Answered step by step

Verified Expert Solution

Question

1 Approved Answer

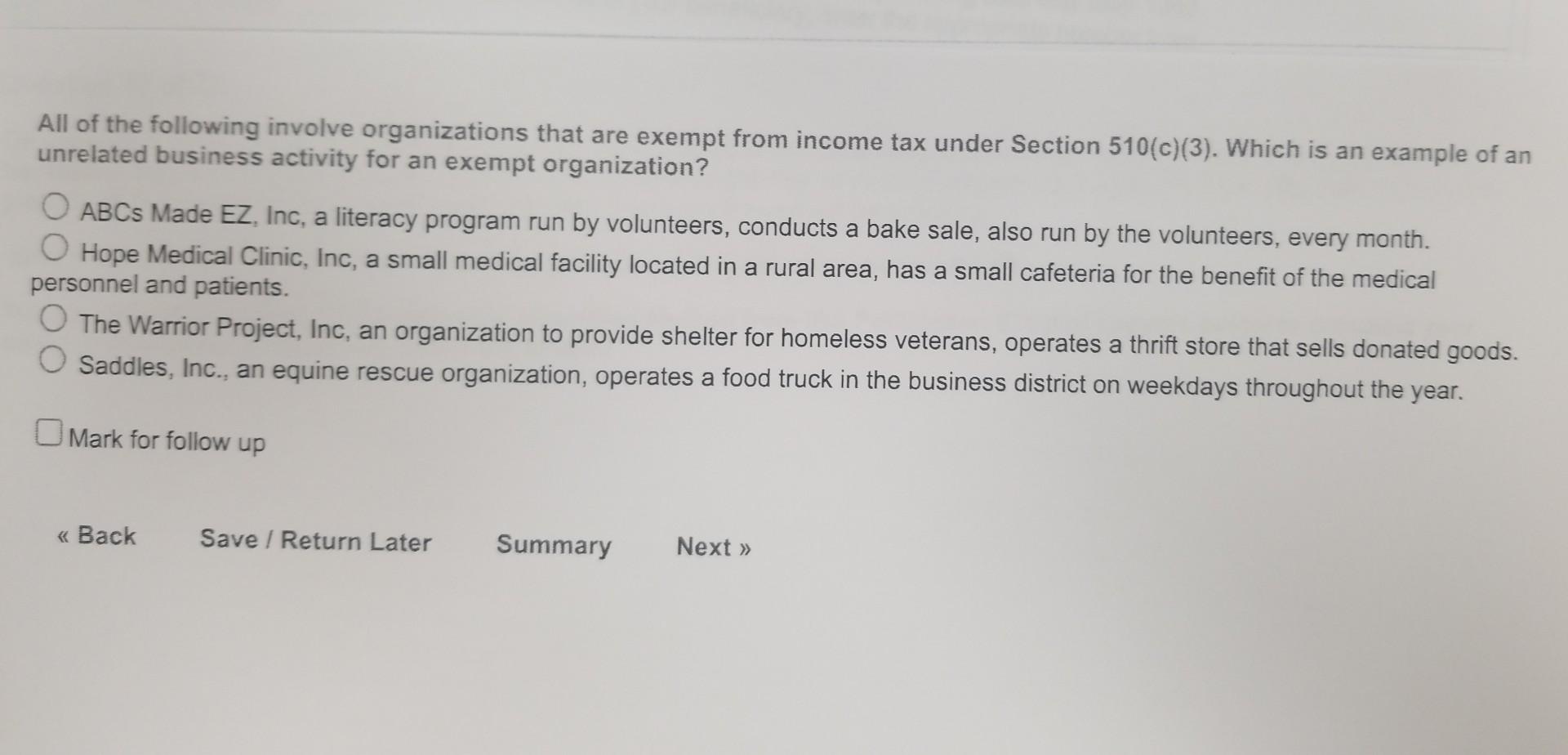

All of the following involve organizations that are exempt from income tax under Section 510(c)(3). Which is an example of an unrelated business activity for

All of the following involve organizations that are exempt from income tax under Section 510(c)(3). Which is an example of an unrelated business activity for an exempt organization? ABCs Made EZ, Inc, a literacy program run by volunteers, conducts a bake sale, also run by the volunteers, every month. Hope Medical Clinic, Inc, a small medical facility located in a rural area, has a small cafeteria for the benefit of the medical personnel and patients. The Warrior Project, Inc, an organization to provide shelter for homeless veterans, operates a thrift store that sells donated goods. Saddles, Inc., an equine rescue organization, operates a food truck in the business district on weekdays throughout the year. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started