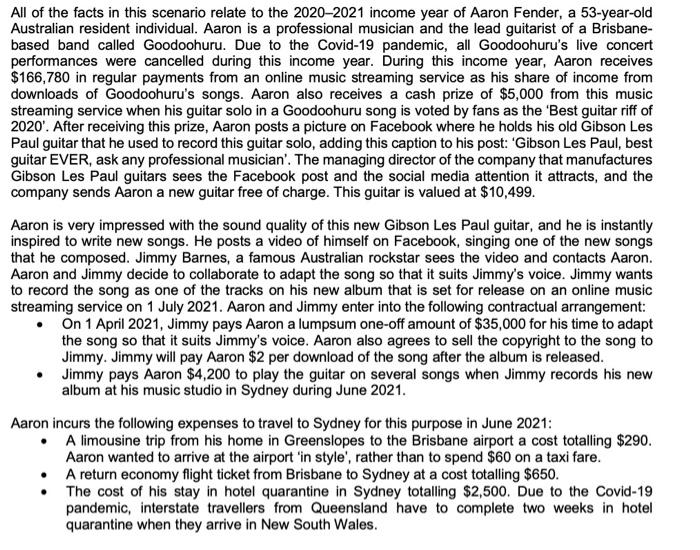

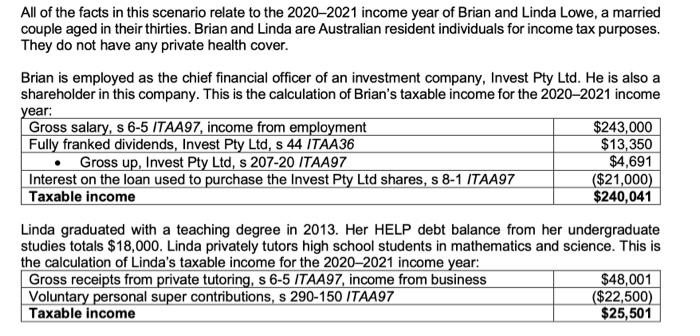

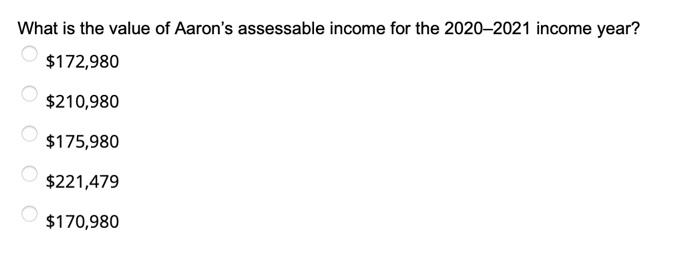

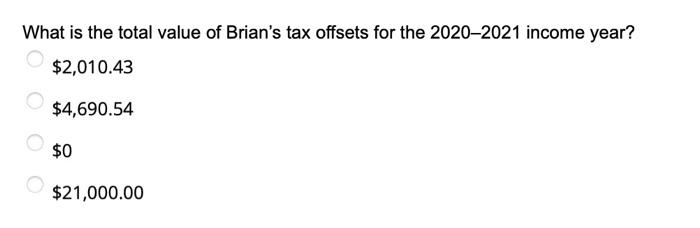

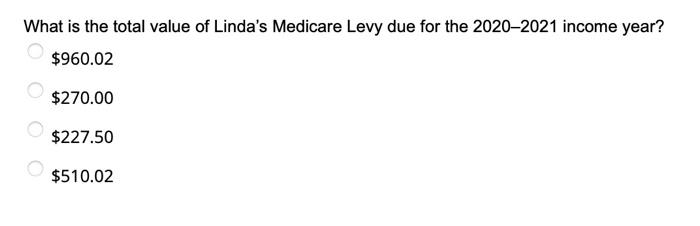

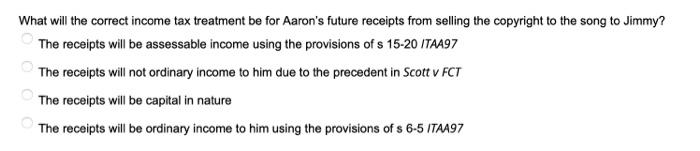

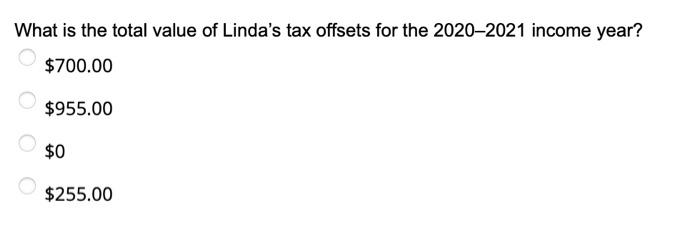

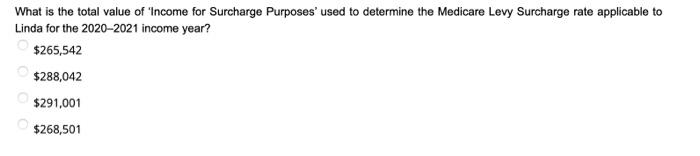

All of the facts in this scenario relate to the 2020-2021 income year of Aaron Fender, a 53-year-old Australian resident individual. Aaron is a professional musician and the lead guitarist of a Brisbane- based band called Goodoohuru. Due to the Covid-19 pandemic, all Goodoohuru's live concert performances were cancelled during this income year. During this income year, Aaron receives $166,780 in regular payments from an online music streaming service as his share of income from downloads of Goodoohuru's songs. Aaron also receives a cash prize of $5,000 from this music streaming service when his guitar solo in a Goodoohuru song is voted by fans as the 'Best guitar riff of 2020'. After receiving this prize, Aaron posts a picture on Facebook where he holds his old Gibson Les Paul guitar that he used to record this guitar solo, adding this caption to his post: 'Gibson Les Paul, best guitar EVER, ask any professional musician'. The managing director of the company that manufactures Gibson Les Paul guitars sees the Facebook post and the social media attention it attracts, and the company sends Aaron a new guitar free of charge. This guitar is valued at $10,499. Aaron is very impressed with the sound quality of this new Gibson Les Paul guitar, and he is instantly inspired to write new songs. He posts a video of himself on Facebook, singing one of the new songs that he composed. Jimmy Barnes, a famous Australian rockstar sees the video and contacts Aaron. Aaron and Jimmy decide to collaborate to adapt the song so that it suits Jimmy's voice. Jimmy wants to record the song as one of the tracks on his new album that is set for release on an online music streaming service on 1 July 2021. Aaron and Jimmy enter into the following contractual arrangement: On 1 April 2021, Jimmy pays Aaron a lumpsum one-off amount of $35,000 for his time to adapt the song so that it suits Jimmy's voice. Aaron also agrees to sell the copyright to the song to Jimmy. Jimmy will pay Aaron $2 per download of the song after the album is released. Jimmy pays Aaron $4,200 to play the guitar on several songs when Jimmy records his new album at his music studio in Sydney during June 2021. Aaron incurs the following expenses to travel to Sydney for this purpose in June 2021: A limousine trip from his home in Greenslopes to the Brisbane airport a cost totalling $290. Aaron wanted to arrive at the airport in style', rather than to spend $60 on a taxi fare. A return economy flight ticket from Brisbane to Sydney at a cost totalling $650. The cost of his stay in hotel quarantine in Sydney totalling $2,500. Due to the Covid-19 pandemic, interstate travellers from Queensland have to complete two weeks in hotel quarantine when they arrive in New South Wales. All of the facts in this scenario relate to the 2020-2021 income year of Brian and Linda Lowe, a married couple aged in their thirties. Brian and Linda are Australian resident individuals for income tax purposes. They do not have any private health cover. Brian is employed as the chief financial officer of an investment company, Invest Pty Ltd. He is