process as of January 1 were 3,700 figurnes at a cost of 565,000.00 Of this amount, 559,200.00 was from raw materials added; 54,440.00 for labor and $2,22000 for overhead These 3,700 figurines were assumed to be 6000% compleie as to labor and oveitead During January, 26,000 units were started, $418,86000 of materials and $48,500,00 of labor costs were incurred The 4,000 figurnes that were in-process at the end of January were assumed to be.20.00\% 0 omplete to: labor and ovelhead All fournes in January passed impecton General information The I See The Light Company has a related company that produces the figurines. They use process costing in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. The material is added at the beginning of the process. The labor and overhead costs are assumed to be added uniformly throughout. Month of January Selected information for January is presented below. Note that the applied overhead rate was 50% of direct labor costs in the molding department. Molding Department Goods in-process as of January 1 were 3,700 figurines at a cost of $65,860.00. Of this amount, $59,200.00 was from raw materiais added, $4,440.00 for labor and $2,220.00 for overhead. These 3,700 figurines were assumed to be 60.00% complete as to labor and overhead. During January, 26,000 units were started, $418,860.00 of materials and $48,560.00 of labor costs were incurred. The 4.000 figurines that were in-process at the end of January were assumed to be 20.00% complete to labor and overhead. All figurines in January passed inspection. (12 00) (1209) [1210] Total cost of Material this period (Round to two places, N And (1209) \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & \\ \hline Total cost of Conversion this period (Round to two places, \#\# infir. \#ill) & \\ \hline \end{tabular} [210 (1211) \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & \\ \hline Cost per equivalent unit of Material this period (Round to seven places, \\ \hline \end{tabular} (12,12) (12,13} (12.14) \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Cost of the ending inventory, material and convesion (Round to two places, s \\ \hline \end{tabular} (1215) Total Cost accounted for (Round to two places, 3mad, (1216)