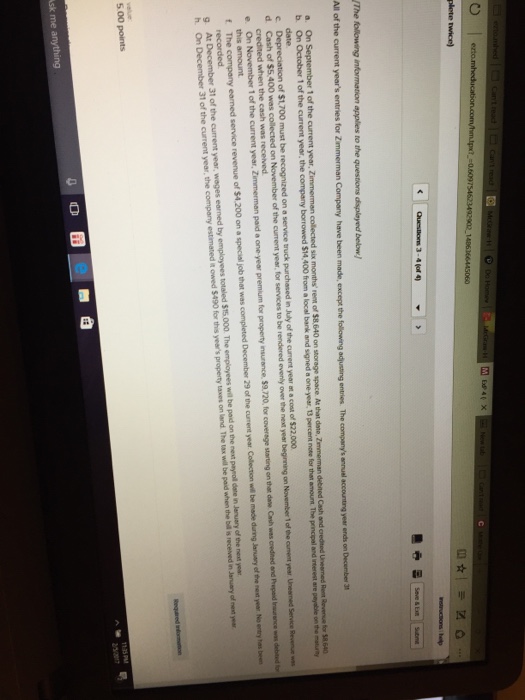

All of the current year's entries for Zimmerman Company have been made, except the following adjusting entries. The company's annual accounting year ends on December 3 a. On September 1 of the current year, Zimmerman collected six months rent of $8.640 on storage space. At the date, Zimmerman debited Cash and Credited Unearned Rent Reverse for $8, 640 b. On October 1 of the current year, the company borrowed $14, 400 from a local bank and signed a one-year. 13 percent note for that amount. The principal and interest are payable on the maturity date. c. Depreciation of $1, 700 must be recognized on a service truck purchased in July of the current year at a cost of $22,000. d. Cash of $5, 400 was collected on November of the current year, for services to be rendered evenly over the next year beginning on November 1 of the current year. Unearned Service Revenue was credited when the cash was received. e. On November 1 of the current year. Zimmerman paid a one-year for property insurance $9, 720, for coverage starting on that data. Cash was credited and Prepaid Insurance with debited the this amount. f. The company earned service of $4, 200 on a special job that was completed December 29 of the current year, Colection will be made during January will be made during January of the next year. No entry has been recorded. g. At December 31 of the current year, wages earned by employees totaled $15,000. The employees will be paid on the next payroll date in January of the next year. h. On December 31 of the current year, the company estimated it owned $490 for this year's property taxes on land. The tax will be paid when the bill is received in January of next year. All of the current year's entries for Zimmerman Company have been made, except the following adjusting entries. The company's annual accounting year ends on December 3 a. On September 1 of the current year, Zimmerman collected six months rent of $8.640 on storage space. At the date, Zimmerman debited Cash and Credited Unearned Rent Reverse for $8, 640 b. On October 1 of the current year, the company borrowed $14, 400 from a local bank and signed a one-year. 13 percent note for that amount. The principal and interest are payable on the maturity date. c. Depreciation of $1, 700 must be recognized on a service truck purchased in July of the current year at a cost of $22,000. d. Cash of $5, 400 was collected on November of the current year, for services to be rendered evenly over the next year beginning on November 1 of the current year. Unearned Service Revenue was credited when the cash was received. e. On November 1 of the current year. Zimmerman paid a one-year for property insurance $9, 720, for coverage starting on that data. Cash was credited and Prepaid Insurance with debited the this amount. f. The company earned service of $4, 200 on a special job that was completed December 29 of the current year, Colection will be made during January will be made during January of the next year. No entry has been recorded. g. At December 31 of the current year, wages earned by employees totaled $15,000. The employees will be paid on the next payroll date in January of the next year. h. On December 31 of the current year, the company estimated it owned $490 for this year's property taxes on land. The tax will be paid when the bill is received in January of next year