also a shareholder in this company. This is the calculation of Brian's taxable income for the 2020-2021 income year: Gross salary, s 6-5 ITAA97, income from employment $243,000 Fully franked dividends, Invest Pty Ltd, s 44 ITAA36 $13,350 Gross up, Invest Pty Ltd, s 207-20 ITAA97 $4,691 Interest on the loan used to purchase the Invest Pty Ltd shares, s 8-1 ITAA97 ($21,000) Taxable income $240,041 Linda graduated with a teaching degree in 2013. Her HELP debt balance from her undergraduate studies totals $18,000. Linda privately tutors high school students in mathematics and science. This is the calculation of Linda's taxable income for the 2020-2021 income year: Gross receipts from private tutoring, s 6-5 ITAA97, income from business $48,001 Voluntary personal super contributions, s 290-150 ITAA97 ($22,500) Taxable income $25,501 What is the value of Aaron's assessable income for the 2020-2021 income year? $172,980 $210,980 $175,980 $221,479 $170,980 What is the total value of Brian's tax offsets for the 2020-2021 income year? $2,010.43 $4,690.54 $0 $21,000.00 What is the total value of Linda's Medicare Levy due for the 2020-2021 income year? $960.02 $270.00 $227.50 $510.02 What will the correct income tax treatment be for Aaron's future receipts from selling the copyright to the song to Jimmy? The receipts will be assessable income using the provisions of s 15-20 ITAA97 The receipts will not ordinary income to him due to the precedent in Scott v FCT The receipts will be capital in nature The receipts will be ordinary income to him using the provisions of s 6-5 ITAA97 What is the total value of Linda's tax offsets for the 2020-2021 income year? $700.00 $955.00 $0 $255.00 What is the total value of "Income for Surcharge Purposes' used to determine the Medicare Levy Surcharge rate applicable to Linda for the 2020-2021 income year? $265,542 $288,042 $291,001 $268,501 All of the facts in this scenario relate to the 2020-2021 income year of Aaron Fender, a 53-year-old Australian resident individual. Aaron is a professional musician and the lead guitarist of a Brisbane- based band called Goodoohuru. Due to the Covid-19 pandemic, all Goodoohuru's live concert performances were cancelled during this income year. During this income year, Aaron receives $166,780 in regular payments from an online music streaming service as his share of income from downloads of Goodoohuru's songs. Aaron also receives a cash prize of $5,000 from this music streaming service when his guitar solo in a Goodoohuru song is voted by fans as the 'Best guitar riff of 2020'. After receiving this prize, Aaron posts a picture on Facebook where he holds his old Gibson Les Paul guitar that he used to record this guitar solo, adding this caption to his post: 'Gibson Les Paul, best guitar EVER, ask any professional musician'. The managing director of the company that manufactures Gibson Les Paul guitars sees the Facebook post and the social media attention it attracts, and the company sends Aaron a new guitar free of charge. This guitar is valued at $10,499. Aaron is very impressed with the sound quality of this new Gibson Les Paul guitar, and he is instantly inspired to write new songs. He posts a video of himself on Facebook, singing one of the new songs that he composed. Jimmy Barnes, a famous Australian rockstar sees the video and contacts Aaron. Aaron and Jimmy decide to collaborate to adapt the song so that it suits Jimmy's