Answered step by step

Verified Expert Solution

Question

1 Approved Answer

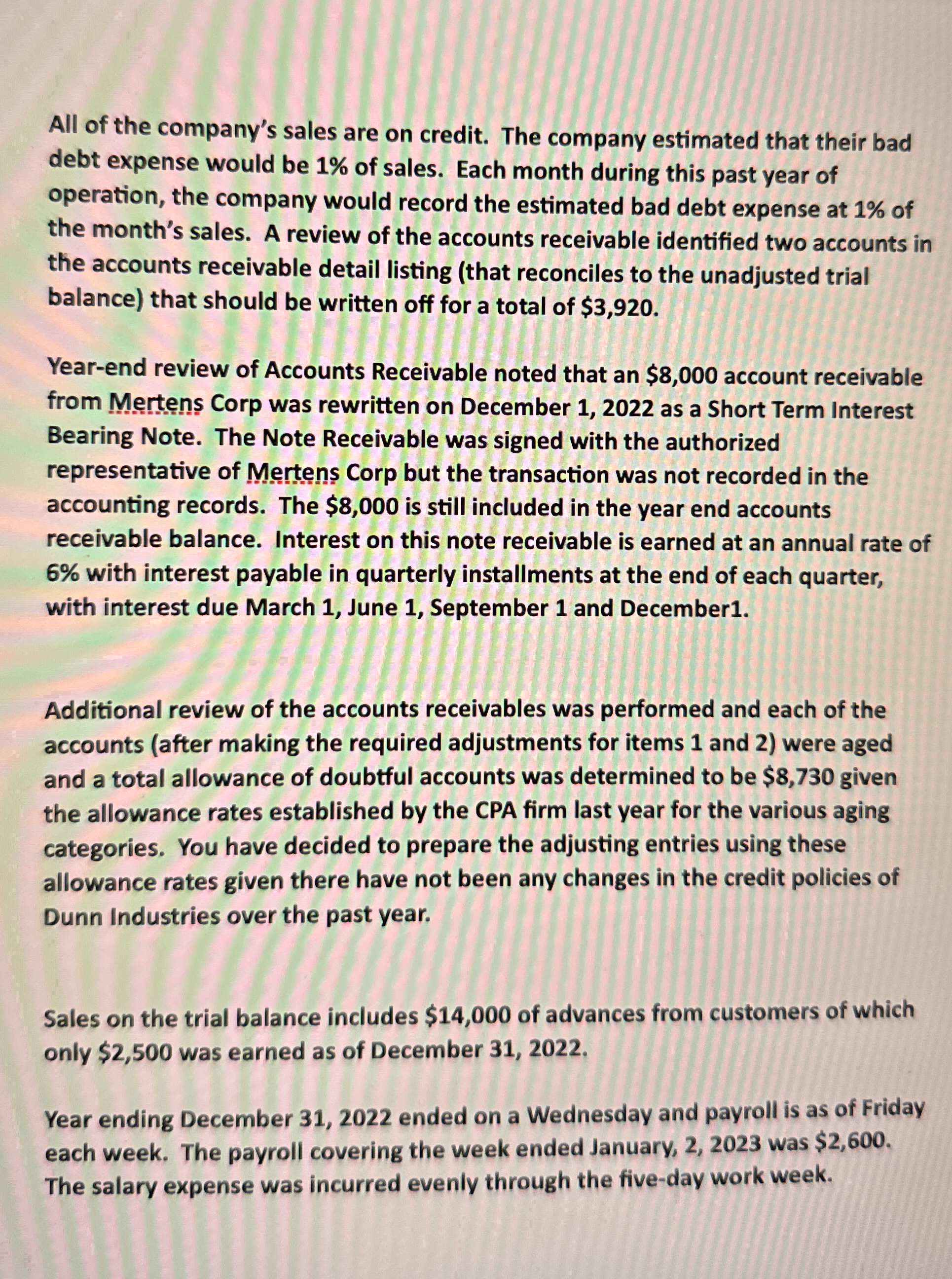

All of the company's sales are on credit. The company estimated that their bad debt expense would be 1 % of sales. Each month during

All of the company's sales are on credit. The company estimated that their bad

debt expense would be of sales. Each month during this past year of

operation, the company would record the estimated bad debt expense at of

the month's sales. A review of the accounts receivable identified two accounts in

the accounts receivable detail listing that reconciles to the unadjusted trial

balance that should be written off for a total of $

Yearend review of Accounts Receivable noted that an $ account receivable

from Mertens Corp was rewritten on December as a Short Term Interest

Bearing Note. The Note Receivable was signed with the authorized

representative of Mertens Corp but the transaction was not recorded in the

accounting records. The $ is still included in the year end accounts

receivable balance. Interest on this note receivable is earned at an annual rate of

with interest payable in quarterly installments at the end of each quarter,

with interest due March June September and December

Additional review of the accounts receivables was performed and each of the

accounts after making the required adjustments for items and were aged

and a total allowance of doubtful accounts was determined to be $ given

the allowance rates established by the CPA firm last year for the various aging

categories. You have decided to prepare the adjusting entries using these

allowance rates given there have not been any changes in the credit policies of

Dunn Industries over the past year.

Sales on the trial balance includes $ of advances from customers of which

only $ was earned as of December

Year ending December ended on a Wednesday and payroll is as of Friday

each week. The payroll covering the week ended January, was $

The salary expense was incurred evenly through the fiveday work week.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started