voice. Jimmy wants to record the song as one of the tracks on his new album that is set for release on an online music streaming service on 1 July 2021. Aaron and Jimmy enter into the following contractual arrangement: On 1 April 2021, Jimmy pays Aaron a lumpsum one-off amount of $35,000 for his time to adapt the song so that it suits Jimmy's voice. Aaron also agrees to sell the copyright to the song to Jimmy. Jimmy will pay Aaron $2 per download of the song after the album is released. Jimmy pays Aaron $4,200 to play the guitar on several songs when Jimmy records his new album at his music studio in Sydney during June 2021. Aaron incurs the following expenses to travel to Sydney for this purpose in June 2021: A limousine trip from his home in Greenslopes to the Brisbane airport a cost totalling $290. Aaron wanted to arrive at the airport in style', rather than to spend $60 on a taxi fare. A return economy flight ticket from Brisbane to Sydney at a cost totalling $650. The cost of his stay in hotel quarantine in Sydney totalling $2,500. Due to the Covid-19 pandemic, interstate travellers from Queensland have to complete two weeks in hotel quarantine when they arrive in New South Wales. All of the facts in this scenario relate to the 2020-2021 income year of Brian and Linda Lowe, a married couple aged in their thirties. Brian and Linda are Australian resident individuals for income tax purposes. They do not have any private health cover. Brian is employed as the chief financial officer of an investment company, Invest Pty Ltd. He is also a shareholder in this company. This is the calculation of Brian's taxable income for the 2020-2021 income year: Gross salary, s 6-5 ITAA97, income from employment $243,000 Fully franked dividends, Invest Pty Ltd, s 44 ITAA36 $13,350 Gross up, Invest Pty Ltd, s 207-20 ITAA97 $4,691 Interest on the loan used to purchase the Invest Pty Ltd shares, s 8-1 ITAA97 ($21,000) Taxable income $240,041 Linda graduated with a teaching degree in 2013. Her HELP debt balance from her undergraduate studies totals $18,000. Linda privately tutors high school students in mathematics and science. This is the calculation of Linda's taxable income for the 2020-2021 income year: Gross receipts from private tutoring, s 6-5 ITAA97, income from business $48,001 Voluntary personal super contributions, s 290-150 ITAA97 ($22,500) Taxable income $25,501 What is the value of Aaron's assessable income for the 2020-2021 income year? $172,980 $210,980 $175,980 $221,479 $170,980 What is the total value of Brian's tax offsets for the 2020-2021 income year? $2,010.43 $4,690.54 $0 $21,000.00 What is the total value of Linda's Medicare Levy due for the 2020-2021 income year? $960.02 $270.00 $227.50 $510.02 What will the correct income tax treatment be for Aaron's future receipts from selling the copyright to the song to Jimmy? The receipts will be assessable income using the provisions of s 15-20 ITAA97 The receipts will not ordinary income to him due to the precedent in Scott v FCT The receipts will be capital in nature The receipts will be ordinary income to him using the provisions of s 6-5 ITAA97 What is the total value of Linda's tax offsets for the 2020-2021 income year? $700.00 $955.00 $0 $255.00 What is the total value of "Income for Surcharge Purposes' used to determine the Medicare Levy Surcharge rate applicable to Linda for the 2020-2021 income year? $265,542 $288,042 $291,001 $268,501